2022

Annual Report

Wells Fargo & Company

CEO Letter

Dear Shareholders,

I’m proud to report that Wells Fargo continued to make

progress on our priorities in 2022. Our underlying financial

performance is improving, we are moving forward on our risk,

control and regulatory agenda, we are focusing on businesses

where we can generate appropriate risk-adjusted returns, we

continue to strengthen the leadership team, and we are

executing on our strategic objectives. While we have made

progress, our work is not complete and we remain focused on

successful and timely execution of our multi-year journey to

complete our risk and control work and to move forward with

our businesses.

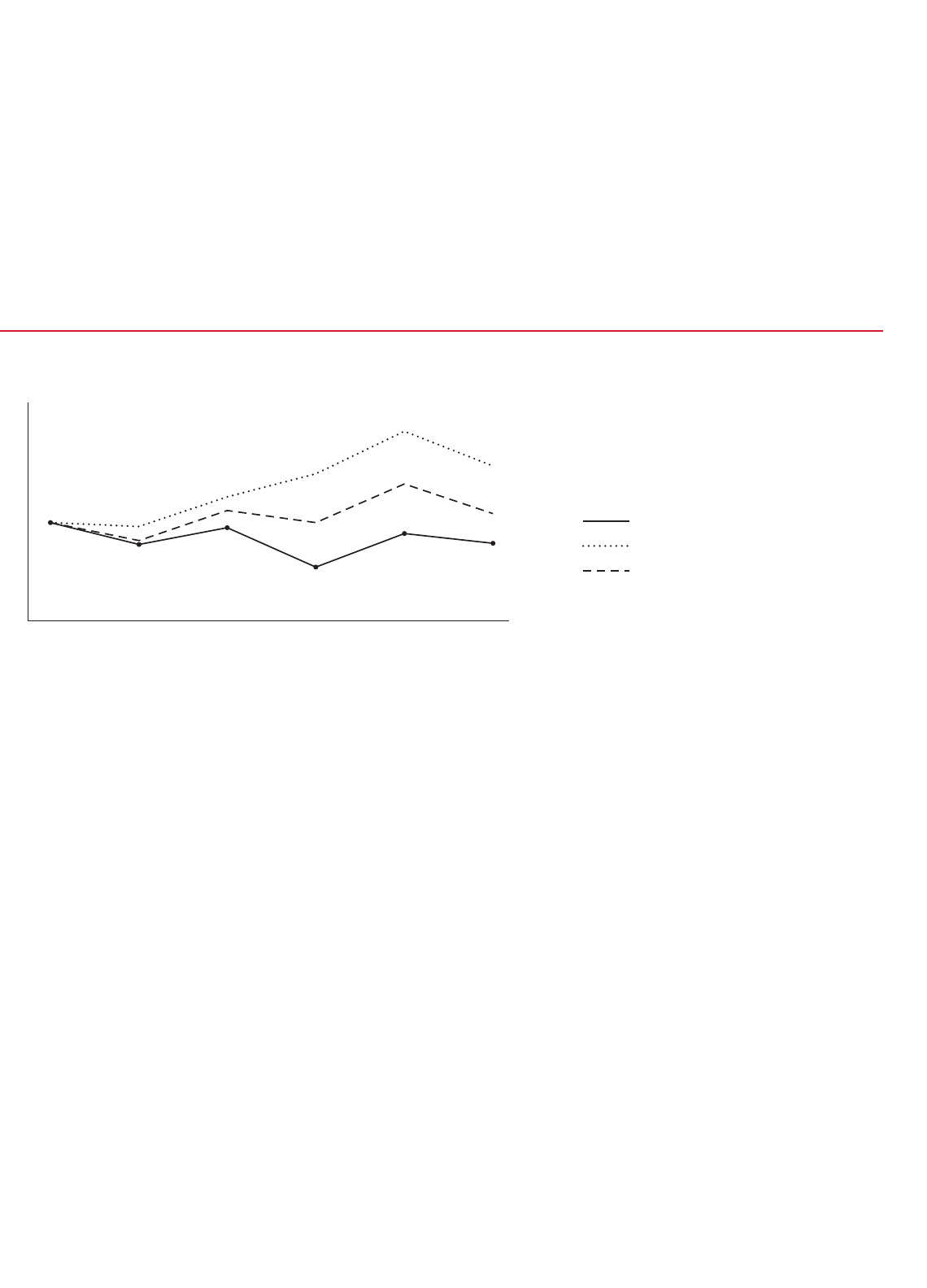

Stronger financial performance

Our financial performance benefitted as we continued to drive

improved efficiency, and it was positively impacted by both

rising rates and a benign credit environment.

In 2022, Wells Fargo generated $13.2 billion in net income, or

$3.17 per common share. Our results were significantly

impacted by $7 billion of operating losses, primarily related to

putting historical issues behind us, including litigation,

regulatory matters, and customer remediations. However, our

performance excluding those items was solid and demonstrates

the continued progress we are making to improve returns.

Our revenue decreased 6% from the previous year. The higher

rate environment and good loan growth drove strong growth in

net interest income, which was up 26% from a year ago.

However, this growth was more than offset by lower net gains

from equity securities, mortgage banking, and investment

advisory and other asset-based fees reflecting market

conditions, as well as the lost revenue related to businesses we

sold in 2021.

Expenses increased 6% from a year ago, reflecting higher

operating losses primarily related to putting historical matters

behind us, as noted above. Excluding operating losses,

noninterest expense declined from a year ago, reflecting

continued progress on our efficiency initiatives and the impact

from business sales. We achieved these efficiency gains while we

made continued investments in our risk and control

infrastructure and in strategic initiatives across our businesses,

and in the face of continued inflationary pressures.

Credit quality remained strong, but, as expected, losses started

to slowly increase in the second half of the year off their

historical lows. Our net charge-off rate declined from 18 basis

points in 2021 to 17 basis points in 2022, and our allowance for

credit losses declined by $75 million in 2022, as our reserve

release in the first quarter was slightly larger than the reserve

builds we had in the last three quarters of the year.

Loans outstanding increased by 7% from one year ago, with

growth in both our consumer and commercial portfolios.

Consumer Banking and Lending grew 4%, driven by growth in

residential mortgage and credit card, which offset a decline in

auto loans. Both Commercial Banking and Corporate and

Investment Banking had strong loan growth, with commercial

loans up 9% from a year ago, driven by growth across all asset

classes. Average deposits in 2022 decreased 1% to $1.42 trillion,

as higher market rates spurred customers to look for higher

yielding alternatives, and consumers continued to spend savings

that built up during the pandemic.

Our capital levels remained well above our required regulatory

minimums plus buffers. We increased our quarterly common

stock dividend in the first quarter of 2022 from $0.20 per share

to $0.25 per share and then to $0.30 in the third quarter of

2022. While we did not repurchase any common stock in the last

three quarters of 2022, we have repurchased shares in the first

quarter of 2023.

Our return on equity was 7.5% and our return on tangible

common equity (ROTCE) was 9.0%

1

. Both of these ratios were

impacted by the operating losses I highlighted earlier.

In my shareholder letter over the past two years, I have

discussed our path to higher returns. Since 2020, we have

executed on a number of important items to improve our

returns, including returning $16 billion to shareholders through

net common stock repurchases, increasing our common stock

dividend from $0.10 per share to $0.30 per share, and delivering

approximately $7.5 billion of gross expense saves. Based on

these actions and others that are in flight, we believe we have a

clear line of sight to a sustainable ROTCE of approximately 15%

in the medium term. In order to achieve that, we need to

continue to optimize our capital, including returning capital to

shareholders and redeploying capital to higher returning

businesses; execute on efficiency initiatives; and benefit from

the investments we are making in our businesses.

1

Return on tangible common equity (ROTCE) is a non-GAAP

financial measure. For additional information, including a

corresponding reconciliation to GAAP financial measures, see

the “Financial Review – Capital Management – Tangible

Common Equity” section in this Report.

2022 Annual Report i

We are actively watching the

economy

Consumers

After a period of strong economic growth and low

unemployment, the Federal Reserve has been increasing

interest rates aggressively with a goal of combatting high

inflation. Increasing interest rates and a slowing economy have

caused headwinds for some of our customers, but our

customers have largely remained resilient over the past year,

with deposit balances, consumer spending and credit quality still

stronger than pre-pandemic levels.

Consumer credit card spend continued to be strong in 2022,

with spending up 25% compared with 2021, which reflects the

benefit of new Wells Fargo product launches. Almost all

spending categories had double-digit spend growth year over

year. Consumer debit card spend slowed to 3% growth in 2022

compared to 2021. Growth was driven by ticket size since

transaction volume was flat year-over-year, and discretionary

spend outpaced non-discretionary spend.

At the same time, we are carefully watching the impact of higher

rates and we expect to see deposit balances continue to

decrease and credit quality to continue to weaken. For certain

cohorts of customers, average deposit balances are below

pre-pandemic levels, and we are closely monitoring activity for

signs of potential stress. For our borrowers, we are working to

limit the risk – both to them and to us – of overextension. We

have taken selective actions across our consumer lending

businesses to mitigate risks associated with inflation and

increased debt leverage. In our auto business, we have adjusted

policies to address risk associated with collateral value declines

and inflationary pressures on consumers’ ability to pay. In home

lending, we have tightened loan-to-value policies nationally and

even more so in local markets that have elevated home value

risk. Additionally, in our card business, we have tightened our

lending policy to focus on applicants who may be exhibiting

debt-seeking behavior.

Businesses

Commercial loans grew 9% in 2022, with most of the growth in

the first half of the year. Higher inventory levels contributed to

increased working capital needs, which drove higher utilization

rates. However, utilization rates stabilized in the second half of

the year, and current data is not pointing to additional inventory

builds, which indicates most businesses are carefully managing

inventory levels amid slowing demand.

We continue to closely monitor the most pandemic-impacted

sectors and inflation-sensitive industries in our commercial

portfolio. This includes:

• Updating underwriting guidelines to include interest-rate

sensitivity to leveraged loans

• Analyzing supply chain issues, inflationary pressures, and the

impact of a potential recession

• Making timely updates to our watchlist

The Commercial Real Estate office market is showing signs of

weakness due to lower demand, driving higher vacancy rates and

deteriorating operating performance. Challenging economic and

capital market conditions are also buffeting the office market,

and while we haven’t seen this translate to significant loss

content yet, we do expect to see stress over time and are

proactively working with borrowers to manage our exposure.

Specifically, we have issued underwriting guidance for navigating

current conditions, including limited tolerance for new credit

policy exceptions, increasing minimum debt yield thresholds,

and stress testing and expansion of the watchlist process,

including additional emphasis on the office market.

Looking ahead to the remainder of 2023, we are prepared for a

range of scenarios. As a large lender to both consumers and

businesses in the United States, we have significant credit

exposure across our businesses, and as the Federal Reserve

continues to take action to reduce inflation, we will continue to

monitor both the markets and our own customer data and will

react accordingly. If our view of economic stress deteriorates

from our view at the end of 2022, we will likely add to credit loss

reserves during 2023.

Moving forward on our risk, control,

and regulatory agenda

We continue to move forward with the foundational work of

building out a risk and control framework appropriate for our

company. This multi-year journey continues to be about setting

clear priorities, cultural change, and operational execution. I have

been clear and consistently reinforce that this foundational work

is our top priority. This should always be the case for a bank such

as ours, but this has not always been the case, so reinforcement

is necessary. We remain confident in our ability to complete this

work and build appropriate risk, control, and operational

excellence into our culture.

The Acting Comptroller of the Currency gave an important

speech in January addressing the potential difficulties of

managing a large bank. Given that the OCC is a key supervisor of

ours, we take the speech seriously and are focused on its key

messages.

The speech focused on the view that there are limits to an

organization’s manageability based on size and, if so, that the most

efficient and effective way to fix this is to compel its simplification.

I am not in a position to agree or disagree with this premise, but I

am in a position to have the strong point of view that Wells Fargo

is not too big or complex to manage. Our shortcomings are not

structural, but they are the result of historically ineffective

management and the lack of proper prioritization of building out

an appropriate risk and control environment that will ultimately

take multiple years to correct.

ii

We are large but are far less complex than many with whom we

compete. In fact, we have more similarities with regional banks

than other global systemically important banks (GSIBs), and

strong and effective risk management processes should scale to

a company of our size. In addition, we have acted and will

continue to act on our own to simplify our company and reduce

operational complexity and risk, as I detail in the section later in

this letter entitled “Executing on Strategic Objectives.”

Operating at a broad scale but with less complexity than peers

1. We are primarily a US domestic bank and we do not have

the many complexities that running large-scale

international businesses bring. Our legal entity structure,

extent of international regulatory oversight and physical

footprint are far simpler than many of our competitors.

Approximately 90% of our revenues come from U.S. clients

or activities of non-U.S. clients in the U.S. Our businesses

outside the U.S. primarily support our U.S. customer base.

We are very happy with our existing footprint and are not

looking beyond for growth opportunities.

2. Our products are not complex compared with those offered

by other banks and are similar to those offered by smaller

institutions. We predominantly provide the same products

and services as regional and smaller, more local banks. We

take deposits, provide financing, move money, and provide

financial advice for our customers. Our trading activities

and the size of our market risk are relatively small compared

to other large GSIBs.

3. Scale in each of our businesses should not make us more

complex. Our distribution methods are similar to smaller

institutions. We manage a branch network, have

relationship managers across our markets, market through

the internet, traditional advertising, direct mail, and word of

mouth, and we rely on our local reputation. The controls

necessary to manage a network of 4,000+ branches are

similar to those necessary to manage a smaller branch

network. The same is true for managing relationship

managers, marketing, and protecting our reputation. Senior

management should be involved at a detailed level, but all

institutions should have and rely on defined control

frameworks in place that are effective at risk management,

regardless of individuals in a seat. These frameworks can

effectively scale to a bank of our size.

4. Our customers benefit from our size and reach. Wells Fargo

has nearly 4,600 retail bank branches, with a presence in 25

of the largest 30 markets in the U.S. A Wells Fargo branch

or ATM is within 2 miles of over half of U.S. Census

households and small businesses in our footprint. The range

of banking services we provide helps us build full

relationships with individuals and companies, allowing us to

see a full picture of their personal, family, and/or business

financial needs, and to meet these needs. We have the

ability to invest in technology to make it faster, safer, and

more transparent for our customers to handle their banking

needs. In addition, our resources allow us to innovate

quickly, developing new products, services, and digitized

experiences to meet constantly changing consumer and

business expectations. These capabilities, along with our

size and reach, are of tangible benefit to consumers across

the country, whether they live in large cities or more rural

areas, and also to the U.S. economy as a whole.

Managing the company with significantly heightened discipline

We agree that there are also traits that management should

avoid as they grow. These signs are familiar to us, as we

identified them as historical behaviors at Wells Fargo when I

arrived. We viewed them then – as we do now – as unacceptable.

Our approach today is dramatically different than it was at Wells

Fargo in the past and we will continue to work so it becomes

part of our culture at all levels in the organization.

1.

Don’t hide behind materiality – As a large institution we

know we cannot let our size hide potential issues. We must

think about raw numbers, not just percentages which are

indexed to a large customer base, asset base, or capital

base. We have built functions and processes to review

customer complaints, employee allegations, and issues

raised from outside the company, and aim to use them to

identify issues and themes so we can address them and

make changes as required.

2. Don’t assume incidents are isolated – One of the

advantages large institutions have is the amount of data

and information we see and have, but we must use it

expeditiously. Individual incidents provide data points which

can help us learn and react, and we should treat each as

such. We strive to make data-driven decisions and to

explore whether incidents that can appear isolated can in

fact have broader application elsewhere in the company.

