2024

BENEFITS

GUIDE

TABLE OF CONTENTS

2

VENDOR DIRECTORY ............................................................................................................................... 4

ELIGIBILITY, ENROLLMENT, and QUALIFYING LIFE EVENTS ................................................................. 5

2024 BENEFIT RATES ............................................................................................................................... 6

MEDICAL PLAN HIGHLIGHTS .................................................................................................................. 7

MEDICAL PLAN OVERVIEW ...................................................................................................................... 8

PRESCRIPTION PLAN HIGHLIGHTS ........................................................................................................ 9

WELLNESS AND HEALTH MANAGEMENT PROGRAMS ......................................................................... 13

DENTAL INSURANCE ................................................................................................................................ 15

VISION INSURANCE ................................................................................................................................. 17

SPENDING ACCOUNTS ............................................................................................................................ 18

LIFE INSURANCE ...................................................................................................................................... 19

DISABILITY INSURANCE .......................................................................................................................... 20

LONG-TERM CARE INSURANCE ............................................................................................................. 22

EMPLOYEE ASSISTANCE PROGRAM (EAP) ............................................................................................ 23

FACE IT TOGETHER .................................................................................................................................. 24

RETIREMENT ............................................................................................................................................. 25

VOLUNTARY RETIREMENT SAVINGS PLANS .......................................................................................... 26

VACATION BUY, PAID TIME OFF, TUITION ASSISTANCE ........................................................................ 27

EMPLOYEE PERKS ................................................................................................................................... 28

FREQUENTLY ASKED QUESTIONS .......................................................................................................... 30

HELPFUL REMINDERS ............................................................................................................................. 31

HEALTHCARE REFORM ........................................................................................................................... 32

NOTICES ................................................................................................................................................... 33

Mayor Yemi Mobolade

Jamie Fabos,

Chief of Staff

Myra Romero,

Acting Chief Human

Resources and Risk Officer

Hello City Team:

Tha

nk you for your passion and hard work providing the

essential services that residents rely on every day. We’ve

seen a lot of great accomplishments in 2023, and it is

because of the dedication and passion each of you bring

to serving our community.

Attracting and retaining a highly skilled and talented

workforce is critical to the success of our organization

and to creating positive impacts for citizens. That is why

we are pleased to offer a competitive Total Rewards

package for City employees. We are committed to

providing a comprehensive benefits package that

supports your physical and mental wellbeing, as well as

your financial security. We are excited to share changes

for 2024 that provide enhanced coverage with robust and

high-quality providers.

We are proud to invest in our employees with a 2024 Benefits

Program that contributes to your overall well-being.

Onward and Upward,

Mayor Yemi Mobolade

Chief of Staff, Jamie Fabos

Acting Chief Human Resources and Risk Officer, Myra Romero

Please visit the Benefits and Wellness

webpage for detailed information.

This benefits guide is not intended to include all benefit details. It is an outline of available coverage and is not intended to be a legal contract.

If a discrepancy exists between this document and the Plan Documents, the Plan Documents govern.

The benefits guide applies to all City of Colorado Springs civilian and sworn employees, unless otherwise noted.

NOTE: ANNUAL APPROPRIATIONS REQUIREMENT: Other than those benefits specifically required by federal or state law, the programs

within the benefits plan provided by the City for employees are subject to annual review and budget appropriations by City Council. The City and

employee contributions toward the cost of the benefits plan, as well as the benefit plan designs, may be changed, or discontinued altogether at

the Mayor’s discretion. Specific details are available at coloradosprings.gov in the Policies and Procedures Manuals (PPM).

3

VENDOR DIRECTORY ............................................................................................................................... 4

ELIGIBILITY, ENROLLMENT, and QUALIFYING LIFE EVENTS ................................................................. 5

2024 BENEFIT RATES ............................................................................................................................... 6

MEDICAL PLAN HIGHLIGHTS .................................................................................................................. 7

MEDICAL PLAN OVERVIEW ...................................................................................................................... 8

PRESCRIPTION PLAN HIGHLIGHTS ........................................................................................................ 9

WELLNESS AND HEALTH MANAGEMENT PROGRAMS ......................................................................... 13

DENTAL INSURANCE ................................................................................................................................ 15

VISION INSURANCE ................................................................................................................................. 17

SPENDING ACCOUNTS ............................................................................................................................ 18

LIFE INSURANCE ...................................................................................................................................... 19

DISABILITY INSURANCE .......................................................................................................................... 20

LONG-TERM CARE INSURANCE ............................................................................................................. 22

EMPLOYEE ASSISTANCE PROGRAM (EAP) ............................................................................................ 23

FACE IT TOGETHER .................................................................................................................................. 24

RETIREMENT ............................................................................................................................................. 25

VOLUNTARY RETIREMENT SAVINGS PLANS .......................................................................................... 26

VACATION BUY, PAID TIME OFF, TUITION ASSISTANCE ........................................................................ 27

EMPLOYEE PERKS ................................................................................................................................... 28

FREQUENTLY ASKED QUESTIONS .......................................................................................................... 30

HELPFUL REMINDERS ............................................................................................................................. 31

HEALTHCARE REFORM ........................................................................................................................... 32

NOTICES ................................................................................................................................................... 33

Medical Benefits

Medical Insurance

Group Number: JCQ003

Premier Plan

Advantage Plan

Anthem Blue

Priority PPO Network

CEMC:

Monday - Friday

7:30 AM - 4:30 PM

Wednesday

9:00 AM - 6:00 PM

Pharmacy:

Monday – Friday

8:30 AM – 5:30 PM

Teladoc

ZERO Health

Hinge Health

Dental Insurance

Vision Insurance

Reach Your Peak

Wellness

UCCS

Life Insurance

Disability Insurance

Long Term Care (LTC)

Spending Accounts

FSA

HRA

Retirement

Profile Employee

Assistance Program

Face It Together

HR Solutions Center

VENDOR DIRECTORY

City Care

AmeriBen Concierge Consumer Support

AmeriBen Medical Management

Case Management, and Prior Authorization

Anthem - Provider Network Access

Castlight

Provider Search, Cost and Quality

Comparisons, and Health Related Resources

City Employee Medical Clinic (CEMC)

Medical Services located at

4863 North Nevada Avenue, 2nd Floor,

Colorado Springs, CO 80918

City Employee Pharmacy

Pharmacy located in the Garden Level of the City

Administration Building (CAB), Suite L04

MaxorPlus

Pharmacy Benefit Manager, In-Network Retail

Pharmacies, and Pharmacy ID Cards

Medical & Behavioral Health Services

Delta Dental

Hi-Option Plan #1512

Standard Option Plan #1844

Vision Service Plan (VSP)

Plan #12061804

HealthYou

UCCS

The Hartford - Policy #804057

The Hartford - Policy #804057

UNUM Life Insurance Company of America

Policy #220508 (Elections prior to 2008)

Policy #127251 (Elections 2008 and forward)

Navia Benefit Solutions

FSA for Health Care & Dependent Care

HRA for Advantage Plan Participants

Public Employees Retirement Association

Fire & Police Protective Association (FPPA)

MissionSquare Retirement, LLC

Gloria Michalko

Profile EAP: Centura Health

Company Code: COSPGS

Addiction & Recovery Coaching

HR/Benefit questions and enrollment support

(866) 955-1482

myameriben.com

(855) 778-9052

myameriben.com

anthem.com

(800) 684-0624

mycastlighthealth.com

(719) 385-5841

Fax: (719) 385-5842

(719) 385-2261

Auto-Refill Line: (800) 573-6214

cityemployeepharmacy.com

(800) 687-0707 • maxor.com

(800) 835-2362 • teladoc.com

(815) 816-0001 • [email protected]

(855) 902-2777 • [email protected]

(800) 610-0201 • deltadentalco.com

(800) 877-7195 • vsp.com

(719) 314-3535

cosreachyourpeak.com

(888) 563-1124 • thehartford.com

(888) 301-5615

Abilityadvantage.thehartford.com

(800) 227-4165 • unum.com

(866) 897-1996

Fax: (866) 831-6222

naviabenefits.com

105@NaviaBenefits.com

(800) 759-7372 • copera.org

(800) 332-3772 • fppaco.org

(202) 759-7178

(800) 645-6571 • profileeap.org

(855) 539-9375 • wefaceittogether.org

(719) 385-5125

4

WHAT IS A QUALIFYING LIFE EVENT (QLE)?

Note: Newborns are not automatically added to your plan. Do not wait

until you receive the birth certificate and/or Social Security number to

contact the HR Solution Center.

QUALIFYING LIFE EVENTS:

You can review your benefits at the time of a qualifying

life event. If you have a qualified life event change in

status during the plan year, you must:

Contact the HR Solutions Center within 30 days of the

event in writing.

Complete and submit a Benefits Change Form.

Provide documentation of the qualifying event.

Note: Benefit changes occur prospectively on the first of the month after

the HR Solutions Center receives all necessary paperwork.

ELIGIBILITY

All regular, probationary, and special employees

scheduled to work 20 hours or more each week may

participate in the City of Colorado Springs’ Benefits

Programs unless otherwise noted.

Hourly employees may be eligible for medical benefits

as mandated by the Patient Protection and Affordability

Care Act.

Eligible dependents include:

Your legal spouse, common law spouse or civil union.

Your natural, adopted, or stepchildren (up to age 26).

Eligible children of any age who were disabled before

age 26.

Note: Only eligible dependents can be covered under the plan(s).

must provide proof of dependent eligibility

ENROLL & MAKE CHANGES

Carefully review the benefits available to you and choose

the best package for you and your family and budget.

Your enrollment choices remain in place for the plan year

(January 1, 2024 – December 31, 2024)

You can enroll in or make changes to your benefits:

Within 30 days of your hire date.

During the annual Open Enrollment (OE) period.

Within 30 days of a Qualifying Life Event.