3. Identify weaknesses ourselves and address them quickly –

The Acting Comptroller stated that “the business of

banking is operationally intensive. Even at banks with

strong teams and robust risk management systems and

controls, mistakes and problems can arise. Well-managed

banks identify such problems early and often, address them

quickly, and take steps to prevent their recurrence.” We

agree completely. Many of the historical issues we continue

to work through were identified by regulators, not by us.

We are changing this, emphasizing our responsibility to

self-identify more issues and address them with a

heightened sense of urgency. As we implement our risk and

control framework, we will likely identify more issues and

move with haste to implement compensating and

ultimately permanent controls. Our risk and control

framework is not a project, but an ongoing set of actions,

and it will be part of our culture.

4.

Hubris, contempt, and indifference are unacceptable and

dangerous traits – We cannot believe that we know better

2022 Annual Report iii

than others and need to react with seriousness and urgency

when issues are raised – whether from employees,

customers, regulators, or others outside the company.

Every issue raised has the opportunity to be a learning

moment and we should also proactively look at our

competitors to learn as well.

5. Integration of mergers is more than a short-term

technology conversion – While we have not had a merger-

related systems integration in my time at Wells Fargo, we

agree that “simply stitch[ing]…systems together” can

cause a proliferation of issues. It is critical to merge and

simplify platforms, whether merger-related or as part of a

customer service strategy, as the reduced complexity in the

number of platforms should make it easier to properly serve

customers. For example, asking customer-service

representatives to learn multiple systems to provide the

same information creates more operational risk and the

possibility of a poor customer experience.

But these platform mergers should be the beginning of

integration, not the end. This is true looking both from our

perspective and the customer perspective. Customers think

of us as one company, not as separate relationships with

individual lines of business. They want to see their

information seamlessly and be able to transact with us

easily across all of their products. Unless we integrate our

platforms, we will either not appear as one company to the

customer, or we will create workarounds to try and

accomplish this, which creates unneeded operational risk. A

major competitive advantage of Wells Fargo is serving our

customers across a broad range of products, but we can

only do so effectively with common platforms.

The same is true of data platforms. Pulling customer data

from multiple platforms is operationally complex and

expensive. Common data platforms across our company are

critical. We rely on this for financial reporting, regulatory

reporting, risk reporting, and the ability to assess a

customer relationship holistically.

And finally, it is a mistake to lose sight of aged platforms, to

not invest in improving them and to not move to new ones.

New software and hardware solutions make it easier to

reduce complexity and properly serve customers, and when

these solutions are part of a program with a clear target

state, they should significantly reduce operational

complexity.

Recognizing this, Wells Fargo is implementing a modern

technology stack that is cloud-native and therefore more

elastic and resilient. We are applying this stack for the

various product domains that we are modernizing across

our businesses. Examples include a more modern digital

desktop for our financial advisors in Wealth and Investment

Management, our value-at-risk models in Corporate and

Investment Banking, and our payment platforms across

businesses. These modernization initiatives are guided

top-down by a product and platform architecture that sets

clear boundaries and expectations for teams. In addition to

this, the hosting of our platforms is more and more

migrating to a combination of private and public cloud,

powered by our partnerships with Google and Microsoft.

This also is leading to faster innovation by plugging in

innovative services provided by these cloud providers into

our platforms.

In parallel to these modernization efforts, we are also

enhancing the way we deliver software and the developer

experience. We are implementing new cloud-native tool-

chains that allow our developers to have the experience that

they deserve: on-demand, instant, elastic and with

embedded automated controls.

Further taking stock of where we stand – why haven’t we

completed our risk and regulatory work

I am frequently asked why our risk and regulatory work is not

complete though we have been publicly reprimanded, have a

growth constraint, and I have been leading the company for over

3 years. I wish my job was merely to complete work that was well

underway, but unfortunately this was not the case. Simply said,

the work to build the appropriate risk and control infrastructure

and close consent orders takes years when managed effectively,

and we were not as far along as I had expected when I arrived.

Much work was needed to build what is necessary to properly

accomplish the work.

When I arrived, we did not have the culture, effective processes,

or appropriate management oversight in place to remediate

weaknesses on a timely basis. Today, we approach these issues

differently. This management team (the broad team – not just

me) has the skills and experience and is now responsible for

closing our consent orders. We have changed and implemented

much to put ourselves in a position to have the confidence that

we can accomplish this. The specifics of our regulatory

remediation plans are confidential, and while we are not where

we need to be, I believe that our position is significantly

improved and that we will reach our goals. We are committed to

making all necessary resources available to meet our obligations.

I have said we are a different company today, and in this

sub-section, I provide some examples.

1. When I arrived at the company in 2019, we had 12 open,

public enforcement actions. Given this and the other

control issues we needed to assess, it took many months to

understand the depth and breadth of the weaknesses and

what was required to complete the work.

2. We then went about recruiting a mostly new management

team with the experience and skills that we did not

sufficiently have at the company. A large portion of the

Operating Committee was recruited during 2020 and they

then needed to do their own assessments and develop

plans. They then needed several years to build out their

teams.

iv

3. For each consent order Matters Requiring Attention

(MRAs), and other control gaps identified, we needed to

build detailed plans that satisfied both us and our

regulators. Our plans are now detailed and have hundreds of

deliverables with designated delivery dates. Many of our

consent orders have work that relies on work from another

order, so any slippage on one plan can impact another. Our

ability to assess all of this accurately for work to be done

over multiple years has not been perfect, and we have

missed some deliverables, but we have learned, adjusted,

and continue to move forward.

4. We needed to build processes to manage these across the

company. Building reporting and setting up management

review structures for these activities has been critical to

moving the work forward. Most of these did not exist or

were ineffective, and we now believe we have much more

effective reporting and processes in place to provide

appropriate oversight and allow us to identify issues early

so we can course-correct.

5. We did not have the resources necessary to accomplish this

work when I arrived. We have added close to 10,000 people

across numerous risk- and control-related groups and have

spent approximately $2 billion more in 2022 than in 2018 in

these areas. We are committed to make the investments

needed to complete the work.

6. And we had to build the management disciplines and

culture to govern and execute such a large body of work.

Our Operating Committee reviews risk and regulatory

progress and escalations on a weekly basis. We provide

detailed reporting to the full board and appropriate

committees so they can provide oversight. These reviews

are systematic and detailed, and they are helping us provide

the appropriate oversight and involvement to accomplish

the work.

I should add that we had to do all of this during the very worst of

the COVID-19 pandemic. While we were not alone in dealing

with the complexities of work from home, social distancing and

meeting the needs of customers during a pandemic, we were

alone in what we had to build, and doing so in a remote working

environment increased the difficulty level significantly.

Some have suggested that banks view enforcement actions and

fines as a cost of doing business, but I can tell you that today,

nothing is further from the truth at Wells Fargo. We view any

such action by our regulators as something that requires

immediate management attention. We aim both to avoid the

necessity of such action by doing the work ourselves and, when

regulators do take enforcement action against us, we follow a

disciplined process to work towards closure, again with all

necessary resources available for the effort.

The negative impact on our reputation of having not fulfilled our

obligations is clear. Simply put, failure to satisfy our regulatory

requirements carries significant consequences for our company.

On the other hand, fulfilling our obligations and building an

appropriate risk and control framework will allow us to build a

strong reputation amongst a broad set of stakeholders. So why

do we have so many consent orders that have been open for

extended periods? Again, our historical practices were

inadequate, and it has taken time to build what is necessary to

change our historical inadequacies.

So as I look at our situation today, the failure of Wells Fargo to

complete its work appropriately has resulted in multiple consent

orders, fines, and an asset cap. But I can say confidently that we

have taken significant actions including focusing and simplifying

the company, refreshing the board, replacing most of the senior

management team, and are now moving forward to correct past

deficiencies. We have the willingness and the ability to complete

the work.

And to be clear, we are committed to prioritizing this work

above all else by devoting all necessary resources to the effort.

Our planning is designed to ensure other activities do not

interfere with this top priority. If we have a conflict, our risk and

control work comes first.

I have said our progress will likely not be a straight line. We

continue to resolve issues that were found years ago or are the

result of the inadequate control environment that existed when

we arrived at the company. This means that resolution of

outstanding issues such as litigation, customer remediations or

regulatory investigations have and could continue to have

financial impacts. Additionally, until our work is complete, we will

likely find new issues that need to be remediated, and these may

result in additional regulatory actions.

Finally, as we continue to execute on our detailed plans, given

the scope and complexity of our work, we may miss some

interim milestones. We recognize the importance of meeting

milestones that we ourselves set, but perfection is unlikely.

When we discover an issue, we act quickly to course-correct and

do what we can to get back on schedule. This is frustrating for us

and others outside the company but is not indicative of our

willingness or ability to complete our work. Rather, it is an

obstacle that presents itself in nearly any large-scale, multi-year

transformation.

When Wells Fargo faces criticism about where we stand, I

understand the sentiment. I hope this section has provided

detailed context and is helpful in providing an understanding of

what we are doing to close our gaps. This team is taking decisive

action to move our company past these issues.

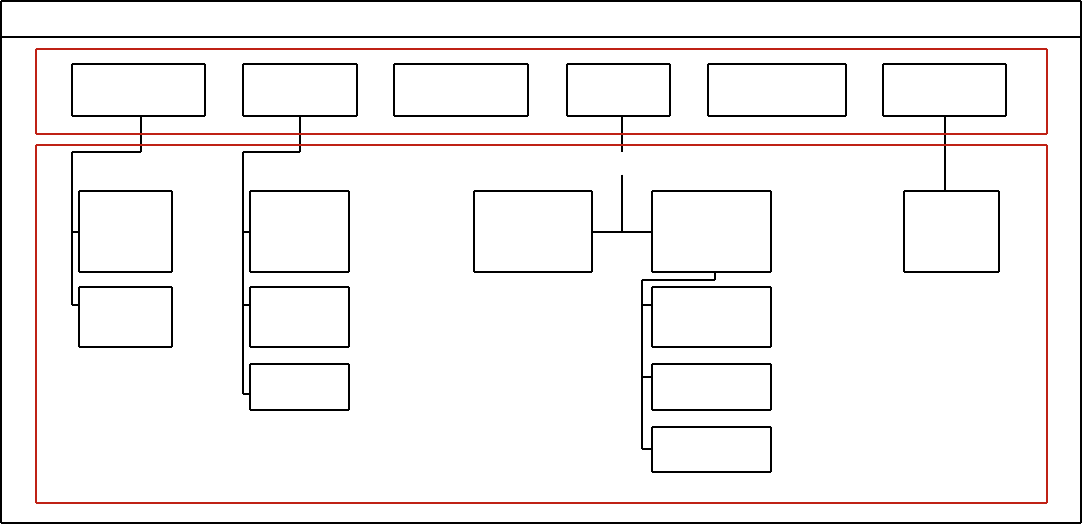

Leadership Team

Key to transforming the company, changing our culture, and

realizing the full strength of our franchise is having the best

management team in place. Since I joined the company in 2019,

12 of our 17 Operating Committee members are new to Wells

Fargo and 15 are new to their roles. In 2022, we put in place a

new Chief Auditor, a new Chief Risk Officer, a new head of

Consumer Lending, and a new head of Diverse Segments,

Representation and Inclusion.

2022 Annual Report v

We continue to refresh our management ranks more broadly.

Over 80% of our senior executive leaders – a group of

approximately 150 people, most of whom report to Operating

Committee members – are new to their roles since 2019, and

nearly 60% are new to the company over the same time period.

Over 30% of the individuals in this senior executive cohort began

in new roles in 2022 or 2023. New leaders who have joined over

the past several years bring important experience that is

necessary for our journey.

Executing on Strategic Objectives

Simplifying our business

We continue to review the strategic positioning of the company

and are focusing our efforts on building products and services

that are core to serving our clients. This focus has led us to

decisions to sell, downsize, or curtail multiple businesses. These

decisions simplify the company, reduce operational complexity

and risk, and allow us to focus on both our core risk and control

buildout and ways to serve our customers in our core franchises.

There are several examples since I joined the company in 2019.

In January 2023, we announced plans to simplify our Home

Lending business and will primarily serve bank and wealth

management customers as well as borrowers in minority

communities. As part of this shift, we announced our plans to

exit the Correspondent business, reduce the size of our Servicing

portfolio, and optimize our Retail team so it aligns with our

narrower customer focus. These actions will allow us to reduce

risk in the Home Lending business while continuing making

homeownership possible to thousands of Americans.

Over the past year, we have taken several additional steps to

simplify the way we operate. For instance, we have:

• Implemented a cloud-native operating model which will

enable us to reduce reliance on older, less stable platforms

and allows us to innovate faster

• Centrally organized our Control Management teams, to

enable better coordination across our businesses

• Streamlined our divisional leadership in Wells Fargo Advisors,

moving from eight regional divisions to four

• Combined Treasury Services platforms across Commercial

Banking and Corporate and Investment Banking

Looking further back to 2021, 2020, and 2019, we have:

• Sold Wells Fargo Asset Management

• Sold our Corporate Trust Services business

• Sold our student lending portfolio and stopped the

origination of new student loans

• Exited our international wealth management segment

• Sold our Canadian direct equipment finance business

• Stopped offering new home equity lines and loans

• Exited the direct Auto business

• Stopped originating personal lines of credit

• Sold our Institutional Retirement and Trust business

• In addition, over the past several years, we have closed over a

dozen representative offices globally to better focus our

international business, including offices in Asia, Europe, South

America, the Middle East, and elsewhere.

Going forward, we will continue to evaluate our businesses with

an eye toward reducing complexity, increasing risk-adjusted

returns, and focusing our resources on the most important

products and services our customers require. Market dynamics

change, the competitive environment changes, regulatory

expectations evolve and we must adjust our business

accordingly.

Focusing on customer needs and expectations

Each of our businesses is working to transform how we serve our

customers by offering focused, innovative products and

solutions. Many of the initiatives underway reduce risk in the

company and we evaluate new initiatives to consider the

potential impact on our control environment. Some examples

are below.

Our Consumer Businesses: Consumer and Small Business

Banking, Consumer Lending, and Wealth and Investment

Management

• We rolled out our new consumer mobile app with a simpler,

more intuitive user experience which has improved customer

satisfaction. We also completed the development of Fargo,

our new AI-powered virtual assistant, which provides a more

personalized, convenient, and simple consumer banking

experience. Fargo is currently live for eligible employees and is

set to begin rolling out to customers during the first half of

this year. Providing such digitized services directly to our

customers reduces operational complexity in our service

centers and increases customer satisfaction.

• We continued to improve our credit card offerings including

launching two new cards – Wells Fargo Autograph and BILT.

While we describe these as new products, these are actually

updated products in a business we have been in for many

years.

• We launched Wells Fargo Premier, our new offering dedicated

to the financial needs of affluent clients by bringing together

our branch-based and wealth-based businesses to provide a

more comprehensive, relevant, and integrated offering for

our clients.

• We also relaunched Intuitive Investor in our Wealth and

Investment Management segment, making it easier for

customers to invest with a streamlined account opening

process and a lower minimum investment.

vi

Our Wholesale Businesses: Commercial Banking and Corporate

and Investment Banking

• We have made several hires in Corporate and Investment

Banking that have received some press. These hires are in

industries we currently serve and products we currently offer,

but the individuals bring new expertise to Wells Fargo.

• We continued to enhance the partnership within our

commercial businesses to bring Corporate and Investment

Banking products such as foreign exchange and M&A advisory

services to our middle-market corporate clients.

• In December we announced Vantage, an enhanced digital

experience for our commercial and corporate clients. Vantage

uses artificial intelligence and machine learning to provide a

tailored and intuitive platform based on our clients’ specific

needs.

• Over the past year our industry-leading API platform team

continued the development of payment APIs for commercial

and corporate clients, invested in solutions to support our

financial institution clients, ramped-up and grew product

offerings in consumer lending, and began developing

commercial lending solutions.