ELIGIBILITY, ENROLLMENT, & QUALIFYING LIFE EVENTS

Birth of a newborn, adoption, or placement

or guardianship of a child. This QLE occurs

on the event date.

Family changes, such as marriage, divorce,

legal separation, change in dependent eligibility,

or death of your spouse or dependent.

Change in employment status by you or your

eligible dependents such as termination or

commencement of employment, unpaid leave

status, or change from full-time to part-time.

Enrollment in a Qualified Health Plan through

the Marketplace; Government Health Plan

such as Tricare, Medicare, or Medicaid; or

other Group Health Coverage.

5

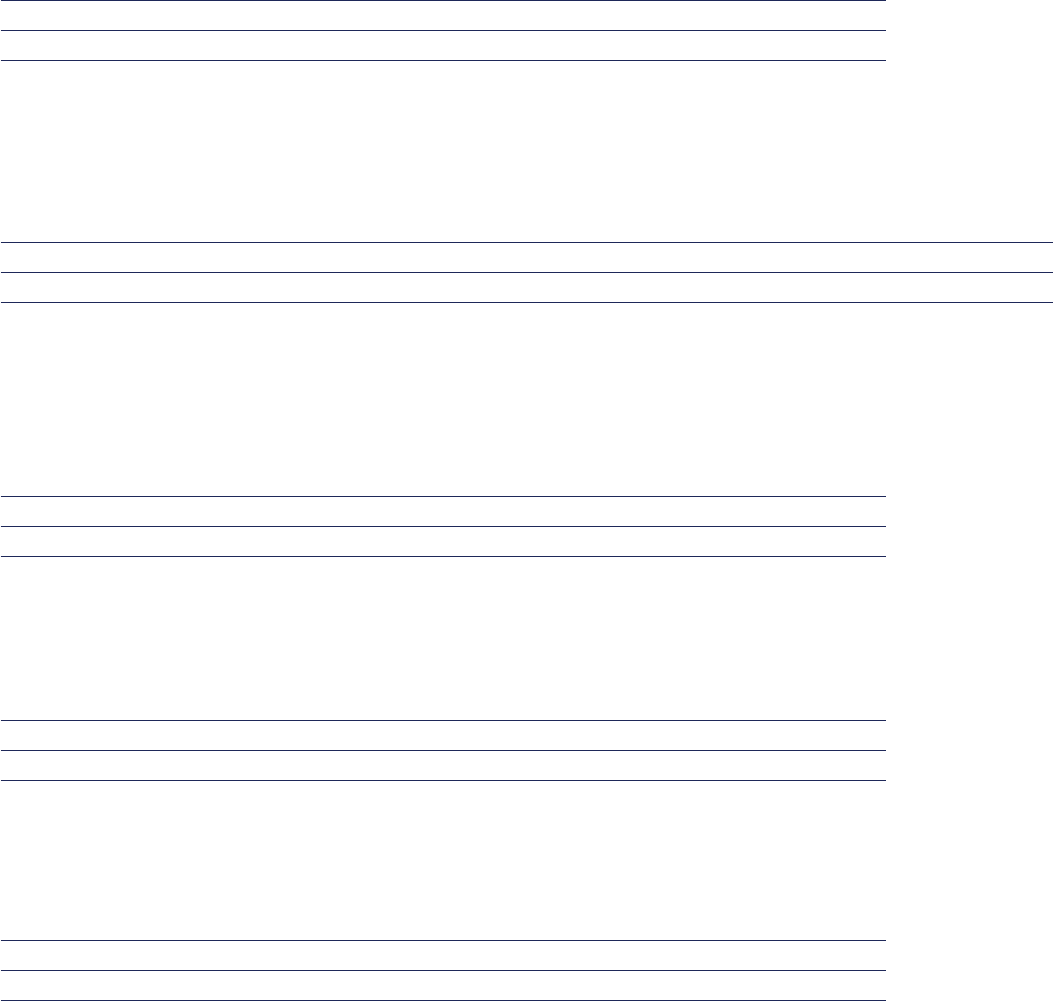

2024 MEDICAL PLAN HIGHLIGHTS BENEFIT RATES

Premier Medical Plan Rates – Monthly

Coverage Level Total Plan Cost Employer Share Employee (EE) Share*

EE Only $947 $699 $248

EE + Spouse $1,879 $1,270 $609

EE + Child $1,767 $1,222 $545

EE + Family $2,674 $1,850 $824

Advantage Medical Plan Rates – Monthly

Coverage Level Total Plan Cost Employer Share Employee Share* Annual Employee

HRA Funding

EE Only $738 $699 $39 $500

EE + Spouse $1,491 $1,270 $221 $750

EE + Child $1,419 $1,222 $197 $750

EE + Family $2,152 $1,850 $302 $750

*Note: There is an additional $50 per month surcharge for employees on the Premier and Advantage medical plan who are tobacco users.

Delta Hi-Option PPO Dental Plan Rates – Monthly

Coverage Level Total Plan Cost Employer Share Employee Share

EE Only $49 $35 $14

EE + Spouse $111 $45 $66

EE + Child $90 $45 $45

EE + Family $136 $45 $91

Delta Standard Option PPO Dental Plan Rates – Monthly

Coverage Level Total Plan Cost Employer Share Employee Share

EE Only $35 $35 $0

EE + Spouse $83 $45 $38

EE + Child $67 $45 $22

EE + Family $101 $45 $56

Vision Service Plan Rates – Monthly

Coverage Level Total Plan Cost Employer Share Employee Share

EE Only $7.72 $0 $7.72

EE + Spouse $15.46 $0 $15.46

EE + Child $16.55 $0 $16.55

EE + Family $26.44 $0 $26.44

To calculate your rates per pay period, divide the Employee Share amount by 2. There are 24 premium payments during

the year. Civil Union cost may have Pre-Tax and Post Tax implications; contact the HR Solutions Center for more details.

6

IMPORTANT PLAN TERMS

Premiums

The amount you and your employer pay each month to be

enrolled in medical, dental, and vision insurance.

Deductible

The amount you must pay each year for certain covered

health services before the insurance plan will begin to pay.

Coinsurance

Your share of the cost of covered health care services,

after you meet your deductible.

Co-pay

A fixed amount you pay for certain covered health services.

Typically, your co-pay is due at the time of service.

Out-of-Pocket Maximum

The most you will pay for covered health services during

the plan year. Co-pays, deductibles, and coinsurance all

apply toward the out-of-pocket maximum.

Covered Services

Services for which benefits are payable. If you receive

care for services not covered under the plan, the amount

you pay for those services will not apply toward your

deductible or out-of-pocket maximum.

Enhanced Personal Health Care (EPHC)

Primary Care Providers. You will pay a lower co-pay, and

have your deductible waived when you see these providers.

Tier I Specialists

Using these specialists will reduce your out-of-pocket

expenses and you will pay a lower co-pay and have your

deductible waived.

Site of Service Program

Save money on advanced imaging and outpatient surgery by

participating in a free-standing, independent imaging provider

or ambulatory surgery center from the Anthem Network.

MEDICAL PLANS

The City offers two self-funded medical plans: the Premier

Plan and the Advantage Plan. The Advantage Plan is paired

with a Health Reimbursement Account (HRA) funded by the

City. Both plans feature an in-network and out-of-network

benefit. Anthem Blue Cross Blue Shield is our preferred

provider organization (PPO) network for both plans and

AmeriBen is the medical claims administrator. Medical

premiums may be paid using pre-tax dollars and both plans

include access to a robust, affordable care delivery model.

Employees and family members on the City’s Medical

Plan are eligible for these services:

• City Employee Medical Clinic

• City Employee Pharmacy

• Alternative Medicine

• Diabetes Ten City Challenge

• CardioRx Program

• Maternal Health Program

• Tobacco Cessation

• Reach Your Peak

(Available only for Employee and Spouse)

7

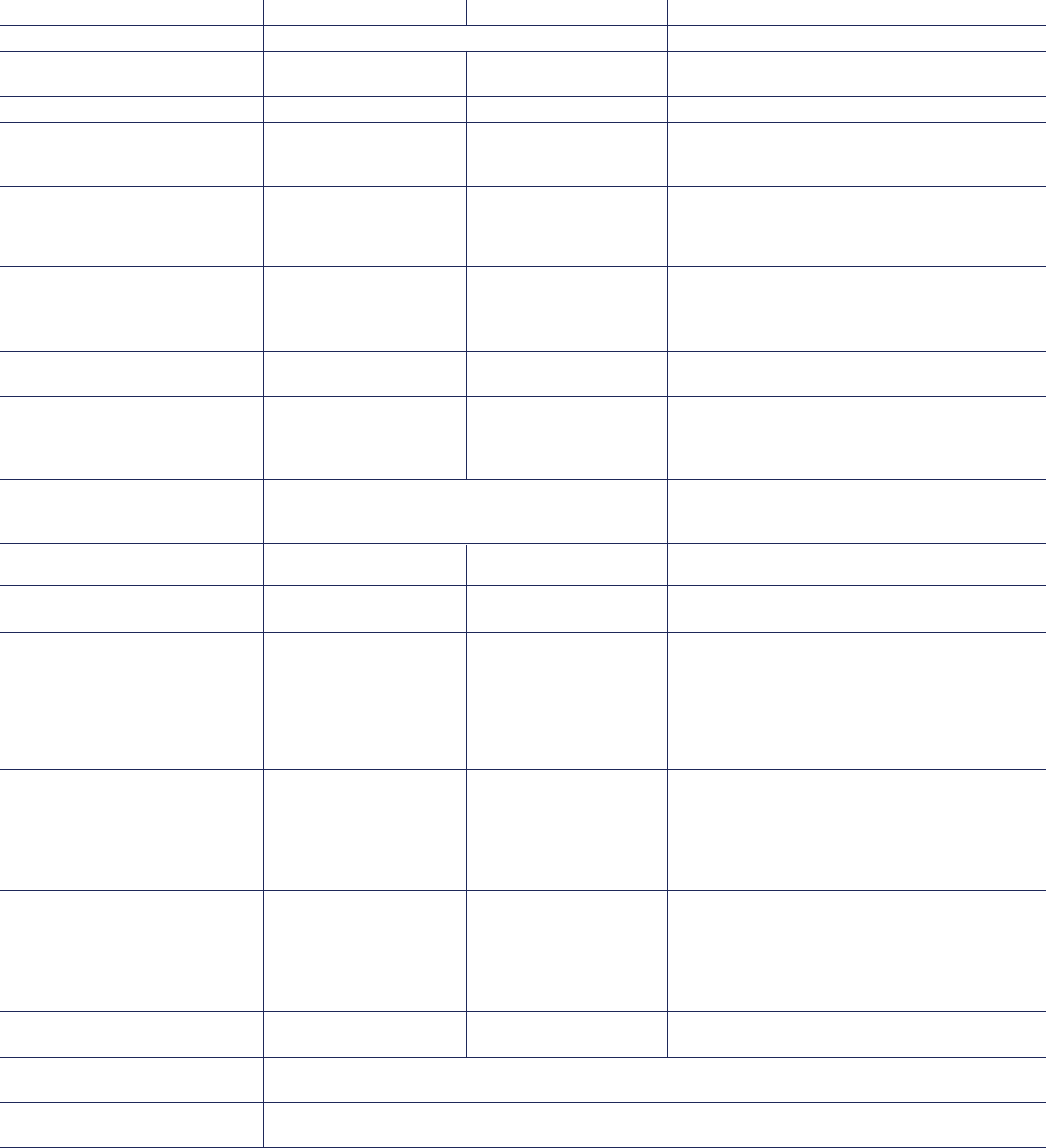

MEDICAL PLAN HIGHLIGHTS TERMS & MORE

Premier Plan Advantage Plan

Type of service In-Network Benefit Out-of-Network Benefit In-Network Benefit Out-of-Network Benefit

Lifetime Maximum Unlimited Unlimited

Annual Deductible $500 Individual $1,250 Individual $1,500 Individual $4,500 Individual

$1,250 Family $2,500 Family $3,000 Family $9,000 Family

Coinsurance (1) You pay 20% You pay 50% You pay 20% You pay 50%

Annual Out-of-Pocket $2,500 Individual $4,050 Individual $3,500 Individual $9,000 Individual

Maximum $7,500 Family $12,150 Family $8,000 Family $18,000 Family

(OPM)/Coinsurance (1)

Primary Care Office Visit (2) EPHC - $25 co-pay, You pay 50% EPHC - $30 co-pay, You pay 50%

deductible waived; after deductible deductible waived; after deductible

All others - $35 after All others - $40 after

deductible deductible

Specialist Office Visit (2) Tier I - $40 co-pay, You pay 50% Tier I - $60 co-pay, You pay 50%

deductible waived; after deductible deductible waived; after deductible

All others - $60 after All others - $70 after

deductible deductible

Mental Health Office Visit (3) $25 co-pay, You pay 50% $30 co-pay, You pay 50%

deductible waived after deductible deductible waived after deductible

Urgent Care $50 co-pay, deductible You pay 50% You pay 20%, You pay 50%

waived; coinsurance for after deductible deductible coinsurance after deductible

diagnostic & surgical for diagnostic & surgical

services services

Emergency Room Visits $250 co-pay, then you pay 20% for diagnostic You pay 20%, deductible waived

and surgical services, deductible waived

If admitted to the hospital, ER co-pay waived

Diagnostic Services You pay 20% You pay 50% You pay 20% You pay 50%

after deductible after deductible after deductible after deductible

Inpatient Mental Health You pay 20% You pay 50% You pay 20% You pay 50%

after deductible after deductible after deductible after deductible

Inpatient Hospital Services Utilize an UCHealth You pay 50% Utilize an UCHealth You pay 50%

Facility - you pay after deductible Facility - you pay after deductible

15% after deductible 15% after deductible

All hospital services All hospital services

and all other facilities and all other facilities

You pay 20% after You pay 20% after

deductible deductible

Advanced Imaging Freestanding Facility You pay 50% Freestanding Facility You pay 50%

(MRI/CT/PET) - you pay 10% after after deductible - you pay 10% after after deductible

deductible; deductible;

All other facilities - All other facilities -

you pay 20% after you pay 20% after

deductible deductible

Outpatient/Ambulatory Freestanding Facility You pay 50% Freestanding Facility You pay 50%

Surgery - you pay 10% after after deductible - you pay 10% after after deductible

deductible; deductible;

All other facilities - All other facilities -

you pay 20% after you pay 20% after

deductible deductible

Preventive Care (3) You pay $0 You pay 50%; You pay $0 You pay 50%;

deductible waived deductible waived

Alternative Medicine Plan Pays 50% of each claim up to an annual family maximum of $1,000, deductible waived.

Nutritionists & Dieticians – maximum of 16 visits per year per member, 50% coinsurance, deductible waived

Fertility Benefits This plan pays up to a $30,000 lifetime benefit and supports you through your unique fertility challenges,

helping you explore your options and undergo treatment processes.

Notes: (1) The OPM and coinsurance are accounted for separately for in-network and out-of-network services.

(2) Co-pay applies to an office visit only. Deductible and coinsurance apply for diagnostic and surgical

services performed in the office setting.

(3) A Mental Health Screening is a covered benefit under Preventive Care.

This table is not intended to include all benefit details. It is an outline of coverage available and is not intended to be a legal contract.

If a discrepancy exists between this document and the official Plan Documents, the Plan Documents govern.

MEDICAL PLAN OVERVIEW

8

PRESCRIPTION PLAN HIGHLIGHTS

Employees and their eligible dependents

enrolled in a City medical plan can fill their

prescriptions at the City Employee

P

harmacy or through one of the MaxorPlus participating

network pharmacies. You will save money if you fill your

prescription at the City Employee Pharmacy.

MaxorPlus also provides services relating to specialty inject

ables, specialty drugs, and certain respiratory therapies

through its subsidiary, Maxor Specialty Pharmacy. This

Specialty Injectable and Specialty Drug Program will benefit

you and the patient and help contain the costs of expensive

medications. Maxor Specialty Pharmacy will be working in

conjunction with the City Employee Pharmacy to fill medications

through this program.

To access high quality care at the lowest cost, visit the City Employee Pharmacy.

Pharmacy Tier Prescription Type Cost

City Employee Pharmacy 1st Tier Generic $6 co-pay (30-day supply)

$15 co-pay (90-day supply)

2nd Tier Preferred Brand $35 co-pay (30-day supply)

$70 co-pay (90-day supply)

3rd Tier Non-Preferred Brand $60 co-pay (30-day supply)

$120 co-pay (90-day supply)

Specialty Pharmacy 4th Tier* Preferred Chronic Injectables 20% coinsurance with a maximum

(MaxorPlus IV Solutions) and other Specialty Drugs co-pay of $100 (30-day supply)

5th Tier* Non-Preferred Chronic Injectables 20% coinsurance with a maximum

and other Specialty Drugs co-pay of $150 (30-day supply)

MaxorPlus Retail 1st Tier Generic $25 co-pay (30-day supply)

Network Pharmacies 2nd Tier Preferred Brand $55 co-pay (30-day supply)

3rd Tier Non-Preferred Brand $75 co-pay (30-day supply)

4th Tier & 5th Tier Preferred/Non-Preferred N/A – Only available through

Chronic Injectables

Co-insurance and co-pays for prescription drugs do not apply to the deductible but do apply to the out-of-pocket maximum.

Maintenance Prescription Fills - For a complete listing of participating pharmacies go to the Preferred Pharmacy

Information at cityemployeepharmacy.com. Plan participants will progressively pay higher co-pays for maintenance

prescriptions that are filled at a MaxorPlus Retail Network Pharmacy versus the City Employee Pharmacy. Additional

information regarding your pharmacy benefits can be found on MaxorPlus.com.

Engagement in health management programs may allow for waived co-pays. Contact the HR Solutions Center or City

Employee Pharmacy to learn more.

Maintenance prescriptions filled at any MaxorPlus Retail Network Pharmacy:

First fill: Member pays the normal co-pay Second fill: Member pays double the co-pay

Third and subsequent fills: Member pays 100% of the retail cost for the maintenance prescription

Select preventive care medications are covered at 100% and may change in accordance with United States Preventive

Services Taskforce guidelines.

*Maxor Specialty Pharmacy Patient Care Advocates will assist members with enrollment in manufacturer copay assistance

programs if available. Please note that not all specialty medications will have co-pay assistance available. Those medications

that do have assistance available are subject to availability and may be discontinued at any time. Any portion known to have

been paid by a secondary payer (i.e., patient assistance, co-pay cards, discounts, or other insurance) will not be considered

as true out-of-pocket costs and will not apply to your plan deductible and out-of-pocket maximums.

This table is not intended to include all benefit details. It is an outline of coverage available and is not intended to be a legal contract. If a discrepancy exists

between this document and the official Plan Documents, the Plan Documents govern.

9

CASTLIGHT

An informed consumer shops for high quality,

affordable health care using Castlight’s

transparency tool, receives their preventive

care benefits, and uses the correct facility or

provider for services. When you are an engaged consumer

of health care, you do make a difference.

Get peace of mind - Clearly see what is covered by your

plan, how much services will cost, and where you have

spent your healthcare dollars.

Find doctors you will love - Search ratings and reviews

from real people and find high-quality (EPHC and Tier 1)

doctors or specialists in your network and near you.

Feel great about your benefits - Discover your health and

well-being resources and see all your perks in one place.

10

MEDICAL PLAN HIGHLIGHTS

TELADOC

Teladoc gives you access 24 hours a day, 7 days a week

to a U.S. board certified doctor through the convenience

of phone, video, or mobile app visits. Teladoc is accessible

anywhere in the U.S.