Evolving our approach to technology

Technology is helping us better serve our consumer and

corporate clients. Our technology talent is modernizing

platforms for our customers, clients and colleagues. Specific

areas of focus are:

• A cross-product pricing platform

• Digitization of our lending origination platforms across Small

Business, Commercial and Corporate Banking

• Continued modernization of our Treasury Services and

Payments platforms

• Strengthening our technological capabilities in fraud

prevention

• Modernizing key corporate risk platforms

• Refreshing our Auto loans platform

These enhanced digital capabilities are just the start of the

initiatives we have planned as part of our multi-year digital

transformation.

Seeing early returns from this work

Our work to build better, more customer-focused products and

a more technology-enabled company is generating measurable

returns. For instance:

• In Consumer and Small Business Banking, mobile active

customers grew 4% from a year ago.

• The new credit cards I mentioned above helped drive a 31%

increase in new credit card accounts in 2022, and we’ve

continued to maintain strong credit profiles. The average

FICO score of our new accounts in 2022 was 773, compared

to 761 for the 2019 vintage.

• In Wealth and Investment Management, total active Intuitive

Investor accounts increased 56% from a year ago.

• Our U.S. investment banking market share was 3.2% in 2022,

up 61 basis points versus 2021. We had the #7 ranking in this

year’s U.S. investment banking league tables, up two spots

from 2021.

• As a company, we deliver many solutions nowadays in sprints,

reducing our through-put time by as much as 60% compared

to 2020.

ESG, communities and customer

centricity

As I look back at 2022, I’m enthusiastic about the progress we’ve

made in serving our communities and our customers, and I feel

even better about the opportunities ahead.

Let me start with the changes we made during the year to help

millions of customers avoid overdraft fees and meet short-term

cash needs. These efforts included:

• The elimination of non-sufficient funds fees and transfer fees

for customers enrolled in Overdraft Protection.

• Early Pay Day, making eligible direct deposits available up to

two days early.

• Extra Day Grace, giving eligible customers an extra business

day to make deposits to avoid overdraft fees.

• And in the fourth quarter we launched Flex Loan, a new

digital-only, small-dollar loan that provides eligible customers

convenient and affordable access to funds. Teams from

across the company came together to roll out this new

product in just a few months. Though it’s still early, customer

response is exceeding our expectations.

The above actions build on services we’ve introduced over the

past several years, including Clear Access Banking, a consumer

banking account with no overdraft fees. We now have

over 1.7 million of those accounts, up 48% from a year ago.

Beyond our customers, we have an important responsibility to

strengthen the communities we serve. We continued that work

in 2022. This was true on several fronts.

Supporting homeownership

• We launched a Special Purpose Credit Program in 2022,

committing $150 million to advance racial equity in

homeownership, with an additional $100 million investment

towards this racial equity effort announced in 2023.

• We established Wealth Opportunities Restored through

Homeownership, or WORTH, a $60 million national effort to

address systematic barriers to homeownership for people of

color. Nationally, WORTH aims to help create 40,000 new

homeowners of color in eight markets by the end of 2025

2022 Annual Report vii

• We announced an expansion of our Dream.Plan.Home closing

cost credit, which provides borrowers with an income at or

below 80% of the area median income where the property is

located up to $5,000 to use toward closing costs. The credit is

available in 16 states and in Washington, DC.

• We announced Growing Diverse Housing Developers, a

$40 million grant initiative focused on expanding the growth

and success of real estate developers of color, including Black-

and Latino-owned firms.

Banking inclusion

• As part of our Banking Inclusion Initiative, we launched our

first Community Connections Branch outside Atlanta, with

more to come. These branches offer spaces for financial

health seminars and individual consultations.

• Also as part of our Banking Inclusion Initiative, we announced

plans with Operation HOPE to introduce HOPE Inside centers

in 20 markets. HOPE Inside Centers feature financial coaches

who will help empower community members to achieve their

financial goals through financial education and free

one-on-one coaching. To date, we’ve launched these centers

in the Atlanta, Houston, Los Angeles, Oakland and Phoenix

metro regions.

• Since its launch in 2022, our Small Business Resource

Navigator has connected nearly 1,300 small businesses to

potential credit opportunities and technical assistance

services provided by CDFIs.

Climate initiatives

• We announced interim greenhouse gas reduction targets for

the Oil & Gas and Power sectors.

• We issued our second Inclusive Communities and Climate

Bond, a $2 billion bond that will finance projects and

programs supporting housing affordability, economic

opportunity, renewable energy and clean transportation.

In addition, we have made significant progress on our Diversity,

Equity and Inclusion initiatives. These are detailed in our first

Diversity, Equity, and Inclusion annual report, which we

published last summer. We continue to push forward on our

commitment to integrating DE&I across the company, and, as

part of this commitment, we have commissioned an external,

third-party Racial Equity Assessment. We plan to publish the

results of the assessment by the end of this year.

I’m proud of all this work. We are balanced in our approach to

environmental, social and governance issues, and, as I wrote a

year ago, we believe that for us to be successful as a company,

we must consider a broad set of stakeholders in our decisions

and actions, beyond shareholders. This is not in lieu of

shareholders – in fact we believe it will enhance our returns to

shareholders over time. Our history has shown this to be true.

Consumers and businesses want to do business with a company

that has a strong reputation. A strong reputation is achieved not

just from strong financial performance, but from actively

supporting employees, customers, and communities – especially

those most in need.

As we look forward

I remain confident in our company. The franchise we have is

enviable and will become increasingly more so as we transform

the company. We have done much and we must finish the risk

and control work I’ve described in a timeframe and with the

quality to satisfy our regulators to take advantage of the

opportunities in front of us, so this will remain our top priority.

We will do this while we navigate what will likely be a tricky

economic environment. 2022 was a turning point in the cycle

and the impact of the Federal Reserve’s interest rate increases

have not been fully seen in the economy yet. Though we are

starting to see the impact on consumer spend, credit, housing,

and demands for goods and services, it is still early. Thus far, the

impact to consumers and businesses has been manageable.

Though there will certainly be some industries and segments of

consumers that are more impacted than others, the rate of

impact we see in our customer base is not materially

accelerating. This plus the strength with which consumers and

businesses went into this slowing economy is a helpful set of

facts as we look forward.

While we are not predicting a severe downturn, we must be

prepared for one and we are a stronger company today than 1

and 2 years ago. We have actively managed our capital position

and focused on efficiency. Our margins are wider, our returns are

higher, we are better managed, and our capital position is

strong. While we will be impacted by a downturn in the

economic cycle, we feel prepared for a downside scenario if

we see broader deterioration than we currently see or predict.

We still have clear opportunities to improve our performance as

we make progress on our efficiency initiatives. We will invest as

necessary in our risk and control infrastructure, we will

modernize our existing platforms, and we will continue to make

the investments necessary serve our customers through service,

technology and product enhancements.

I want to conclude by thanking our employees across the

company who are working hard each day to continue to make

progress on our transformation. The pressure they feel to

accomplish our work is immense and the dedication that I see is

unmatched. I’m thankful for all that they do and remain

committed to leading us towards the goal of being the most

respected financial institution in the country.

I’m excited about all that we will accomplish in the year ahead.

Charles W. Scharf

Chief Executive Officer

Wells Fargo & Company

March 3, 2023

viii

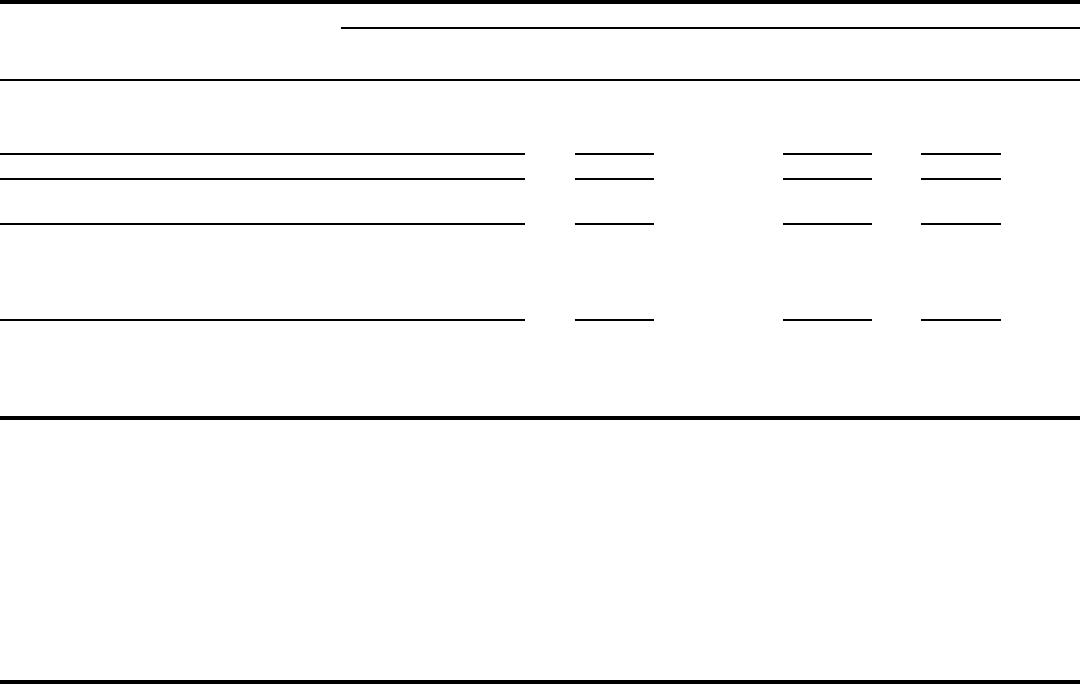

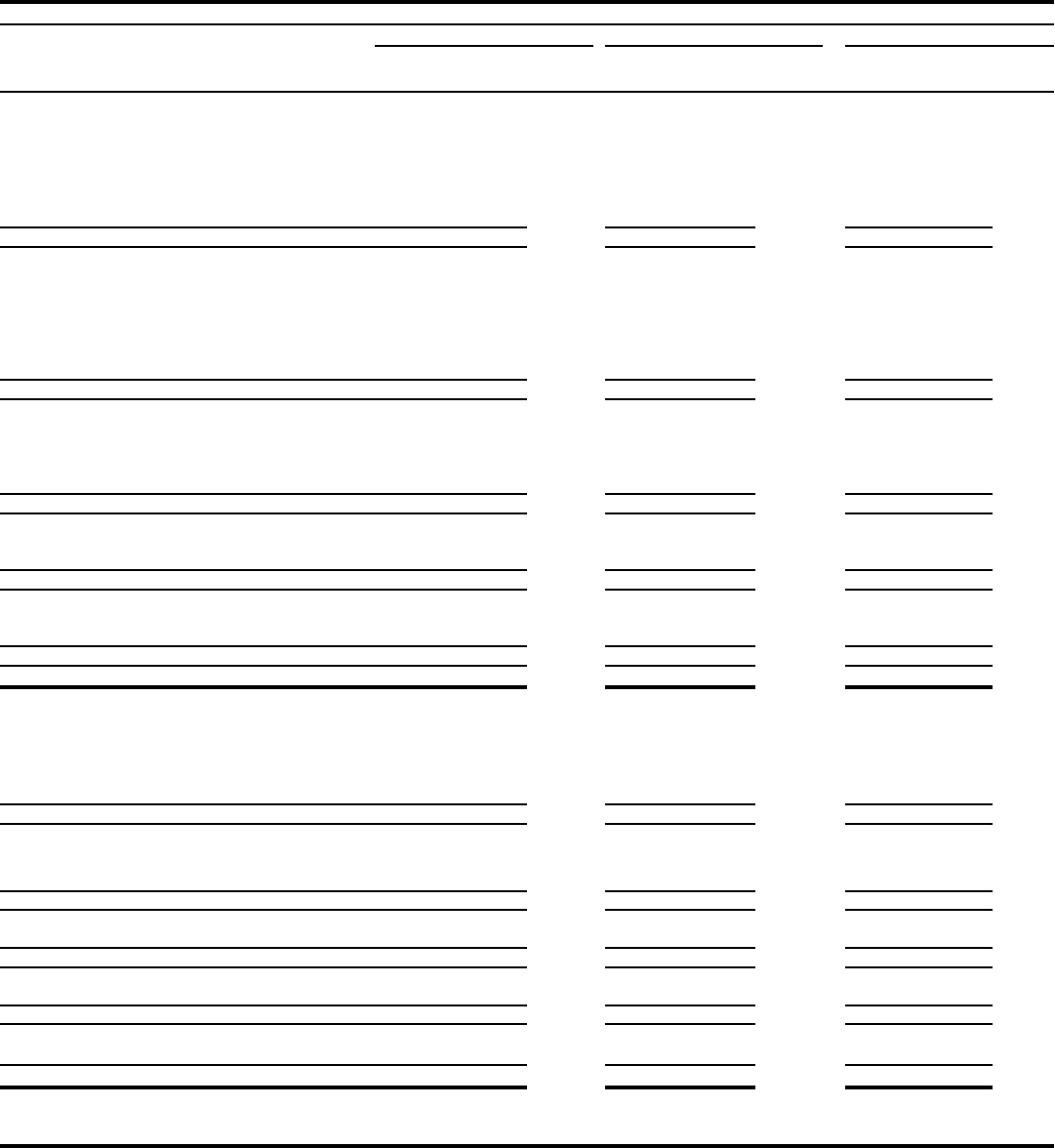

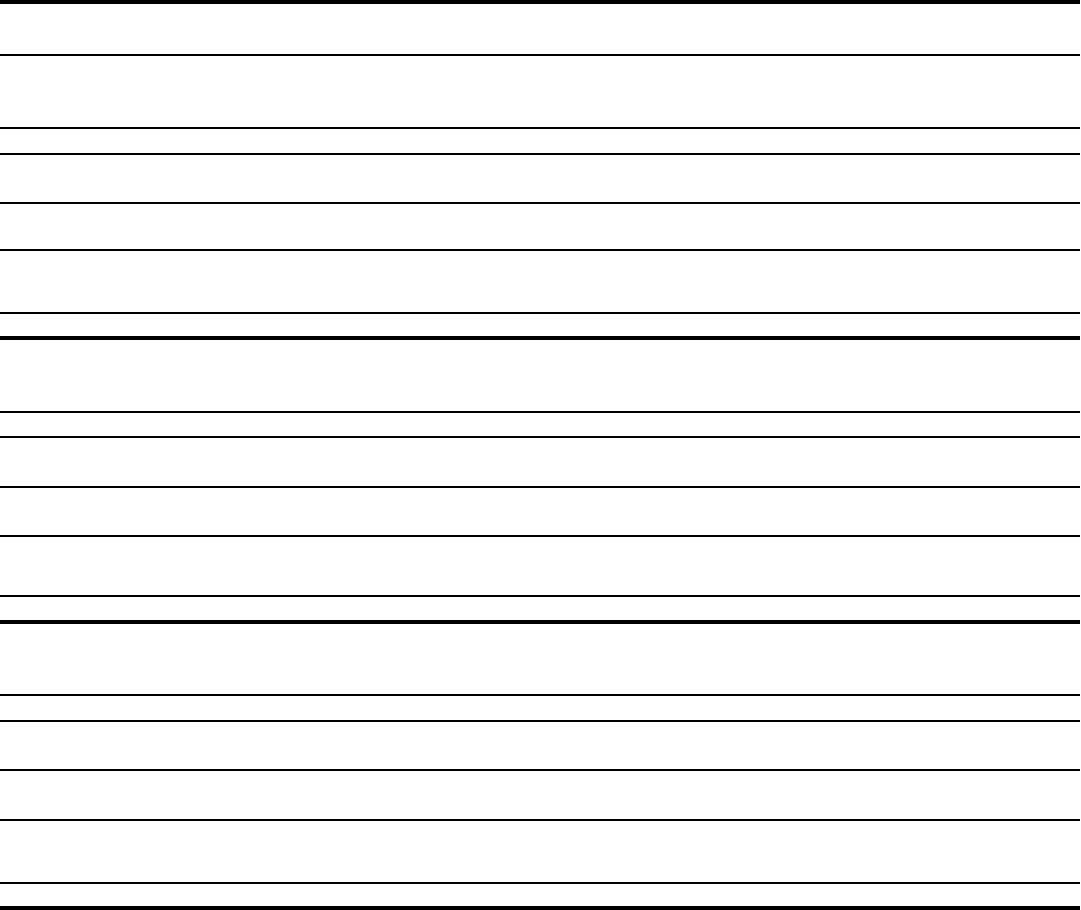

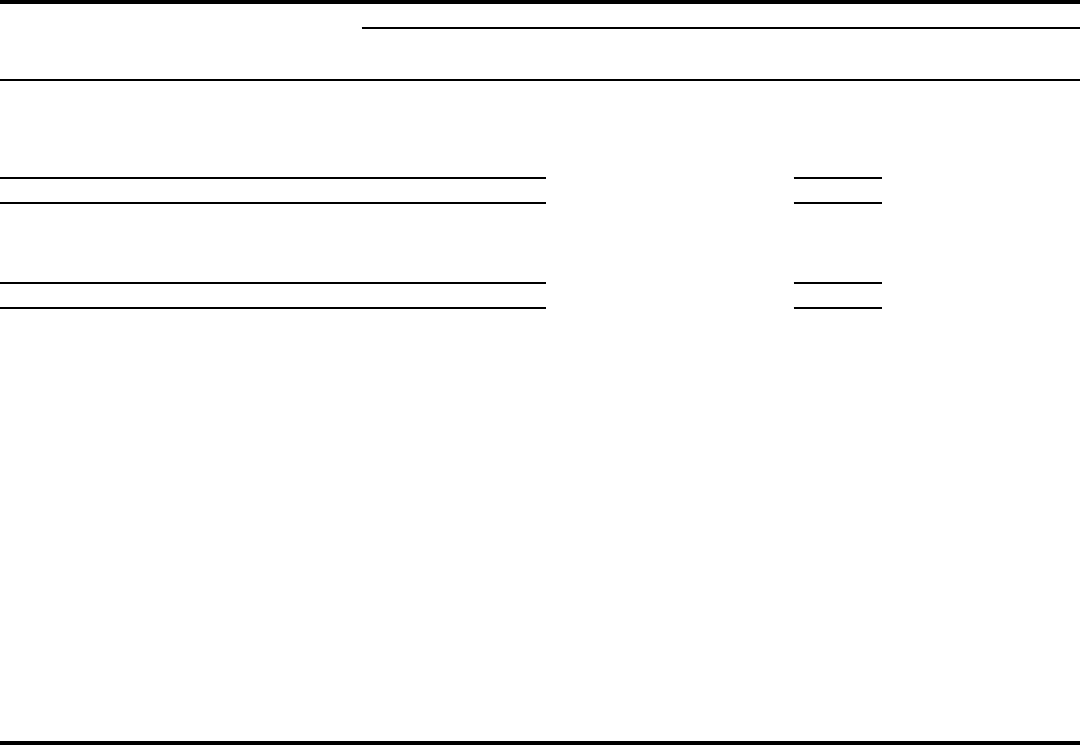

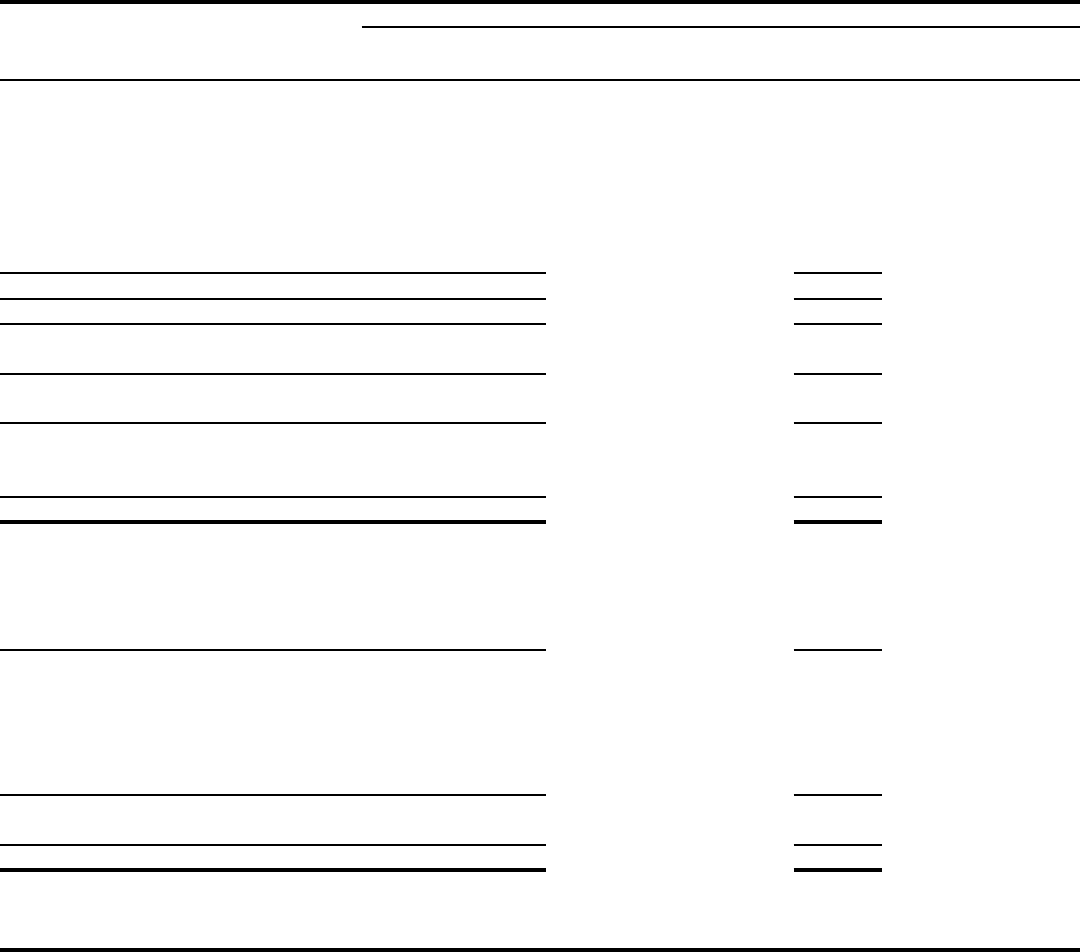

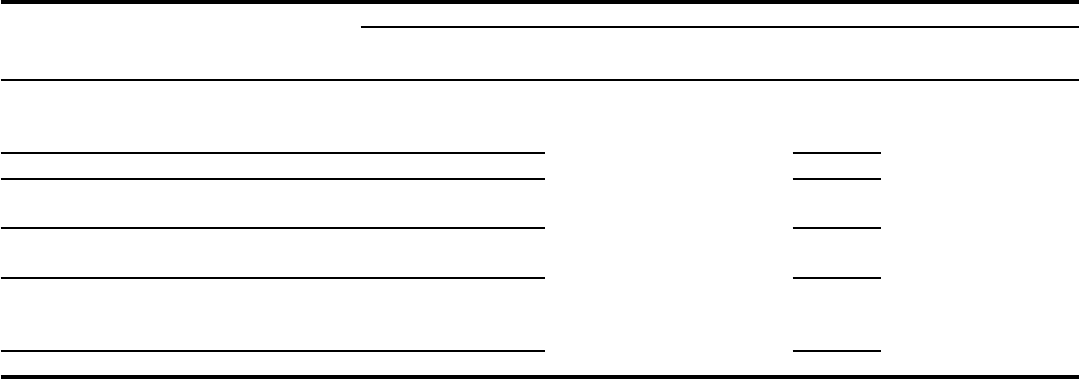

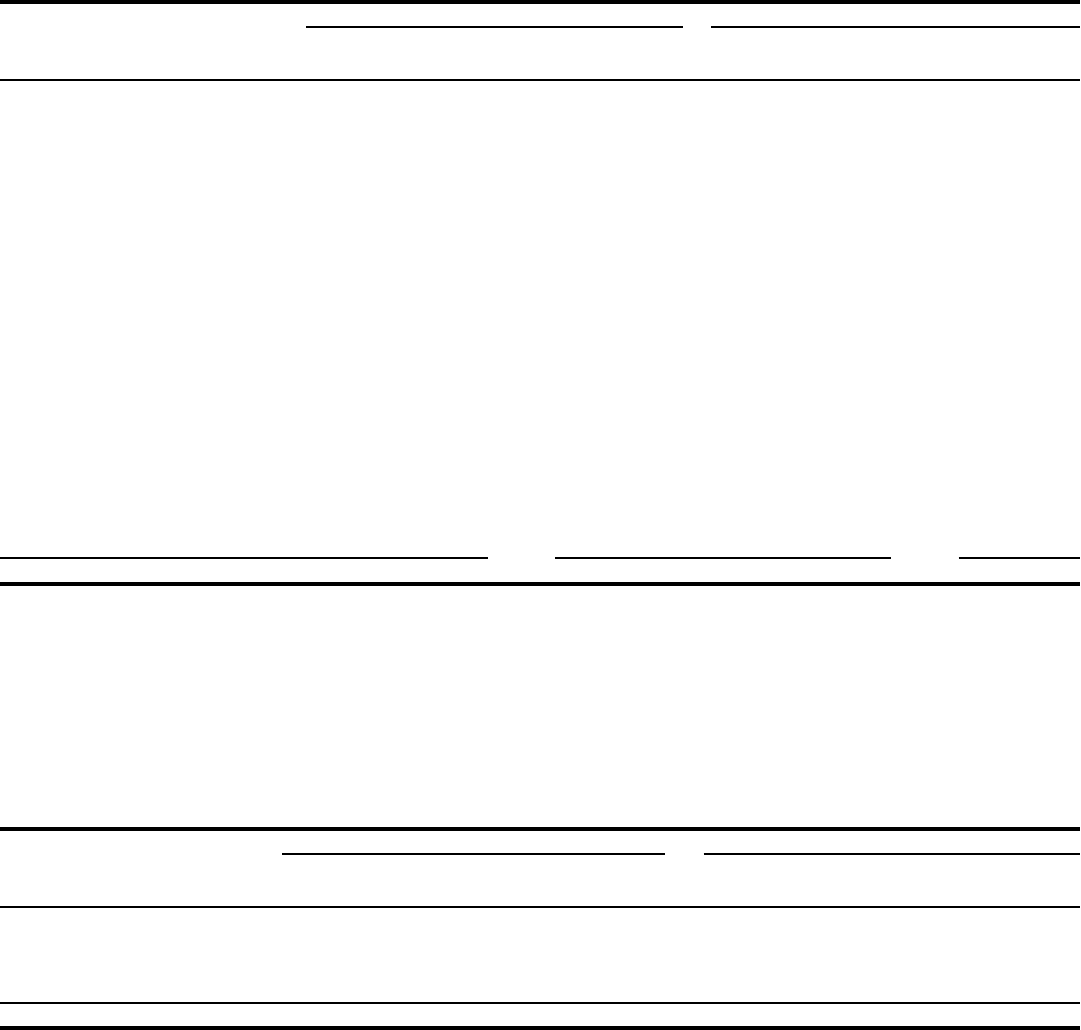

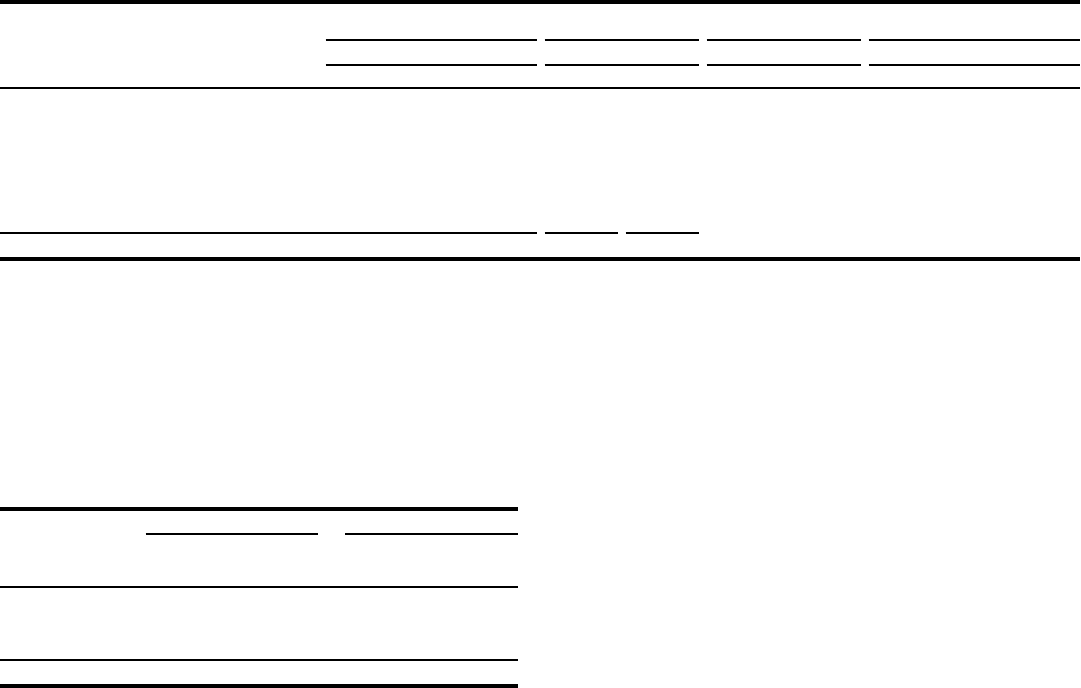

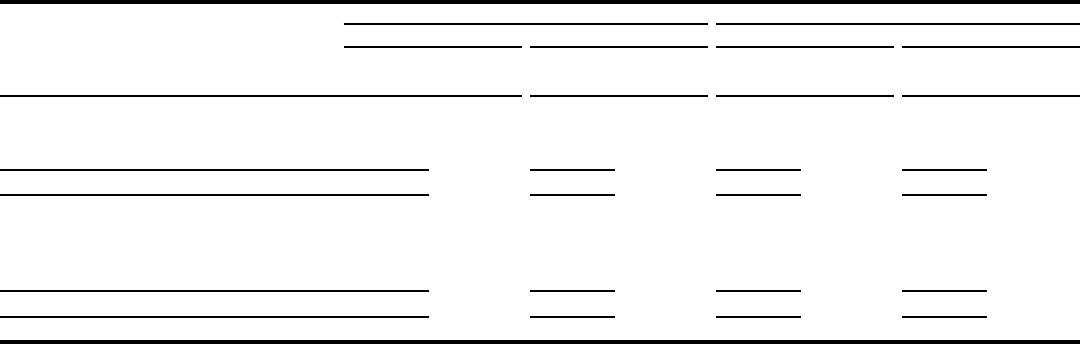

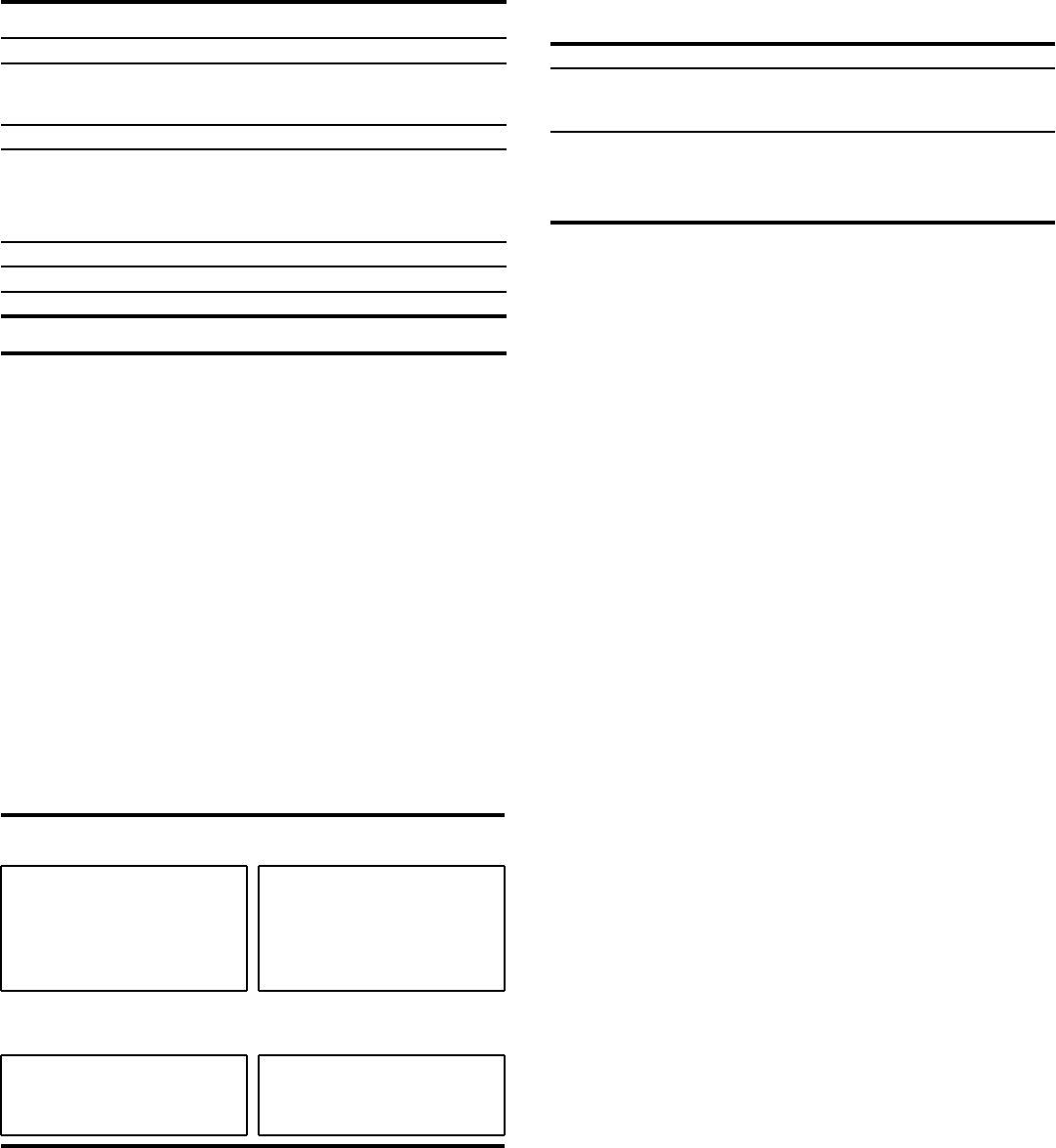

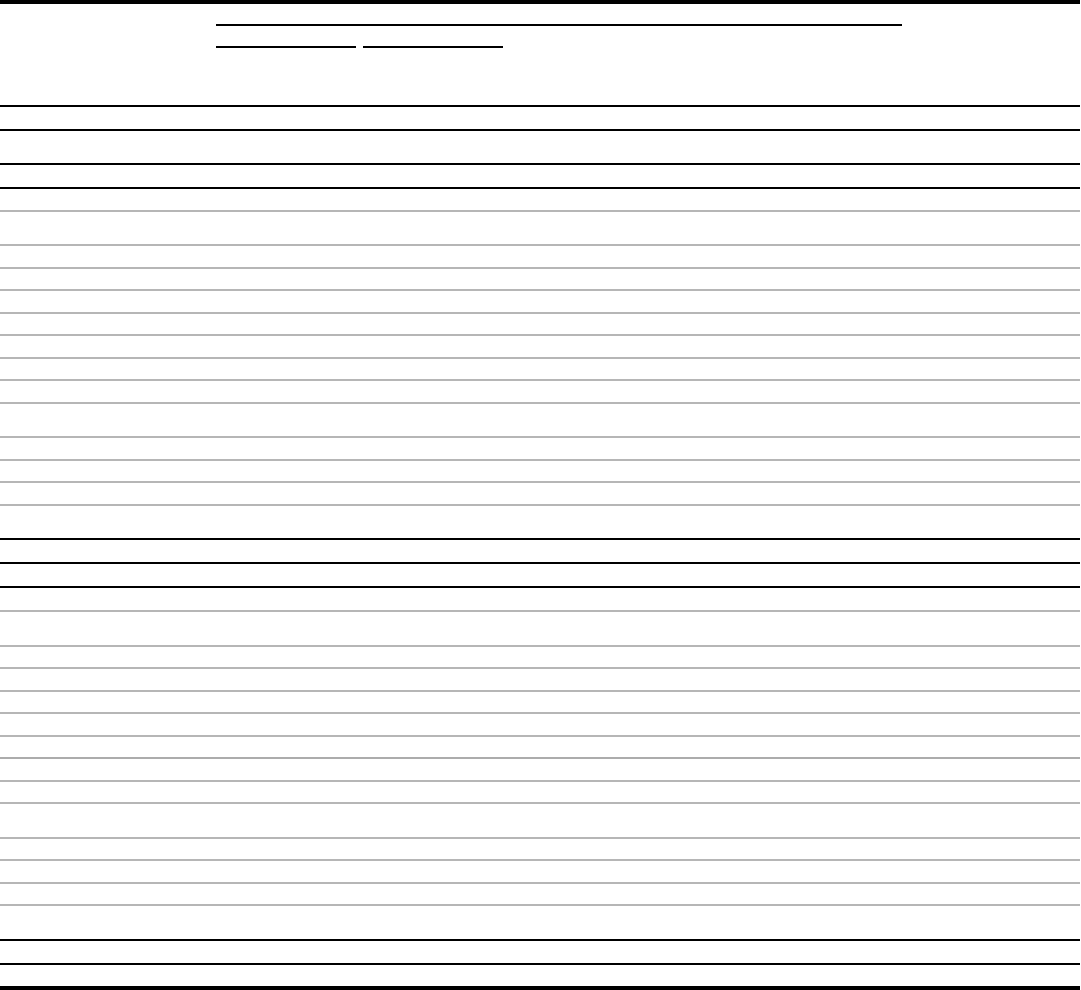

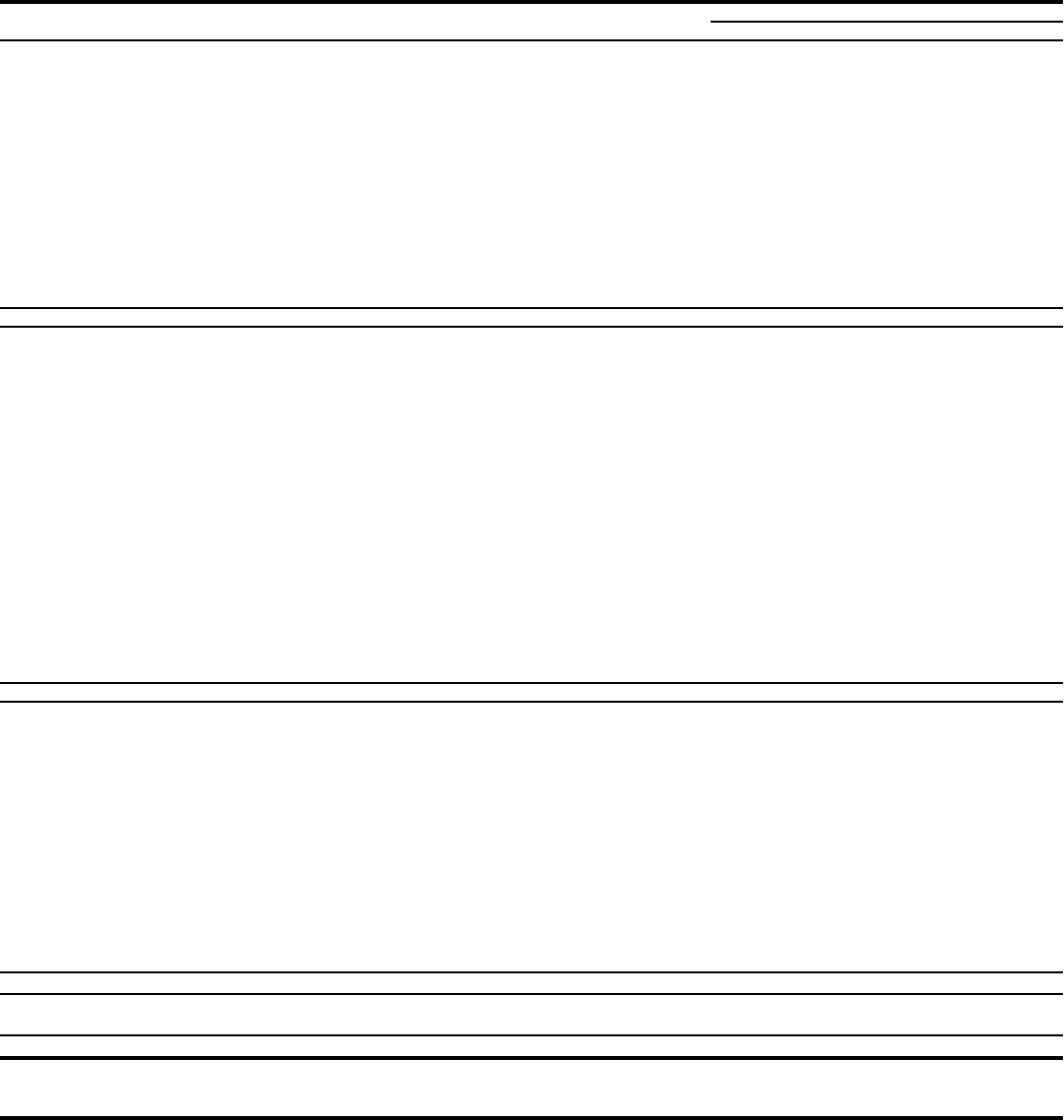

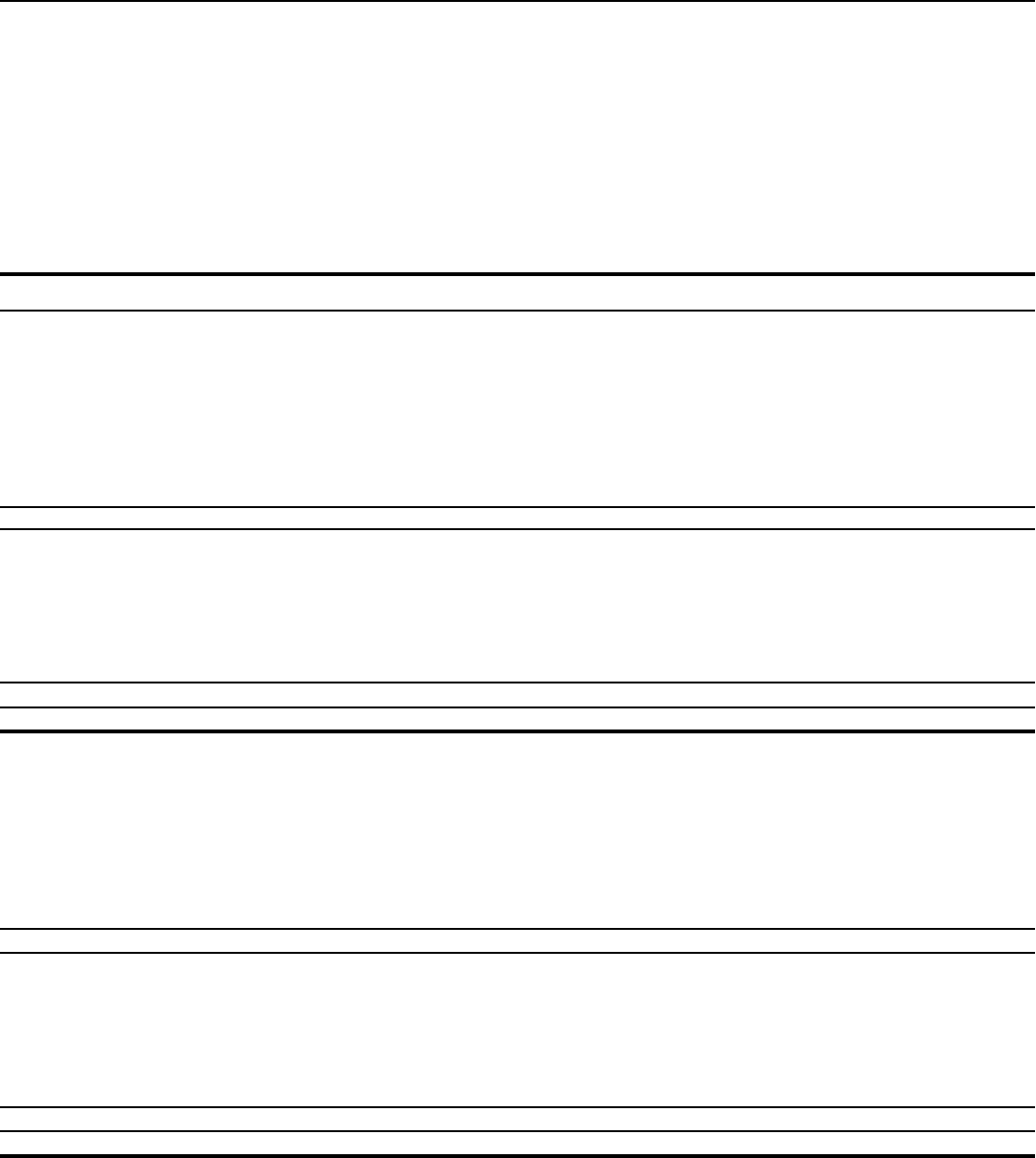

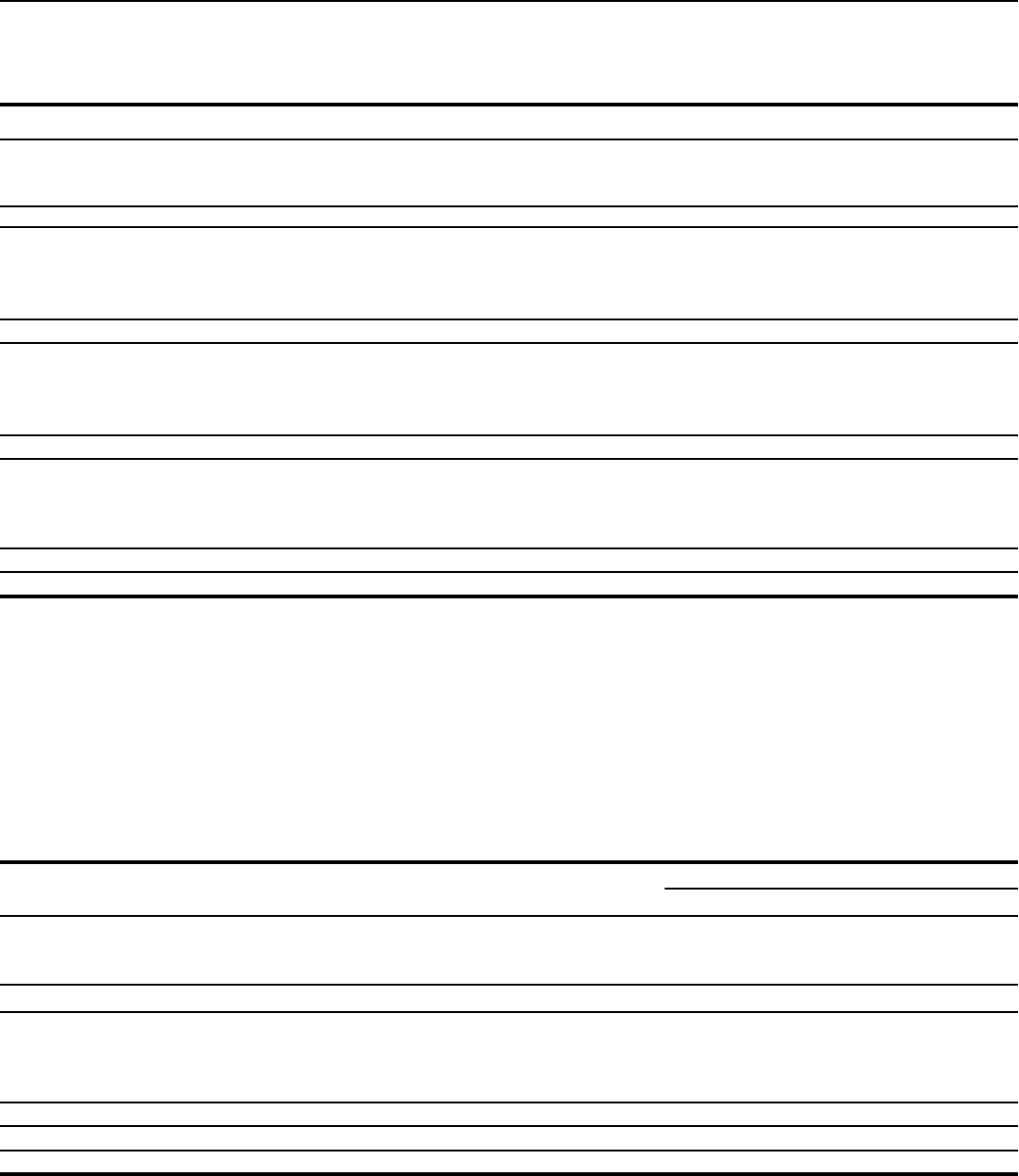

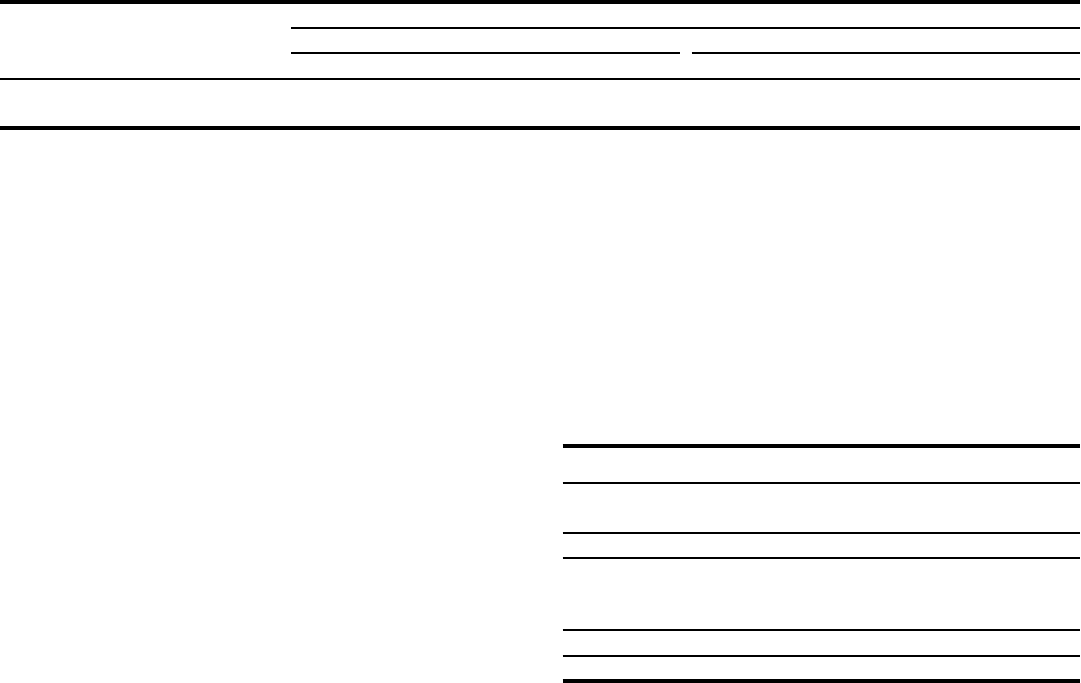

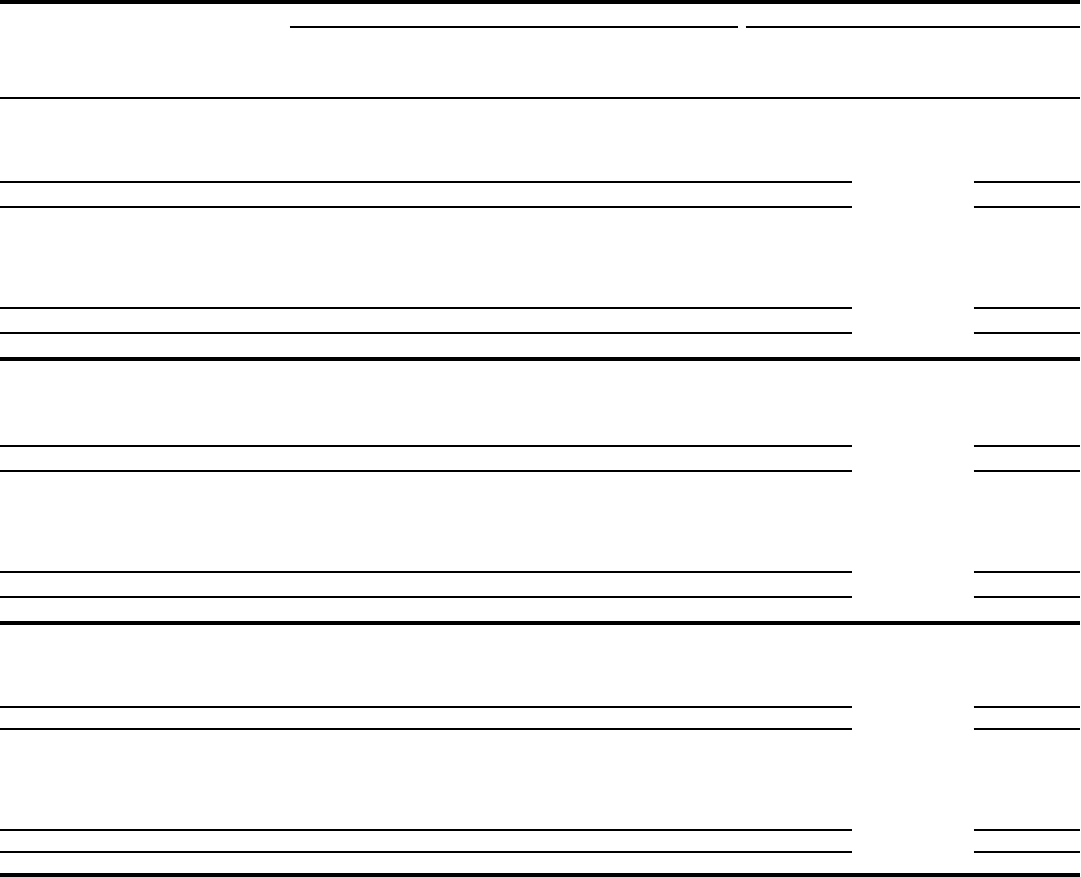

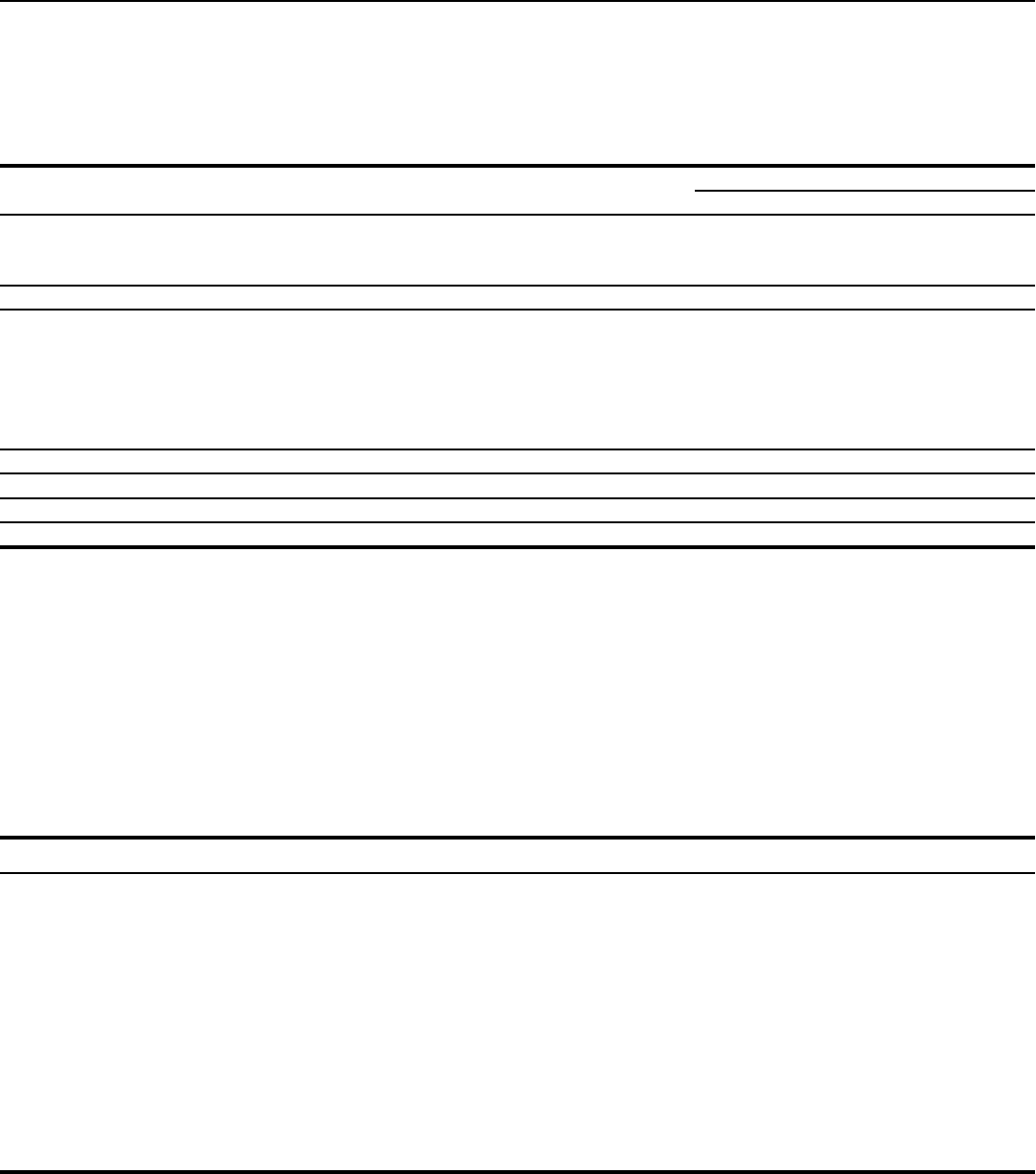

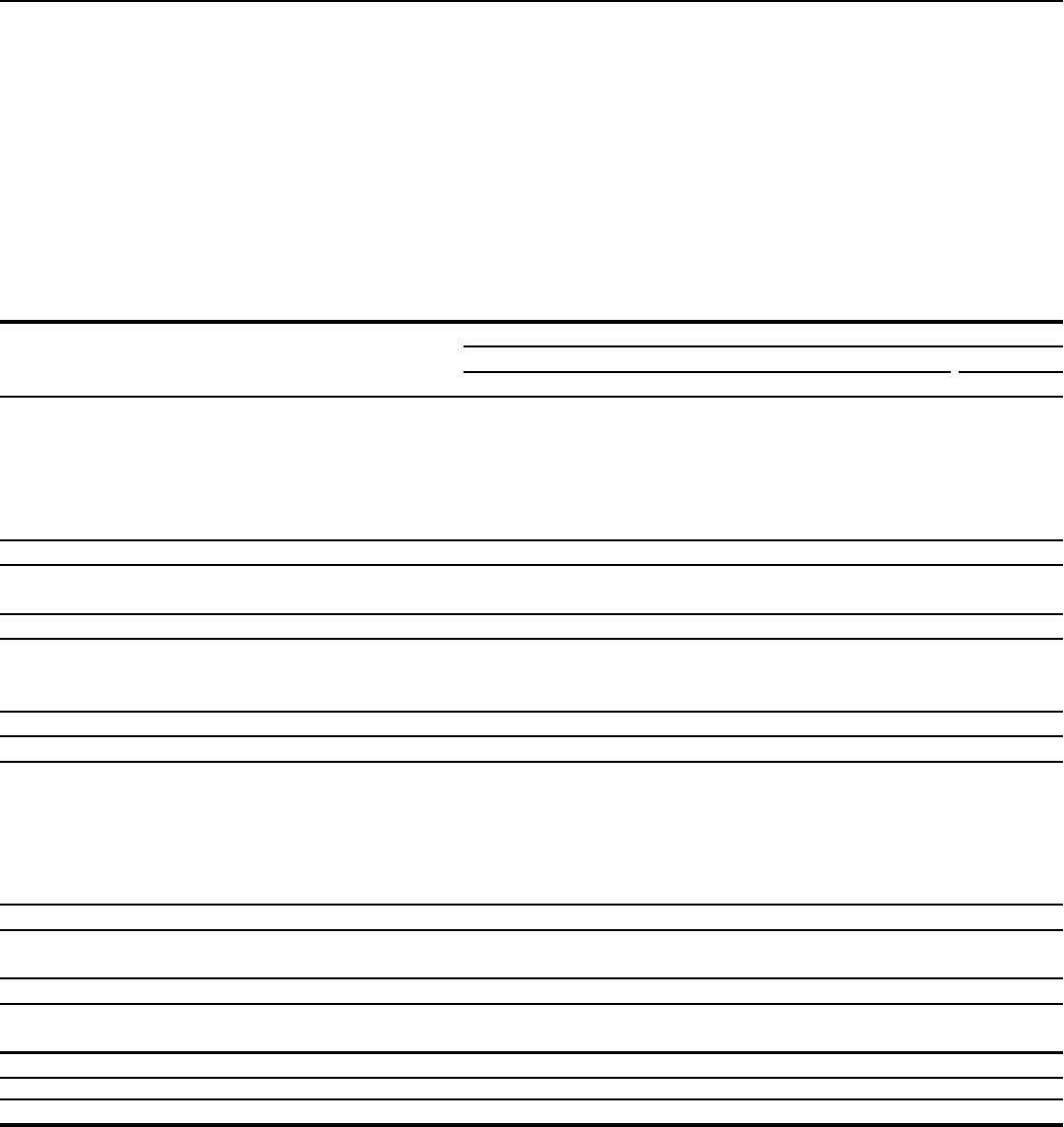

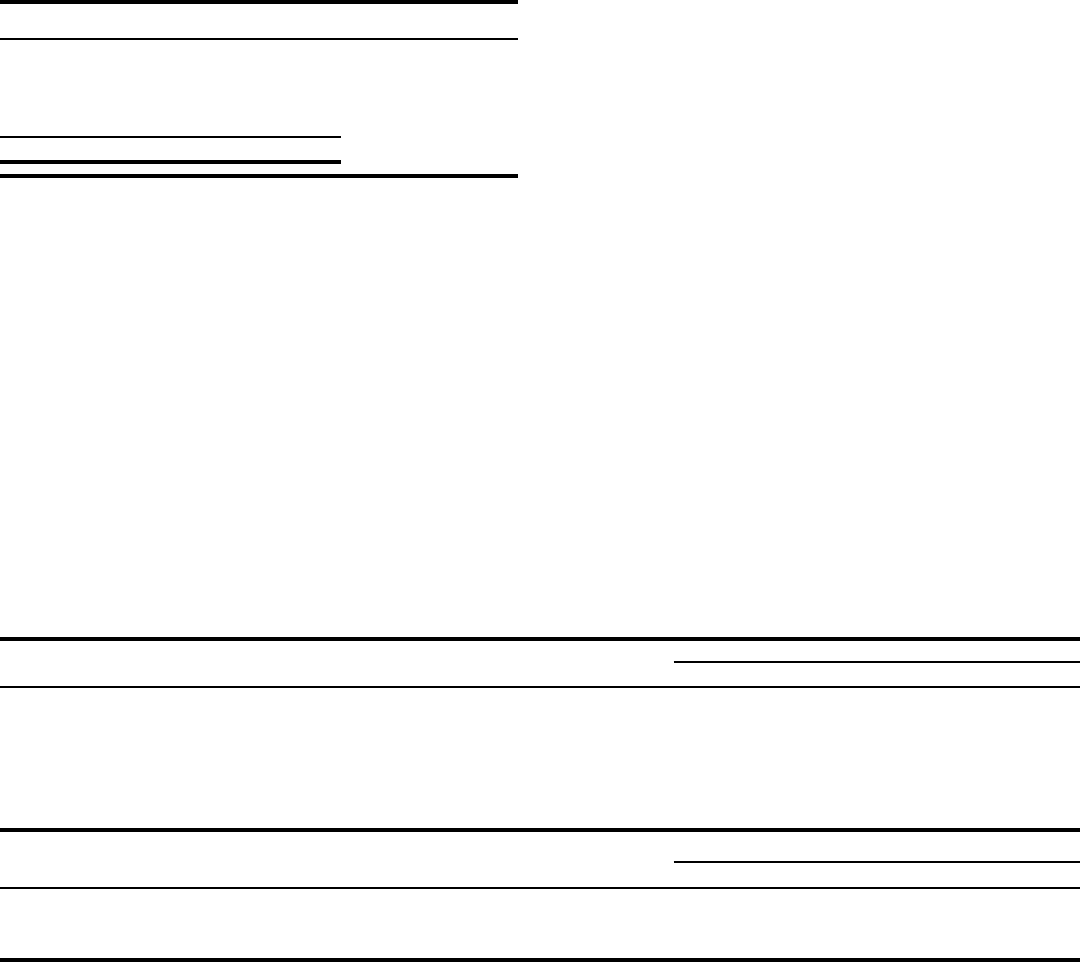