Summary of Services:

Treat the flu, allergies, sinus infection, rash, sore throat, and

more. $0 Co-pay

Taking care of your mental health is an important part of

your overall well-being. With Teladoc’s Mental Health,

adults 18 and older can get care for anxiety, depression,

grief, stress, family issues, and more. Choose to see a

psychiatrist, psychologist, social worker, or therapist and

establish an ongoing relationship. $0 Co-pay

11

CITY EMPLOYEE MEDICAL CLINIC

The CEMC partners with UCCS staff nurse practitioners to

provide a multitude of services to meet your health care needs.

They offer on-site lab services and same day appointments

for acute and urgent care concerns, similar services to what

you would see at a primary care provider.

Preventive Care/ Wellness/Labs (Pay $0)

• Annual Physical & Wellness Exams

• Immunizations

• Children Physical Exams (ages 5+)

General Medicine (Pay $15)

• Chronic Care Services

• Acute Care Services (ages 3+)

• Health Diagnostics & Referrals

• Evaluation & Treatment of Injuries

• Smoking Cessation

• Weight Management

• Functional Medicine

• Gut Health

• Lab Services

• And so much more

CITY EMPLOYEE PHARMACY

The City Employee Pharmacy offers convenient, affordable

prescriptions, and excellent customer service.

• Home & Desk Delivery

• Validated Parking

• Text Alerts

• Refills

• Automated Refill Line (800) 573-6214

• Mobile App

• Over-the-Counter Medication

• Vitamins and Many Other Items

CardioRX (Pay $0)

• Cardiovascular health management programs

• Resources for healthy living

• Free cholesterol screenings & blood

pressure checks

• Waived co-pays for generic hypertension and

cholesterol medications, if enrolled and

engaged in the program

Diabetes Ten City Challenge (Pay $0)

• Diabetes management program (diabetic

and pre-diabetic)

• Resources for healthy living

• Co-pays waived for generic diabetes

medications, if enrolled and engaged in the

program

HEALTH SERVICES

pharmacy pic

Refer to the Vendor Directory for convenient hours and locations.

12

HEALTH SERVICES

ZERO HEALTH

Healthcare Simplified to $0 with your ZERO benefit!

We believe healthcare should be affordable, simple, and personalized. If you are enrolled in the medical plan you can get the

care you need for $0 (Yep. ZERO) and you will never have to worry about deductibles or copays.

With ZERO you have access to thousands of medical services and procedures through the Anthem provider network. You

can search for providers at www.zero.health and chat live with a Personal Health Assistant in just one click.

Some examples include:

• Surgeries (Ear Nose & Throat, Orthopedic, Spinal, Women’s Health)

• Preventive Screenings such as Colonoscopies and Mammograms

• Imaging (CT Scans, MRI, Ultrasound, X-Ray)

• Physical Therapy • Sleep Studies • Labs at Quest Diagnostics

Once your doctor recommends you need a procedure scheduled, follow these simple steps to get the care you need for $0!

1. Connect with your Personal Health Assistant to see if the service or procedure you need is covered.

You can call 855-816-0001, chat www.zero.health or email at help@zero.heatlh.

2. Your Personal Health Assistant will help you find the provider that works best for you and sends all

the details to the ZERO provider to get you scheduled for your procedure.

3. You get access to the care you need without having to worry about things like deductibles, copays

or coinsurance - you always pay $0. For real. You always pay ZERO.

ZERO’S Lab Partner is Quest Diagnostics. To pay $0 for all your lab work:

1. Ask your doctor or nurse to send your lab orders to Quest Diagnostics

2. You can go to the closest Quest Diagnostics location - just make sure to show your physical or digital

ZERO Member ID Card when you arrive. Access your digital copy at my.zero.health.

3. Quest Diagnostics will send the lab results to your prescribing physician and you pay $0!

For everything from minor sprains to chronic pain, Hinge Health offers a clinical care team

that uses advanced technology to manage member pain and remove barriers to recovery.

Personalized care from day one:

Integration of prior-authorization, claims, and medical history ensures continuously personalized care.

Ongoing customization:

Ongoing exercise, education, and behavioral plan customizations based on members’ real-time feedback and needs.

High-risk intervention:

Care coordination with in-person providers enables earlier intervention with technology like Enso, surgery decision

support, and more.

No matter where you have pain, Hinge Health has you covered, get the support you need at no cost to you or your

family if they are on the medical plan.

13

WELLNESS & HEALTH MANAGEMENT PROGRAMS

ALTERNATIVE MEDICINE

Medical plan participants can be reimbursed for alternative

medicine by completing and submitting a AmeriBen Claim Form.

Plan pays 50% of claims up to $1,000 annual maximum per

family for the following:

• Massage Therapy

• Rolfing

• Homeopathic

• Naturopathic

Plan pays 100% up to 16 visits (no maximum dollar amount)

per year for each covered member for the following:

• Dietician

• Nutritionists

AMERIBEN MATERNAL HEALTH PROGRAM

Maternal Health Benefit:

Baby Steps, AmeriBen’s Maternal Health program, provides

families with the following before, during, and after your

pregnancy at no additional cost to you:

• Education

• Support

• Specially Trained Maternal Health Nurse

TOBACCO CESSATION

Is it time to Quit using Tobacco? We have free resources to

assist you on this journey.

Tobacco Cessation program with Teladoc at no cost to you.

• Multifaceted program that combines health

coaching support, physician treatment, and

tobacco cessation content to help members

break their tobacco habit.

• 24/7 support when cravings hit.

• Celebrate the milestones at 7,20,90,120,

and 365 days!

• Work with physician and get free over-the-

counter medication with a script: Zyban,

Chantix, Nicotrol, nicotine gum, patches, and

lozenges

Download the app, call (800) 835-2362 or visit Teladoc.com

Tobacco Cessation with City Employee Medical Clinic.

Work with City Employee Medical Clinic staff to help you

kick the tobacco habit and to get free over-the-counter

medication with a script: Zyban, Chantix, Nicotrol, nicotine

gum, patches, and lozenges.

14

REACH YOUR PEAK YEAR 20 (RYP20)

Program Year: January 1, 2024 – November 30, 2024

A fully customized wellness program designed to help you reach your individual life, body, and/or mind goals. RYP20

offers planned wellness tracks or customizable experiences, which help you achieve balanced wellness.

Employee Points Spouse Points

Required: Primary Care 100 Points Required: Primary Care 100 Points

Provider Screening or Provider Screening or

Biometric Screening Biometric Screening

Total Points to earn incentive 400 Points Total Points to earn incentive 100 Points

Incentive $400 Incentive $100

For more information Visit the Benefits & Wellness Intranet

or contact the HR Solutions Center

(719) 385-5125 • [email protected]

15

DENTAL INSURANCE

Dental coverage is available through Delta Dental of Colorado and you have two plans from which to choose: Delta Hi-Option

PPO and Delta Standard PPO. Both plans pay 100% for cleanings, oral exams, and x-rays when you use a PPO dentist.

Please refer to the current year’s Dental Plan Comparison and Rate Chart and/or the Delta Dental Plan Document for more

information or visit DeltaDentalCo.com.

Annual Maximum

Plan Will Cover

Annual Deductible

Per Person

Per Family

Routine Dentistry (2)

Cleaning

Oral Exams

X-Rays

Sealants (3)

Basic Dentistry (4)-(6)

Fillings

Extraction

Root Planning/Quadrant

Major Dentistry (6)

Crown (full cast)

Denture Repair

Bridge

Orthodontia

Orthodontic Benefit

Lifetime Maximum

Implant Coverage

Sleep Apnea Appliance

Lifetime Maximum

Prevention First

Type of Benefit Delta Hi-Option PPO (1) Delta Standard-Option PPO (1)

PPO Dentist Premier & Non- PPO Dentist Premier & Non-

Participating Dentists Participating Dentists

$1,500

per individual

$50

$150

(5) (6)

80%

80%

80%

80%

(5) (6)

50%

50%

50%

(5) (6)

50%

50%

50%

(6)

50%

$3,000

Surgical &

Restorative

60%

$3,000

Included

$2,000

per individual

$50

$150

100%

100%

100%

100%

90%

90%

90%

60%

60%

60%

(6)

60%

$3,000

Surgical &

Restorative

60%

$3,000

Included

$1,500

per individual

$50

$150

(5)

80%

80%

80%

80%

(5) (6)

50%

50%

50%

(5) (6)

50%

50%

50%

(6)

Not covered

Not covered

Not covered

50%

$3,000

Included

$1,500

per individual

$50

$150

100%

100%

100%

100%

80%

80%

80%

50%

50%

50%

(6)

Not covered

Not covered

Not covered

60%

$3,000

Included

Notes:

(1) Member and plan receive discounted contract pricing if a PPO & In-Network provider is utilized. The Non-Participating % of benefits is limited to the

non-participating Maximum Plan Allowance. You will be responsible for the difference between the non-participation Maximum plan Allowance and

the full fee charged by the dentist.

(2) Deductible does not apply to routine dentistry services.

(3) Sealants for permanent teeth for children through age 14 are a covered benefit on all plans as a routine dentistry service. Sealants for pre-molars are covered.

(4) Resin or composite filling will be covered at the same benefit as amalgam filling.

(5) Services received by a non-Participating dentist are reimbursed at the allowable Maximum Plan Allowance (MPA) for non-contracted dentist.

Members will be responsible for the difference between the allowable fee for non-contracted provider and the billed amount. By using a Delta Dental

contracted PPO or Premier provider, the member will not be balanced billed for the difference between the allowable Maximum Plan Allowance fee

and the billed amount, must be written off by provider. You will see the most savings with a PPO provider.

(6) The deductible applies to these services.

The plan will pay 60% PPO / 50% Premier & Non-Participating Dentists coinsurance for one occlusal mouth guard every 3 years to prevent grinding

when services are rendered by a covered dentist. Over the counter (OTC) mouth guards are excluded under the dental plans.

The coinsurance will apply towards the Annual Plan Maximum.

This table is not intended to include all benefit details. It is an outline of coverage available and is not intended to be a legal contract. If a discrepancy

exists between this document and the official Plan Documents, the Plan Documents govern.

17

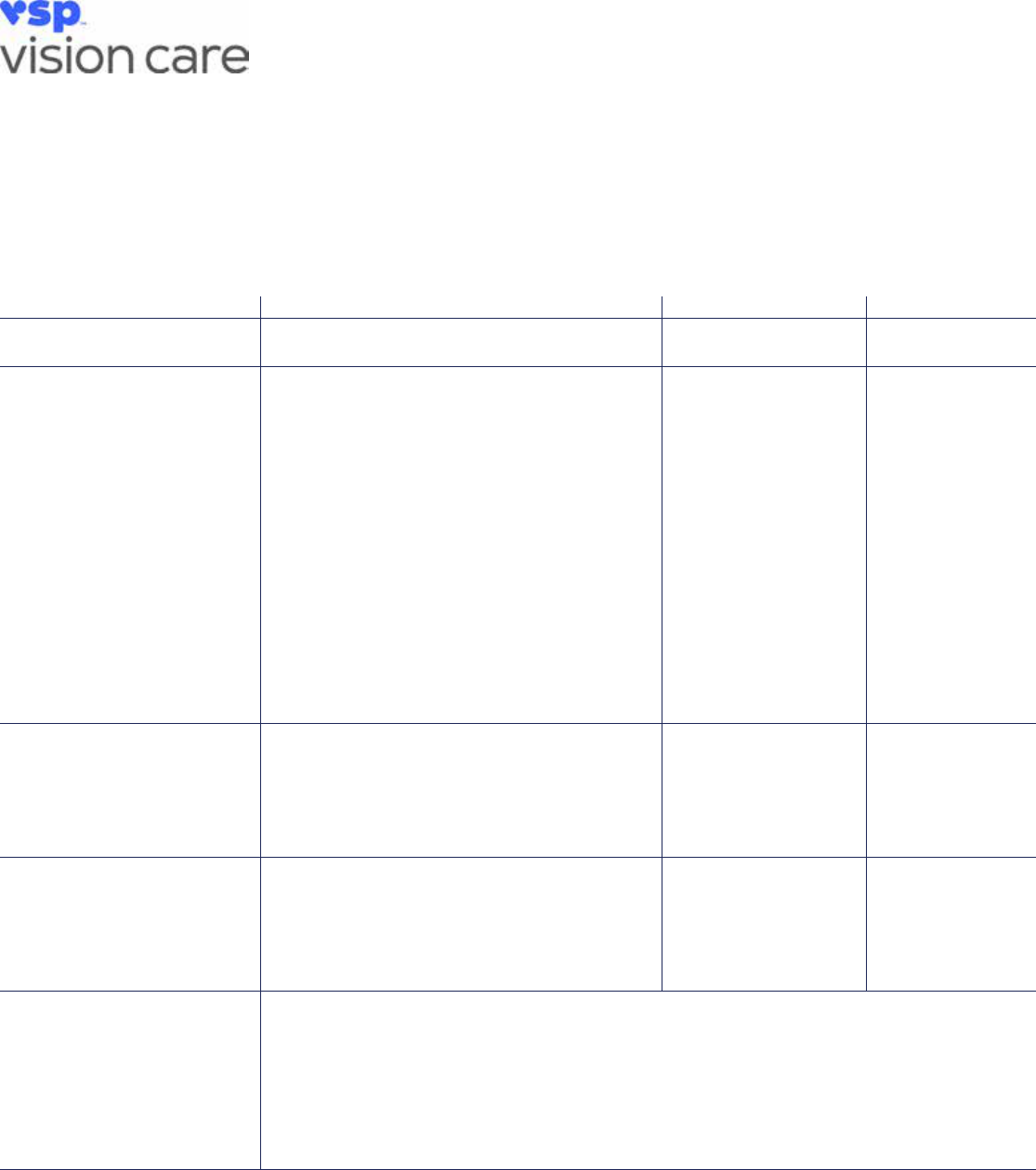

VISION INSURANCE

Vision coverage is offered through VSP. This plan provides coverage once per plan year for routine eye exams, frames,

lenses, and contact lenses and provides other services such as preferred member pricing on contact lenses and direct

delivery to the home. Please refer to the current year Plan Summary and Rate Chart and/or Vision Plan Document for more

information. For the lowest cost visit a VSP provider. You can find in-network providers at vsp.com.

NEW: $0 exam copay and $0 Anti-reflective lenses when you visit a Premier Edge Provider.

Visit www.vsp.com/eye-doctor and select All Premier Edge Locations.

Well Vision Exam

Prescription Glasses

Frames

Lenses

Lens Enhancements

Average savings of 30% on

other lens enhancements

Contacts

(Instead of glasses)

You are not eligible for

eyeglasses and contact

lenses in the same benefit

period.

Diabetic Eyecare

Plus Program

Extra Savings

Your Coverage with

Out-of-Network Providers

Benefit Description Co-pay Frequency

Focuses on your eyes and overall wellness

$175 allowance for a wideselection of frames

$225 allowance for featuredframe brands

$95 allowance at Walmart/Costco 20%

savings on the amount over your allowance

Single vision, lined bifocal,and lined trifocal

lenses Polycarbonate lenses for dependent

children

Standard progressive lenses

Premium progressive lenses

Custom progressive lenses

Anti-Reflective lenses

$175 allowance for contacts;

co-pay does not apply

Contact lens exam (fitting and evaluation)

Retinal screening for members with diabetes

Additional exams and services for members

with glaucoma, or age-related macular

degeneration. Limitations and coordination

with your medical coverage may apply. Ask

your VSP doctor for details.

$20 or $0 Exam at

Premier Edge Provider

$15

$10

$0

$95 - $105

$150 - $175

$40 or $0 Premier Edge

Provider Up to $60

$0

$20 per exam

Every

calendar year

Every

calendar year

Every

calendar year

As Needed

As Needed

$0 copay and $0 antireflective coating if you see a Premiere Edge Provider!

Glasses and Sunglasses Extra $20 to spend on featured frame brands.

20% savings on additional glasses and sunglasses, including lens enhancements,

from any VSP provider within 12 months of your last Well Vision Exam.

Retinal Screening No more than a $39 co-pay on routine screening as an enhancement to

a Well Vision Exam.

Laser Vision Correction Average 15% off the regular price or 5% off the promotional

price; discounts only available from contracted facilities

Get the most out of your benefits and greater savings with a VSP network provider.

Call Member Services for out-of-network plan details.

Coverage with a participating retail chain may be different. Once your benefit is effective,

visit vsp.com for details.

This table is not intended to include all benefit details. It is an outline of coverage available and is not intended to be a legal contract.

If a discrepancy exists between this document and the official Plan Documents, the Plan Documents govern.

18

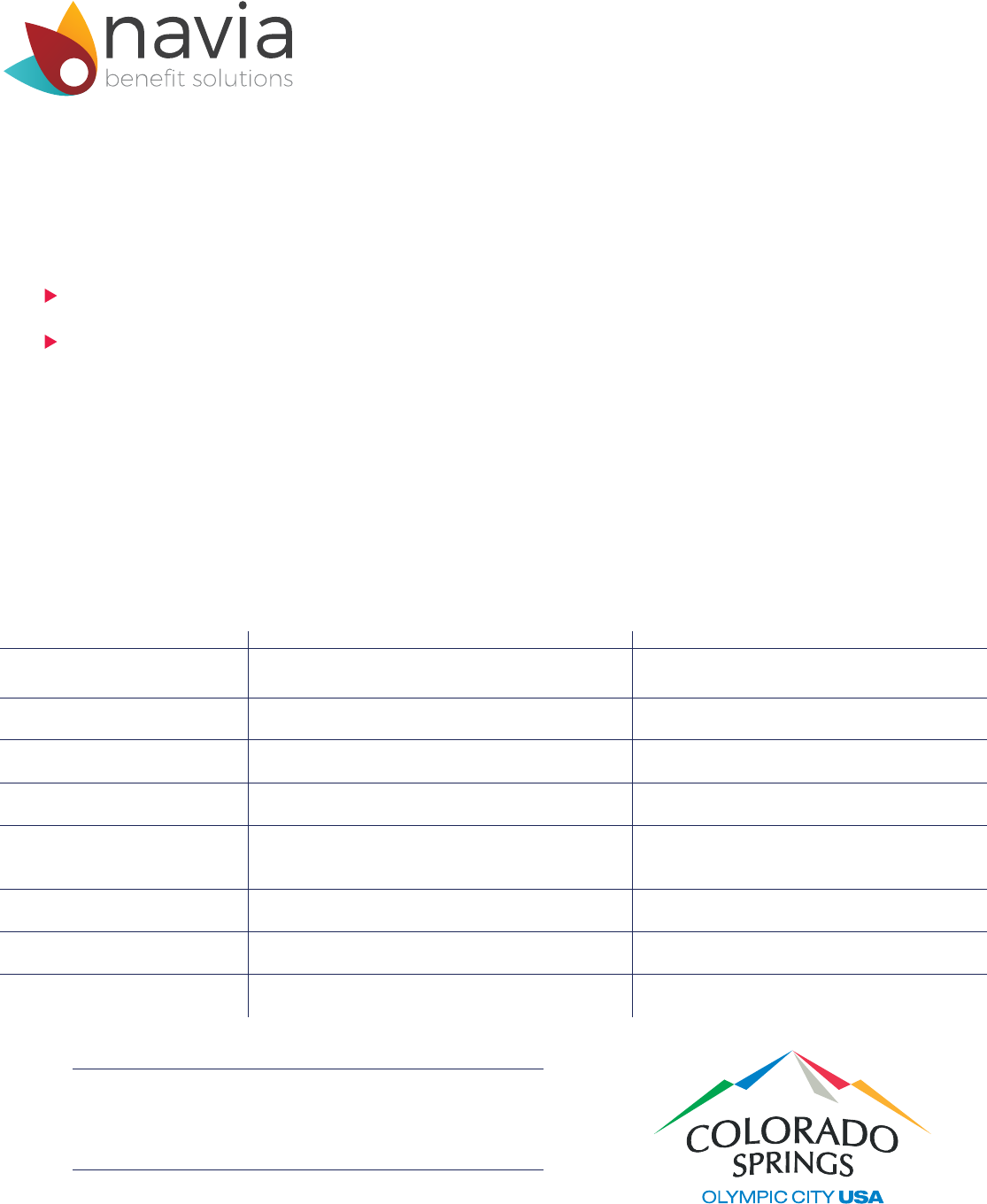

SPENDING ACCOUNTS

Spending accounts administered by Navia Benefit Solutions, offer a smart way to

stretch your paycheck by setting aside pre-tax dollars to pay for eligible health

and dependent care expenses. Each plan year (January 1 – December 31), you must

elect the annual amount you want to contribute to each account.