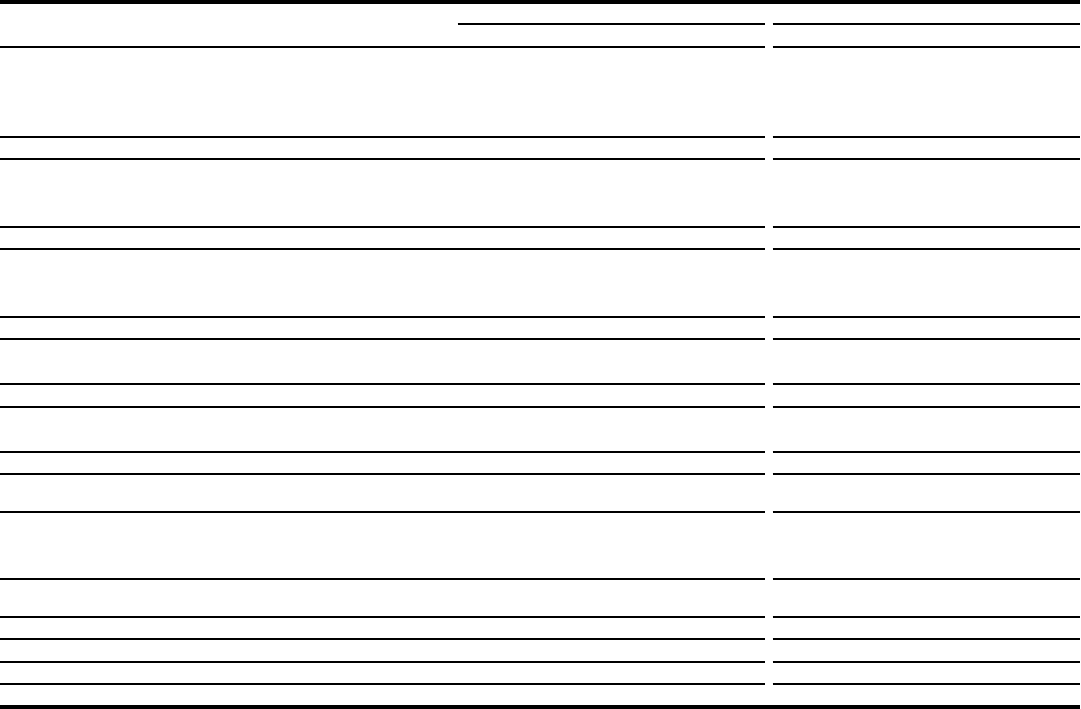

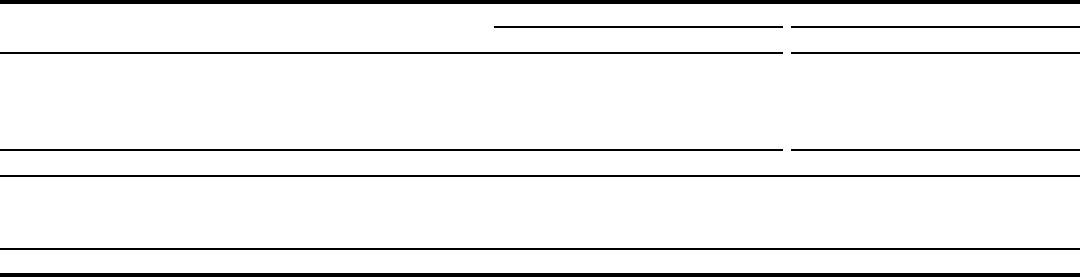

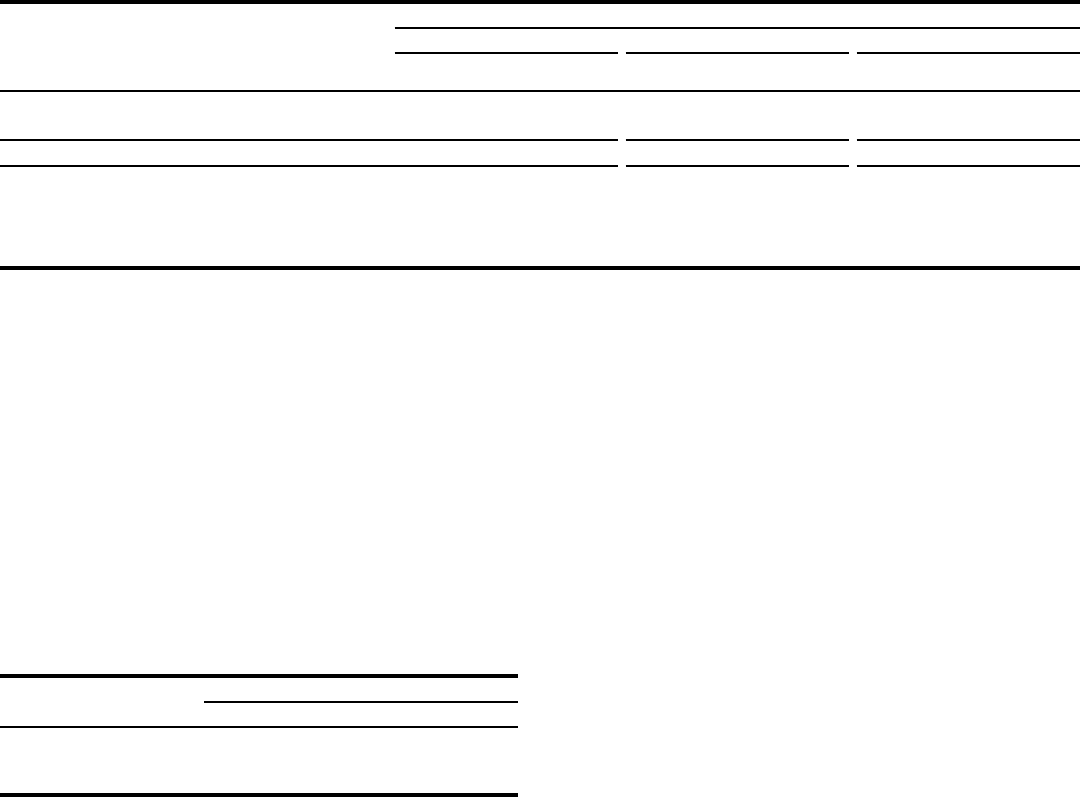

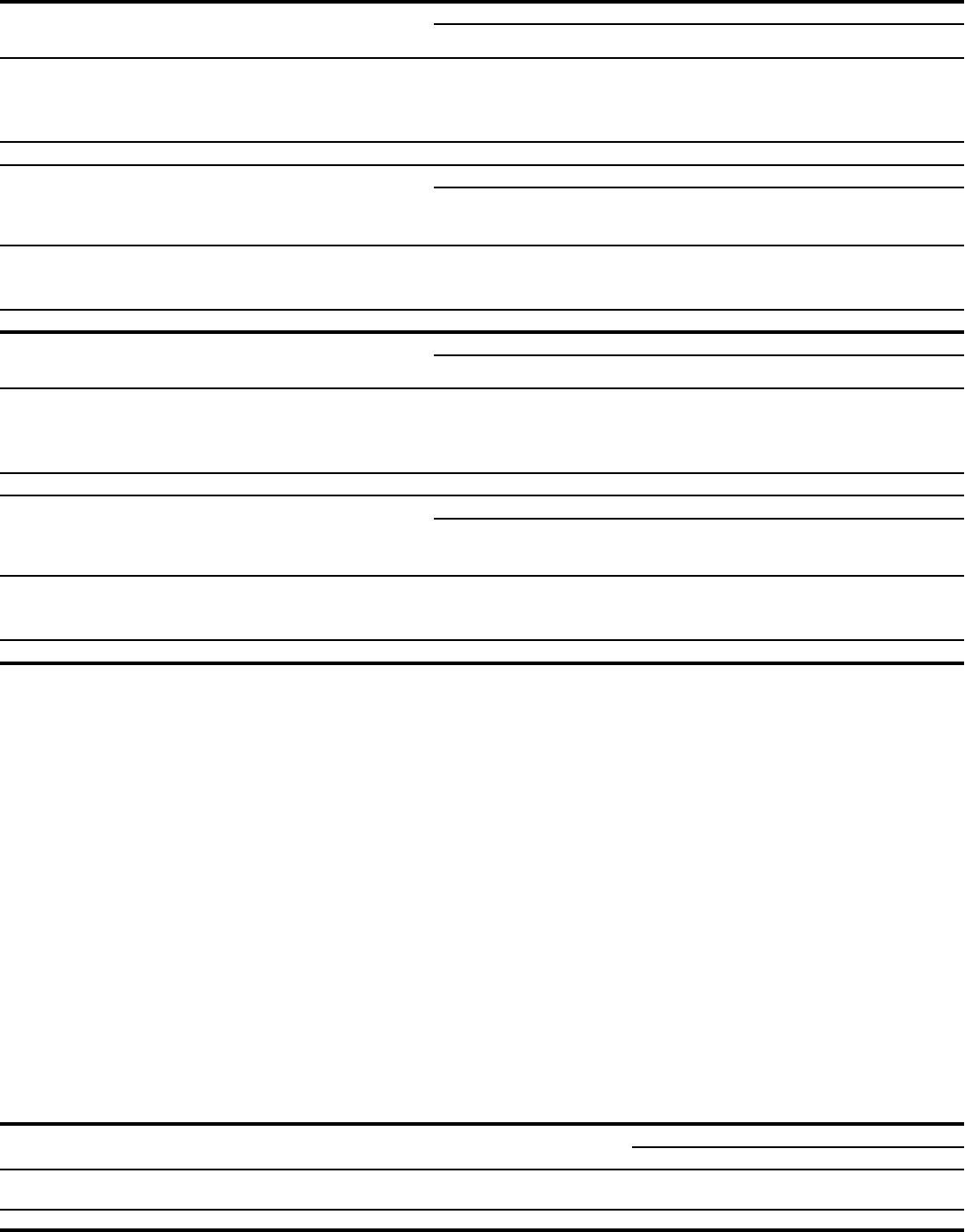

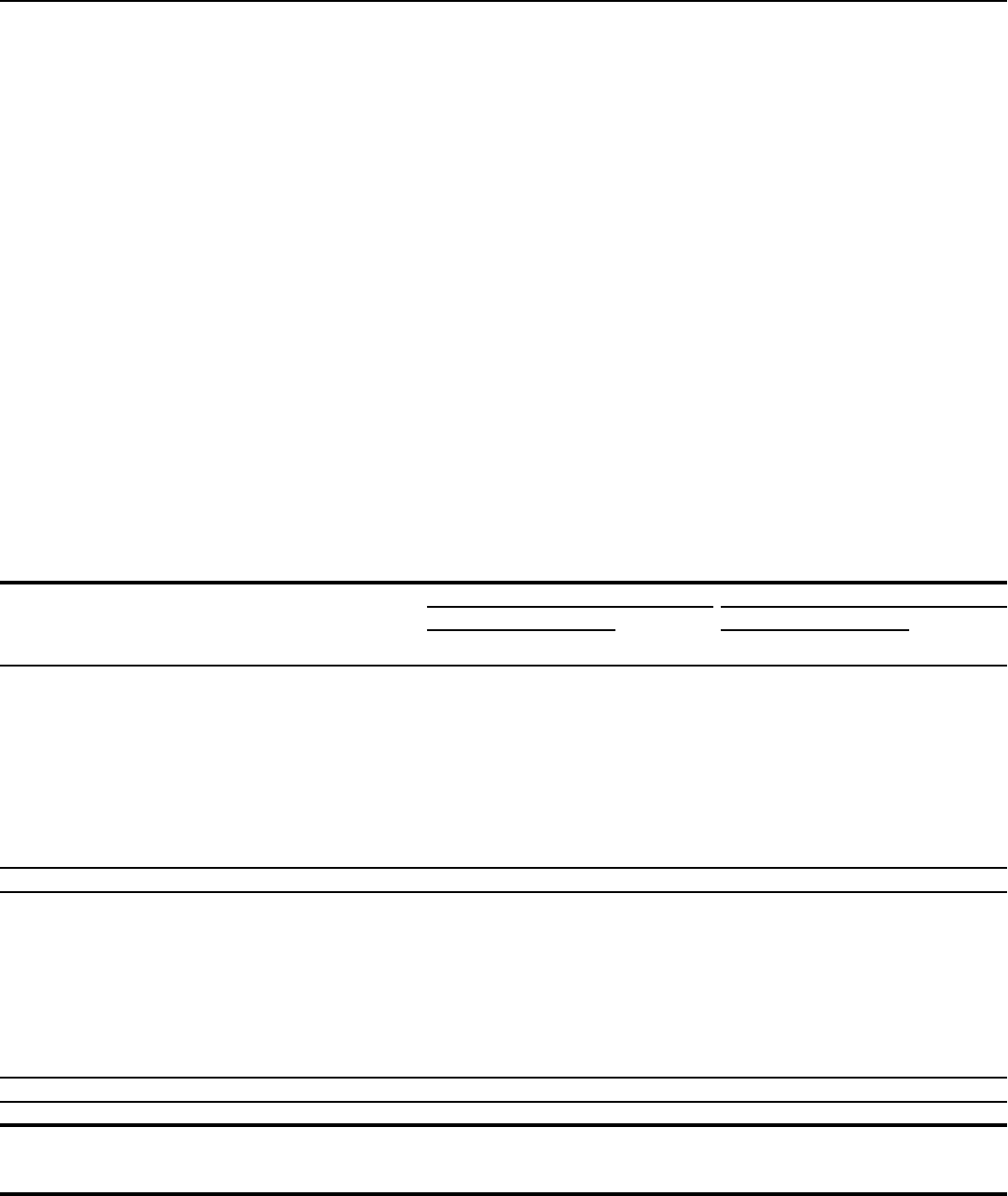

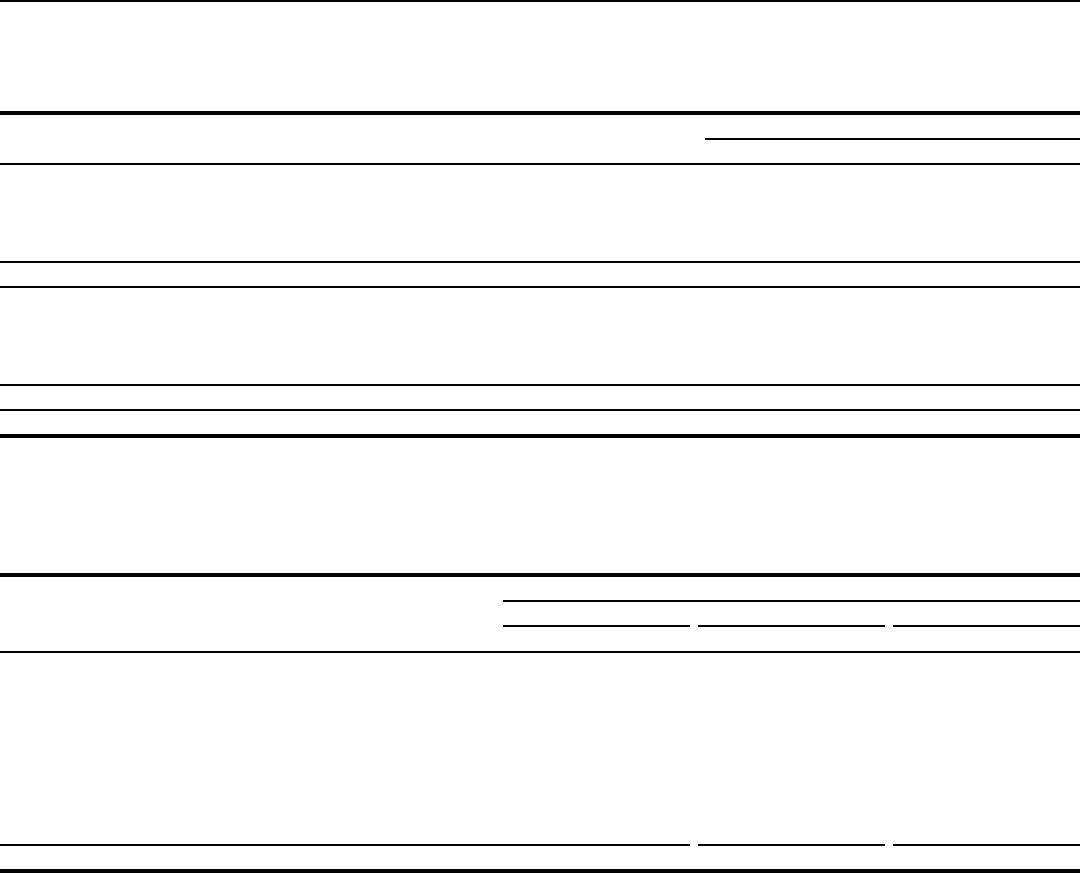

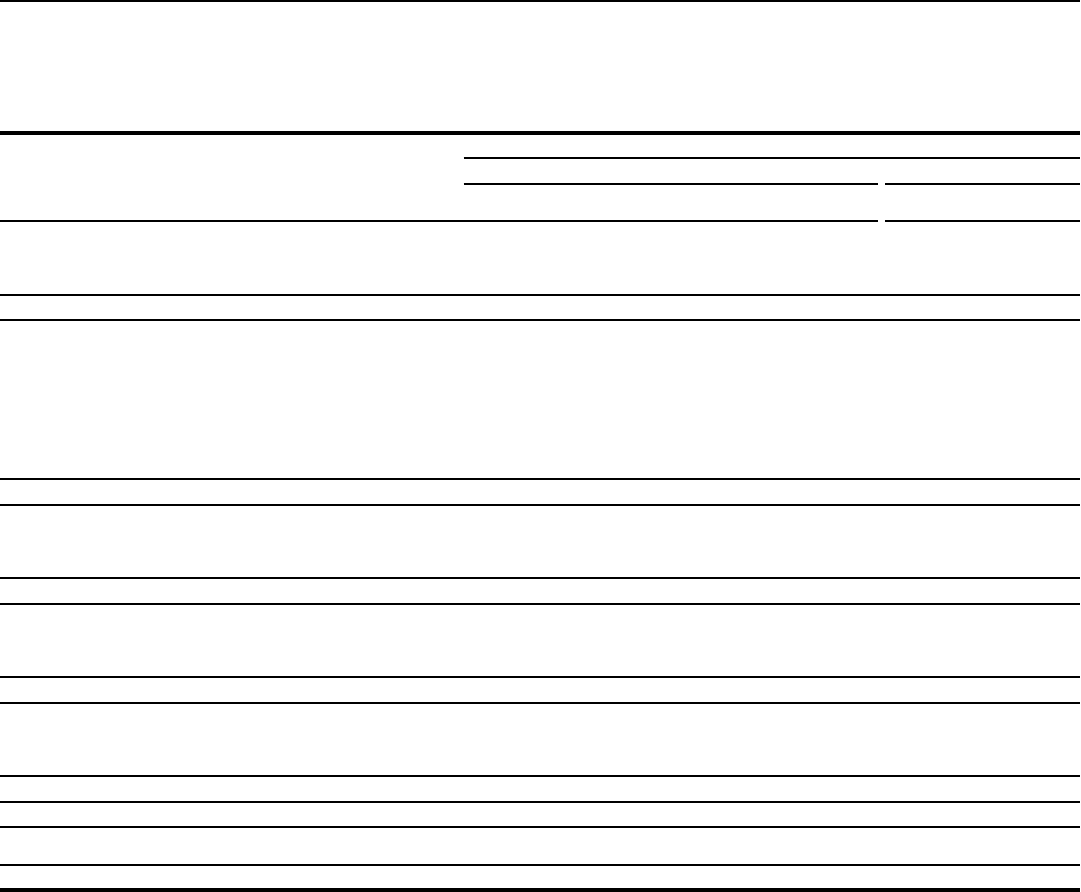

Our Performance

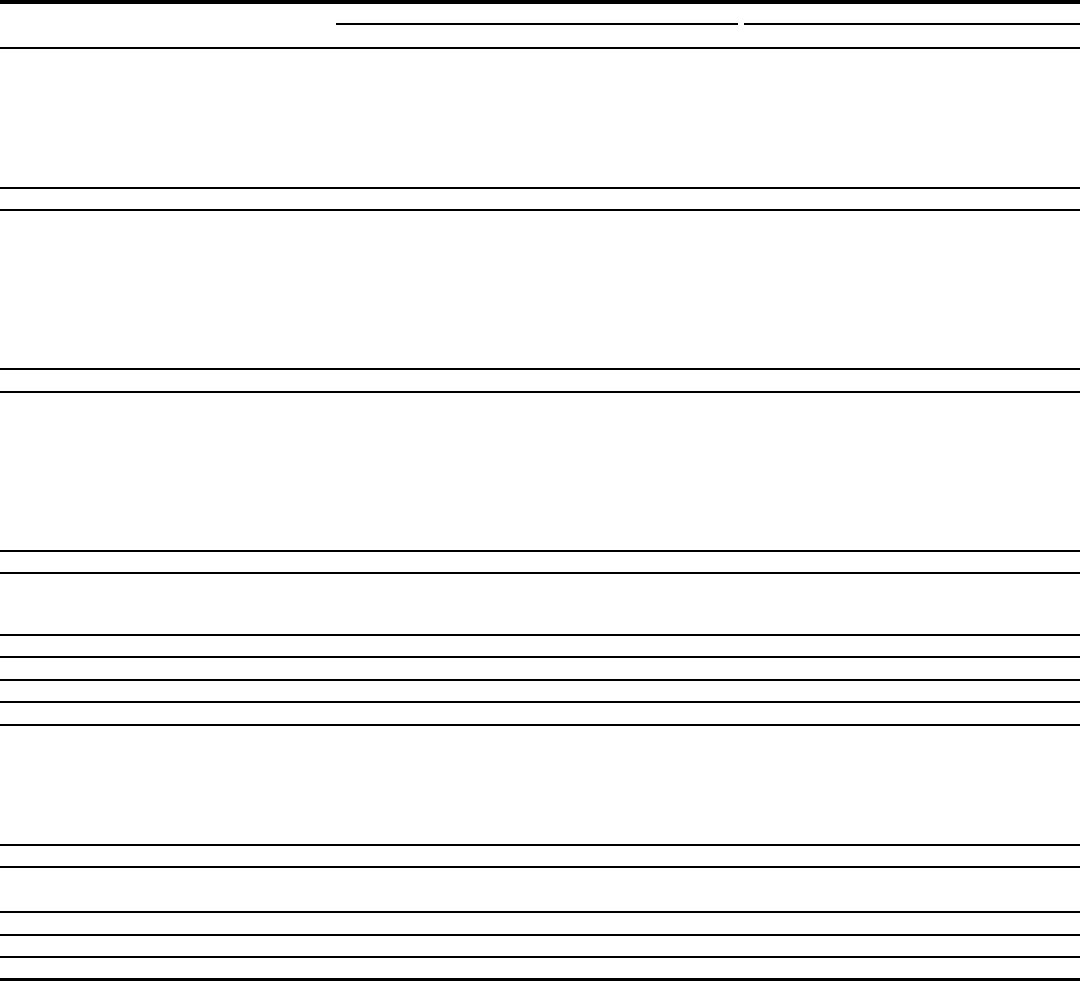

$ and shares outstanding in millions, except per share amounts 2022 2021 2020

SELECTED INCOME STATEMENT DATA

Total revenue $ 73,785 78,492 74,264

Noninterest expense 57,282 53,831 57,630

Pre-tax pre-provision profit (PTPP)

1

16,503 24,661 16,634

Provision for credit losses 1,534 (4,155) 14,129

Wells Fargo net income 13,182 21,548 3,377

Wells Fargo net income applicable to common stock 12,067 20,256 1,786

COMMON SHARE DATA

Diluted earnings per common share 3.14 4.95 0.43

Dividends declared per common share 1.10 0.60 1.22

Common shares outstanding 3,833.8 3,885.8 4,144.0