HEALTH REIMBURSEMENT ACCOUNT (HRA)

Employees enrolled in the Advantage Plan are eligible to

receive an employer-funded Health Reimbursement Account

(HRA). The annual funding level is based on your coverage

tier and prorated for new enrollees during the year. Annual

employer funding as of January 1:

Employees $500*

Employee + All other Tiers $750*

enrollments during the year.

*These amounts are pro-rated for mid-year plan

enrollments.

T

his account allows you to pay for certain medical, dental,

and vision expenses with tax free dollars funded by the City.

If you enroll in a pre-tax Flexible Spending Account (FSA) for

Health Care, you must first exhaust the balance in your FSA

before you can be reimbursed from your employer funded

HRA. The maximum HRA balance you may accrue is $8,000.

Submit claims by March 31 of the following plan year.

FLEXIBLE SPENDING ACCOUNTS (FSAs)

A Flexible Spending Account (FSA) for Health Care allows you

to allocate money on a pre-tax basis to reimburse yourself

for qualified medical, dental, and vision expenses for you and

your family. Qualified expenses include co-pays, deductibles,

prescriptions, and much more. You may rollover unused

monies into the following year, with a maximum allowed per

IRS regulations (see below).

An FSA for Dependent Care allows you to allocate money

on a pre-tax basis to reimburse yourself for dependent

care services. There is a “use it or lose it” rule with FSA for

Dependent Care meaning that, any contributions remaining

in your account that cannot be applied toward current year

dependent care expenses are not refundable.

Eligibility

Annual Contribution

Eligible Expenses

Availability of Funds

Payment or

Reimbursement Options

Rollover Amount

Service Deadline

Submission Deadline

for Reimbursement

Health Care FSA Dependent Care FSA

Eligible employees who are not enrolled in an

HSA on their spouse’s insurance

Minimum of $120 up to $3,050

Visit NaviaBenefits.com for a complete list

The full annual amount you elect is available

on your plan effective date

Debit card or reimbursement

Up to $610 (adjusted for inflation),

of unused funds

Services must be incurred by 12/31/2024

Claims must be submitted by 3/31/2025

All eligible employees

Up to $5,000

($2,500 if married and filing separately)

Care for children aged 12 and under,

disabled children and dependent adults

You can be reimbursed up to the amount

you have contributed

Debit card or reimbursement

Unused funds do not rollover

Services must be incurred by 12/31/2024

Claims must be submitted by 3/31/2025

For more information Visit the Benefits & Wellness Intranet

or contact the HR Solutions Center

(719) 385-5125 • [email protected]

19

LIFE INSURANCE

Life insurance offers financial protection for you and your loved ones when

experiencing loss through death. You are provided Basic Life and Accidental Death

and Dismemberment (AD&D) coverage by the City at no extra cost and can enroll in

supplemental Voluntary Term Life Insurance for yourself and dependents through

The Hartford.

New: Line of Duty benefit for Sworn employees includes an additional $50,000 death benefit.

Basic Life and AD&D = 1.5 X Annual Employee Salary

(Imputed income applies for benefit greater than $50K)

Voluntary Term Life Insurance (VTL)

New:

increased Guaranteed Issued Amount for employees is now $300,000.

Voluntary Term Life (VTL) Insurance can be purchased for yourself, spouse, and/or child(ren). Coverage is

available in increments of $25,000 for yourself and spouse and $5,000 for your child(ren).

No person may be insured as a dependent of more than one active employee under the policy.

Portable and convertible coverage available.

Tobacco rates apply for employee coverage. Must be tobacco-free for one year for non-tobacco user rate.

Insured Minimum Maximum Guarantee Issue

Employee $ 25,000 $ 500,000* $ 300,000

Spouse $ 25,000 $ 250,000 $ 50,000

Child(ren) $ 5,000 $ 25,000 $ 25,000

*You may not elect more than 10 times your annual

An Evidence of Insurability (EOI) is required

for employee coverage greater than $300,000

and for any new spouse coverage during

Open Enrollment. For spouse coverage,

you may increase VTL coverage by one

increment up to Guarantee Issue without an

EOI. Spouse coverage cannot be greater than

employee coverage.

Cost Example:

Desired Coverage Amount: $150,000

Age on January 1st: 35

Smoking Status: Non-Tobacco User

$150,000 / 1,000 = 150

150 x .07 = $10.50/Month

$10.50/Month / 2 = $5.25

Semi-monthly cost = $5.25

VTL Rate Structure Employee and Spouse

Age Bracket

Under 30

30-34

35-39

40-44

45-49

50-54

55-59

60-64

65-69

70-74

Over 74

Child(ren) per $5,000 = $0.72 per month

Non-Tobacco Tobacco User

User Per $1,000 Per $1,000

.04 .07

.06 .10

.07 .11

.08 .15

.11 .23

.17 .34

.32 .57

.50 .83

.97 1.37

1.64 2.79

2.06 2.85

These tables are not intended to include all benefit details. It

is an outline of coverage available and is not intended to be a

legal contract. If a discrepancy exists between this document

and the official Plan Documents, the Plan Documents govern.

20

DISABILITY INSURANCE

If you experience an injury or illness that prevents you from working, The Hartford disability insurance provides partial income

replacement to assist you financially. All benefit eligible employees may enroll in voluntary disability insurance. Premiums are

determined by Class (1,2,3, or 4), age, salary, and disability plan(s) elected. Disability Class is determined by PERA or FPPA

eligibility status.

SHORT-TERM DISABILITY (STD)

Short-Term Disability coverage provides you with partial income replacement if you are unable to work due to an illness,

including pregnancy, or injury that is non-work related.

NEW: Maximum weekly Gross Benefit is $1,500

*If vested with PERA (5 service years), including prior employment, you should notify the HR Solutions Center.

LONG-TERM DISABILITY (LTD)

Long-Term Disability coverage provides you with partial income replacement if you are unable to work for an extended

period due to an illness or injury.

PARTICIPANT DISABILITY CLASS SUMMARY (and examples)

Review Plan Documents for Complete Class Definitions

Voluntary STD (Accident or Illness)

Percent of Earnings Maximum Weekly Gross Benefit Waiting Period Maximum Benefit Duration

60% $1,500 7 days Class 1, 3, & 4: 25 Weeks

Class 2: 8 Weeks

Voluntary LTD (Accident or Illness)

Percent of Earnings Maximum Monthly Gross Benefit Waiting Period Maximum Duration

66.67% $7,500 180 days Varies see Plan Document

Class 1: PERA Defined

Benefit, not vested

Brett joined the City

as a Police Service

Representative in 2021.

Brett is enrolled in the PERA

Defined Benefit Plan but is

not vested under PERA.

Brett’s premiums are

calculated using Class 1

disability rates.

Class 2: PERA Defined

Benefit, vested

Tammy joined the

Accounting team in 2008.

Tammy is enrolled and

vested in the PERA Defined

Benefit Plan.

Tammy’s premiums are

calculated using Class 2

disability rates.

Class 3: Sworn,

covered under FPPA

John joined the City as a

Firefighter in 2021.

John is a member of the

FPPA.

John’s premiums are

calculated using Class 3

disability rates.

Class 4: PERA Defined

Contribution (DC)

Lilly joined the City in 2023

and works in Public Works.

Lilly is enrolled in the PERA

Defined Contribution Plan.

Lilly’s premiums are

calculated using Class 5

disability rates.

21

DISABILITY INSURANCE & FAMILY MEDICAL LEAVE

STD Rates LTD Rates

Age Bracket

18 – 24

25 – 29

30 – 34

35 – 39

40 – 44

45 – 49

50 – 54

55 – 59

60 – 64

65 Plus

Civilian & Sworn

Employees

(Classes 1, 3 & 4)

.094

.094

.084

.094

.105

.126

.147

.188

.230

.230

Civilian PERA

Vested/DB

(Class 2)

.044

.045

.045

.052

.056

.068

.080

.094

.100

.100

Civilian

Employees

(Classes 1 & 4)

.118

.144

.210

.288

.575

.930

1.213

1.336

1.218

1.218

CivilianPERA

Vested/DB

(Class 2)

.036

.047

.082

.113

.196

.349

.534

.637

.611

.611

Sworn

Employees

(Class 3)

.082

.108

.160

.241

.390

.683

1.074

1.290

1.203

1.203

STD Cost Formula: Cost Example: LTD Cost Formula:

$45,000 / 52 = $865.39 Annual Base Salary $45,000 $3,750 / 100 = $37.50

$865.39 *.6 = $519.23 Monthly Base Earnings $3,750 $37.50 x .683 = $25.61

$519.23 / $10 = $51.92 Retirement Plan FPPA $25.61 / 2 = $12.80

$51.92 x .126 = $6.54

$6.54 / 2 = $3.27 Age on January 1 45

Semi-monthly cost $3.27 Disability Class 3 Semi-monthly cost $12.80

Disability tables and summaries are not intended to include all benefit details. It is an outline of coverage available and is not intended to be a legal

contract. If a discrepancy exists between this document and the official Plan Documents, the Plan Documents govern.