Average common shares outstanding 3,805.2 4,061.9 4,118.0

Diluted average common shares outstanding 3,837.0 4,096.2 4,134.2

Book value per common share

2

$ 41.89 43.32 39.71

Tangible book value

per common share

2, 3

34.89 36.35 32.99

SELECTED EQUITY DATA (PERIOD-END)

Total equity 181

,875 190,110 185,712

Common stockholders’ equity 160,614 168,331 164,570

Tangible common equity

3

133,752 141,254 136,727

PERFORMANCE RATIOS

Return on average assets

(ROA)

4

0.70% 1.11 0.17

Return on average equity (ROE)

5

7.5 12.0 1.1

Return on average tangible common equity (ROTCE)

3

9.0 14.3 1.3

Efficiency ratio

6

78 69 78

SELECTED BALANCE SHEET DATA (AVERAGE)

Loans $ 929,820 864,288 941,788

Assets 1,894,309 1,941,905 1,941,709

Deposits 1,424,269 1,437,812 1,376,011

SELECTED BALANCE SHEET DATA (PERIOD-END)

Debt securities 496,808 537,531 501,207

Loans 955,871 895,394 887,637

Allowance for loan losses 12,985 12,490 18,516

Assets 1,881,016 1,948,068 1,952,911

Deposits 1,383,985 1,482,479 1,404,381

OTHER METRICS

Common Equity Tier 1 (CET1) ratio

7

10.60% 11.35 11.59

Market capitalization $ 158

,298 186,441 125,066

Headcount (#) (period-end) 238,698

249,435 268,531

1. Pre-tax pre-provision profit (PTPP) is total revenue

less noninterest expense. Management believes that PTPP is a useful financial measure because it enables investors and others to assess the Company’s ability to

generate capital to cover credit losses through a credit cycle.

2. Book value per common share is common stockholders’ equity divided by common shares outstanding. Tangible book value per common share is tangible common equity divided by common shares outstanding.