22

LONG-TERM CARE INSURANCE

UNUM’s voluntary Long-Term Care (LTC) Insurance offers

peace of mind and financial assistance to support you, your

spouse, parents, or grandparents during a major life event

that limits one’s ability to perform at least two activities of

daily living: eating, bathing, continence, dressing, toileting,

and transferring.

Various coverage options are available and includes optional

inflation protection. Your premium depends on the insured’s

age when entering the plan, the plan elected, and if you elect

the inflation protection option

LTC provides benefits to help you pay

for care and facilities associated with:

• Home Health • Alzheimer’s

• Homemaker Services • Nursing

• Hospice • Personal Care

• Respite Care • Residential

• Rehabilitation

To enroll in coverage, unuminfo.com/coloradosprings/index.aspx. Fax, email, or mail

your enrollment to the address on the form. If you have questions about your coverage,

please contact UNUM Customer Service.

23

EMPLOYEE ASSISTANCE PROGRAM (EAP)

This FREE and confidential program through Profile EAP is available to all benefits-eligible employees and their eligible

dependents. EAP is a professional and completely confidential counseling service designed to help employees and

dependents resolve personal and/or work-related issues. EAP provides up to six (6) counseling visits for each problem

area, each year, at no charge. Participation in a City medical plan may help cover additional treatment if needed.

NEW: Same great service under a new name, Profile EAP is changing to CommonSpirit Health.

YOUR EAP PROVIDES SPECIALIZED SERVICES COUNSELING BENEFITS:

COUNSELING BENEFITS: Licensed, professional counselors to support with relationship

issues, family concerns, grief, stress, depression, or anxiety, substance abuse, and

workplace difficulties.

24/7 CRISIS SERVICE: Individual or group support with crisis situations, available 24

hours a day.

DEPRESSION CARE PROGRAM AND SLEEP CARE PROGRAM: Support with

exhaustion, sense of emptiness, loss of interest, trouble sleeping, and changes to mood

or appetite.

LIFE CYCLE SERVICES: Online platform to support with a wide array of work and life

topics (child/elder care, finances, legal, and so much more) of interest to you and your

family. Contact a Life Expert for additional support.

Visit: Profileeap.org

Company Code: COSPGS

FACE IT TOGETHER

Face It TOGETHER provides all benefit-eligible employees and their dependents access to

free, confidential peer coaching. Peer coaches have lived experience with alcohol and other

drugs – either personally or as impacted loved ones. There’s no judgment because they know

how it feels. Coaches provide professional, compassionate care at no cost to participants. All

services are kept private and adaptable to your individual or family needs. Sobriety isn’t

required and support is non-clinical.

Peer Coach: Your coach is your wellness partner, providing knowledge, support, and practical tools or accountability –

depending on your needs. Flexible, personalized approach means that you get the support you need in a way that is convenient

to your schedule.

Focused on improving every aspect of your life – not just the part that involves drugs or alcohol.

RETIREMENT

CIVILIAN PERACHOICE

City civilian employees and elected officials are members of the State of Colorado

pension system administered under State law by the Public Employees’ Retirement

Association (PERA) in lieu of Social Security. Participation is mandatory for eligible

employees and employees currently contribute 9% of PERA-includable salary to

their account. The City’s contribution for 2024 will be 14.78% (to include amortization

Equalization Disbursement (AED) & Supplemental Amortization Equalization Disbursement (SAED) of the same earnings to

the local government division. Employees hired after December 31, 2018, have the PERAChoice option and can choose to

be part of the PERA Defined Benefit (DB) Plan or the Defined Contribution (DC) Plan.

DEFINED BENEFIT (DB) PLAN

The PERA DB Plan is a hybrid defined benefit plan. It is

designed to attract and retain employees who are interested

in working in PERA-covered employment for a large part

of their careers, while providing greater portability than a

traditional defined benefit plan.

The PERA DB Plan offers a lifetime retirement benefit after

meeting age and service requirements and is sometimes

referred to as a pension.

DEFINED CONTRIBUTION (DC) PLAN

The PERA DC Plan is based on the money you have

contributed, and the investment earnings or losses incurred,

minus expenses. The PERA DC Plan may be attractive if

working in PERA- covered employment for only a small

portion of a career.

The amount of your retirement benefit depends on the

success of your investment decisions, when you begin

withdrawals, and your life expectancy - you bear the risk of

outliving your investments.

SWORN FIRE AND POLICE EMPLOYEES

All Sworn (Fire and Police) employees hired after 2006 are part of the FPPA

Statewide Defined Benefit (SWDB) Plan through the Fire and Police Pension

Association (FPPA) of Colorado in lieu of Social Security. Participation is mandatory

for eligible employees. To fund future pension benefits, employees contribute 12%

of FPPA-includable salary and the City contributes 10% of the same earnings. These

contribution rates are as of January 1, 2024.

The following types of retirement are available under the SWDB plan: normal, early, vested or deferred. If a member

terminates service before retirement eligibility, the member may qualify for a refund of contributions. Additional information

about FPPA benefits is available through FPPA.

26

VOLUNTARY RETIREMENT SAVINGS PLANS

In addition to your PERA and FPPA retirement benefits,

all City employees are eligible to participate in the voluntary

457 Deferred Compensation Plan, Roth 457, and/or Roth IRA.

457 DEFERRED COMPENSATION PLAN

The City of Colorado Springs encourages all employees to

actively participate in their retirement planning. New Hire

paperwork includes an automatic enrollment at a rate of 3%

into the 457 Deferred Compensation Plan. Participation in this

plan is not mandatory and employees may opt-out at any time.

Additionally, employees may enroll or make changes to their

retirement contribution anytime throughout the year.

Automatic 3% enrollment at hire

All employees can participate

Less restrictive than a 401(k)

Diversified Investment Options

Tax- Deferred Contributions

ROTH IRA

Employees have an additional retirement savings option

by investing in a Roth IRA. Roth IRA contributions can

start anytime with any dollar amount and contributions

are withheld directly from your paycheck as an after-

tax deduction. Investment earnings are tax-free at the

time of distribution and are accessible anytime, usually

without penalty.

ROTH 457

Employees also can participate in a Roth 457 plan

through MissionSquare in place of a traditional 457 plan.

In a traditional 457 plan, participants can make pre-tax

contributions that are then taxed along with the earnings

in retirement. Roth 457 contributions differ because they

are made after-tax and are not taxed when the assets are

withdrawn. Earnings may also be withdrawn tax-free if

certain criteria are met.

27

VACATION BUY, PAID TIME OFF, TUITION ASSISTANCE

VACATION BUY

Benefits eligible employees may purchase up to 40 hours of

vacation time pre-tax, based upon their hourly rate of pay

on January 1 of each benefit year. Vacation Buy can only

be elected during Open Enrollment, Qualifying Life Event,

or when newly hired with the City. Full-time employees may

purchase Vacation Buy in one-hour increments and the

minimum purchase amount is eight (8) hours. Vacation Buy

is calculated by multiplying the number of hours purchased

by your hourly rate and then divided by 24 (the amount

of benefit deducted paychecks in the year). Vacation Buy

purchased by new employees during the year use the

remaining number of paychecks (2 per month) during

the year. Vacation Buy hours purchased are available on

January 1 or upon election at the time of hire and must be

repaid if the employee uses Vacation Buy hours and then

separates employment before those hours are paid for. Any

unused Vacation Buy is paid back to employees annually in

December. Unused Vacation Buy hours do not roll over into

the next year.

TUITION ASSISTANCE

The City of Colorado Springs educational assistance program

provides financial support for job-related coursework. Regular

employees are eligible to receive tuition reimbursement for up

to two (2) classes per semester for undergraduate or graduate

coursework. Visit the Organizational Development Intranet

Site for more information.

PAID TIME OFF

The City offers work-life balance through its paid time

off benefits, which includes vacation leave, sick leave, a

personal day, and holidays. Information on paid time off

accruals and personal day eligibility are detailed in the

Civilian and Sworn Policies and Procedure Manuals (PPM).

City recognized holidays for 2024 are:

• New Year’s Day (01/01/2024)

• Martin Luther King, Jr. Day (01/15/2024)

• President’s Day (02/19/2024)

• Memorial Day (05/27/2024)

• Juneteenth (06/19/2024)

• Independence Day (07/04/2024)

• Labor Day (09/02/2024)

• Veteran’s Day (11/11/2024)

• Thanksgiving Day (11/28/2024)

• Day after Thanksgiving (11/29/2024)

• Christmas Eve (Civilian only) (12/24/2024)

• Christmas Day (12/25/2024)

Civilian employee: All benefit-eligible employees, non-shift

civilian employees will receive 8 hours of paid holiday time

on observed holidays, and one 8-hour personal day each

year after six (6) months of employment.

Sworn and shift employees: Please refer to the appropriate

Policies & Procedures Manual for details on how holidays

and personal days are paid.

28

EMPLOYEE PERKS

Nationwide® pet insurance is available for dogs,

cats, birds, and exotic pets. Plans include coverage for your

pet’s injuries and illnesses. Extra features include access

24/7 to a veterinary professional, emergency boarding, lost

pet assistance, and multi-pet discounts.

Call (877) 738-7874 or visit:

benefits.petinsurance.com/city-of-colorado-springs

UCCS Programs

We have partnered with UCCS to bring you a variety of

opportunities for wellness. Benefit-eligible employees and

their spouses can participate in up to 16 UCCS personal

training and/or 4 cooking classes per year at no cost. In

addition, you can participate in unlimited group fitness

classes and wellness workshops at no cost.

Email [email protected] for additional information.

Parking System Enterprises

City employees are eligible to receive a discounted monthly

parking card once they obtain a parking space if they park at

one of the City parking garages.

There are three (3) parking garages:

One is located on the southwest corner of Nevada and

Colorado Avenues (130 North Nevada) across the street from

the City Administration Building; another is located near the

current downtown City bus station at 127 East Kiowa Avenue;

the third is located at 201 North Cascade.

Exclusive discounts, special offers, and preferred seating to

top attractions, travel, shopping, tickets and so much more…

Visit: Ticketsatwork.com

Company Code: coloradosprings

Mountain Metropolitan Transit

City employees, on City business, can ride FREE. Simply

show your City ID badge. City employees also receive

generous discounts on bus passes. A bus pass can be

purchased at the Transit Administration Office, 1015 Transit

Drive, or through interoffice mail at MC 1449.

Call Transit Services at (719) 385-5974 or email

[email protected] for additional

information.

Note: Discounted bus passes are only available to employees

who are not receiving a discounted parking card.

Gym Discounts

We are currently partnered with VASA, Orangetheory, 9

Round, Barre Forte, YogaShield, Blitz45, Anytime Fitness,

LesMills on Demand, Progressive Fitness, Corepower Yoga,

Planet Fitness, and Yogashield to provide discounts on gym

memberships to all City employees.

For discounted tickets and special offers for

City of Colorado Springs Employees.

Visit www.broadmoorworldarena.com/Supergroup

Promo Code: Community 24

or Call (719) 477-2102 when purchasing 10+ tickets.

Additional discounts for Microsoft products, cell phone

services, and more are available. Visit the Employee Perks

section of the Benefits and Wellness intranet for more

information. Work Life Balance, including gym discounts, are

subject to change at any time and without notice.

DISCLAIMER OF ENDORSEMENT. Reference to any specific product or service on this section does not constitute an implied or express recommendation,

endorsement, or favoring by the City of Colorado Springs or its enterprises. Certain links lead to information and resources on servers maintained by third

parties and are provided as a convenience only. Neither the City of Colorado Springs nor its enterprises have control over these outside vendors or their

websites and are, therefore, not responsible, or legally liable for their web content or product or service offerings.

29

30

FAQ

s

Will I receive a Medical ID card? Yes! You will

receive a unique medical member ID number and medical

insurance card. If a medical ID card is not received, or to request a

replacement or additional medical ID card(s), contact AmeriBen.

Be sure to share your member ID card with your providers. To

request a replacement or additional medical ID cards, contact

AmeriBen at (866) 955-1482. You may also view your medical

ID card on www.myameriben.com or mobile app.

Will I receive a Prescription ID card? Yes!

You will prescription member ID card with the same

medical ID number. If a prescription ID card received, or to

request a replacement or additional prescription ID cards,

Contact Maxor Plus. To request a replacement or additional

prescription cards contact MaxorPlus at (806) 324-5430.

You may also view your prescription ID card on

www.maxorplus.com or mobile app.

Will I receive a Dental ID card? Yes! You

will receive Delta Dental ID cards. Members can also access

their dental ID card through the Delta Dental of Colorado

online member portal www.deltadentalco.com or the mobile

app. When you visit your dental provider, provide your 6-digit

employee ID with three leading zeros (five if Sworn) in place of

your social security number. (Example of 9-digit ID: 000XXXXXX)

Will I receive a Vision ID card? No - VSP does not

issue vision ID cards. You may view your member ID card

on the VSP member portal www.vsp.com or mobile app.

When you visit your vision provider, provide your 6-digit

employee ID number with three leading zeros (five if Sworn) in

place of your social security number. (Example of 9- digit ID:

000XXXXXX)

How do I access ZERO Health and receive $0

plan member cost for select services?

Contact

ZERO Health at (855) 816-0001, www.zero.health, or email

at [email protected]. You MUST contact ZERO Health PRIOR

to receiving care to have your plan member responsibility of

$0 for the service(s) rendered.

How do I access Hinge Health and receive $0

plan member cost for select services?

Contact

Hinge Health at (855) 902-2777.

Will member co-pays apply towards my annual

deductible and out-of-pocket maximum?

Member

co-pays do not apply towards your annual deductible;

however, co-pays do apply towards your out-of- pocket

maximum. This includes prescription and CEMC co-pays.

How do I find out information about the

tobacco premium surcharge?

Refer to the Tobacco

Surcharge FAQ, available on the Benefits and Wellness,

Medical Intranet page.

What can be treated through Teladoc?

• General Medicine • Behavioral Health

• Cold & flu symptoms • Stress

• Allergies • Addiction

• Bronchitis • Anxiety

• Respiratory Infection • Depression

• Tobacco cessation

Covered medical plan members have access to Teladoc

services at $0 member co-pay. The above list of services is

for illustrations, and additional services may be available.

Who is the Health Reimbursement Account

(HRA) and Flexible Spending Account (FSA)

Administrator for 2024?

Navia Benefit Solutions

(Navia) is our current provider.

How do I get reimbursed from my HRA and FSA?

You may submit claims to Navia via mail, fax, mobile app, or

online.

What is the timeline to request reimbursement

for my HRA and FSAs (Claim Run-Out Period)?

The HRA and FSAs are administered per plan year.

Participants can request reimbursement through the claim

run-out period for services incurred January 1 – December

31. The claim run-out period is 90 days, or January 1 – March

31, of the following year. Claims for 2024, therefore, must be

submitted for reimbursement by March 31, 2025.

How quickly will I receive my FSA or HRA

reimbursements?

Claims are processed daily. If you set

up a direct deposit with Navia, you will receive your money

faster than if they need to mail a check to your home. Visit the

Navia Benefits member portal to set up your direct deposit.

Debit cards are also available for immediate use.

What is an eligible expense for the HRA and

Health Care FSA?

Most allowable medical expenses

include co-pays for services or prescriptions, deductible

payments, dental work, frames, contact lenses, over-the-

counter medication, personal protection equipment (PPE),

feminine products, sunscreen and more. Contact Navia for

more information.

Who is eligible for the HRA? All employees who

enroll in the Advantage Plan will be covered under the HRA

unless they elect to opt out of the HRA benefit. Each year

the employer will contribute (tax free) $500 if enrolled in

employee only coverage and $750 if enrolled in any other

coverage tier. These amounts are pro-rated for new plan

enrollments during the year.

31

How does the HRA interact with my Health

Care FSA?

If you are enrolled in the Health Care FSA,

claims will be paid from the FSA first and then any remainder

paid from the HRA. Note: You cannot change this order of

payment.

Will I receive a debit card automatically if I

have an HRA or FSA?

Yes. Navia will automatically

send a debit card to HRA and Health Care FSA participants.

Debit cards are also available for Dependent Care FSA

participants, upon request through Navia. You can access

your HRA, and FSAs using one, convenient debit card. To

request additional or replacement debit cards free of charge,

contact Navia.

If you currently have a debit card, please keep this card for

use in 2024.

FAQs (cont) & HELPFUL REMINDERS

HELPFUL REMINDERS

Benefits Information

Learn all about your benefits by visiting the Benefits and

Wellness Intranet page. Let us help!

If you need help with your benefits, please contact the

HR Solutions Center at:

(719) 385-5125 or [email protected]

Coordination of Benefits

You must submit your Coordination of Benefits form to

AmeriBen on an annual basis. You may complete the COB

form and mail to AmeriBen, call the customer care center

at (866) 955-1482 or log into myameriben.com to update

your information.

Will I have to provide documentation when I

use my debit card?

You might. If documentation is

required to substantiate your claim, you will need to submit

the documentation to Navia as soon as possible to avoid

suspension of your debit card.

What happens if I do not provide substantiation

for debit card transactions?

Your debit card will

be deactivated, and the amount becomes taxable income

to you. Always remember to submit proper documentation

when required to substantiate your claims to Navia via fax,

mobile app, mail, or online.

Debit Card Documentation

If you are required to provide documentation that a debit card

was used for an eligible reimbursable expense – be sure to

follow through. Otherwise, your card will be deactivated, and

the expenses will be considered taxable to you.

Health Reimbursement Account (HRA)

Your entire Health Reimbursement Account (HRA) balance

(up to a max of $8,000) will carry over each year as long as

you remain enrolled in the Advantage plan. Remember to

submit for 2024 expenses by March 31, 2025. If you submit

for a reimbursement from your HRA for a dependent, you

will need to certify that the dependent is covered by a group

health plan.

Over-the-Counter Medications

Want to save money on your over-the-counter medications?

The City Employee Pharmacy offers a wide variety of items

at a great discount. Over-the-counter medications are

reimbursable under the HRA and Health Care FSA and are

available to all employees.

32

HEALTHCARE REFORM

The Patient Protection and Affordable Care Act (commonly referred to as ACA or Health Care Reform) is a federal law

passed in March of 2010 with the goal of improving the availability, affordability, and quality of health care coverage

in the United States. In its current form, the law has produced a steady stream of regulations and guidance by federal

agencies charged with clarifying employer requirements under the law. As your employer, we continue to implement

provisions to comply with the requirements of the health care reform law.

HEALTH CARE REFORM FAQS

Am I required to have health insurance? Health Care Reform required most U.S. citizens and legal immigrants to

have a basic level of health coverage (called “minimum essential coverage”) starting January 1, 2014, or else face a tax

penalty. This requirement under the law is called the individual mandate. In December 2017, Congress passed a new

law (the Tax Cuts and Jobs Act) that reduced the individual mandate penalty to zero starting in 2019. This means that

starting in 2019, there is no longer a federal individual mandate penalty for failure to maintain medical plan coverage.

What is the Health Insurance Marketplace? The Marketplace is comprised of state and federal run websites (called

Exchanges) where people can compare and buy individual policies for health care coverage. Plans on the Marketplace

may also be eligible for a tax credit that lowers monthly premiums. Anyone can purchase coverage through the