3. Tangible common equity, tangible book value per common share, and return on average tangible common equity are non-GAAP financial measures. For additional information, including a corresponding reconciliation to

GAAP financial measures, see the “Financial Review – Capital Management – Tangible Common Equity” section in this Report.

4. Represents Wells Fargo net income divided by average assets.

5. Represents Wells Fargo net income applicable to common stock divided by average common stockholders’ equity.

6. The efficiency ratio is noninterest expense divided by total revenue (net interest income and noninterest income).

7. Represents our Common Equity Tier 1 (CET1) ratio calculated under the Standardized Approach, which is our binding CET1 ratio. For additional information, see the “Financial Review – Capital Management” section and

Note 25 (Regulatory Capital Requirements and Other Restrictions) to Financial Statements in this Report.

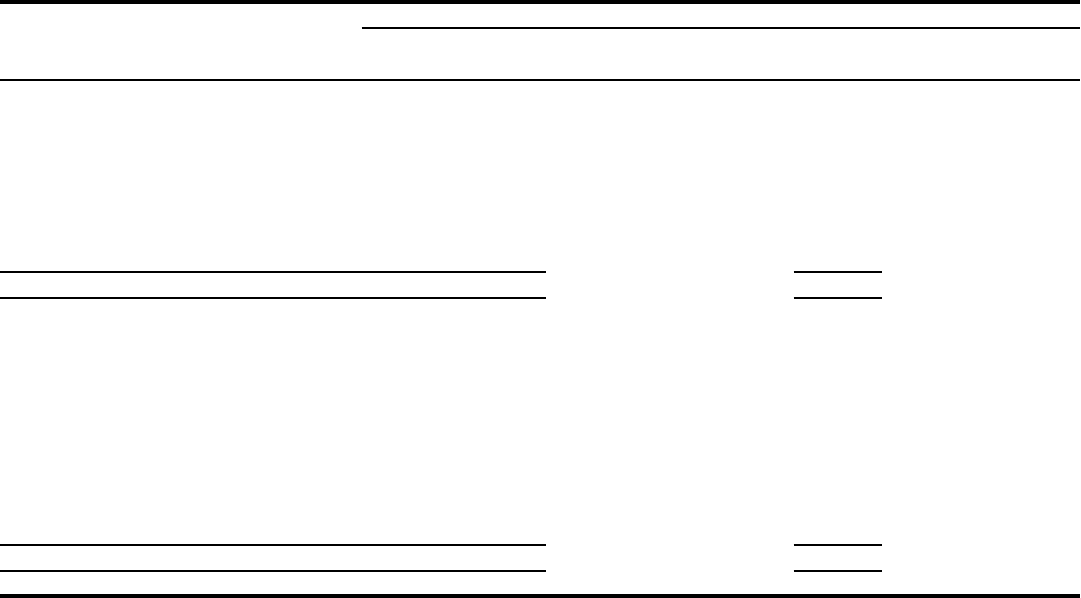

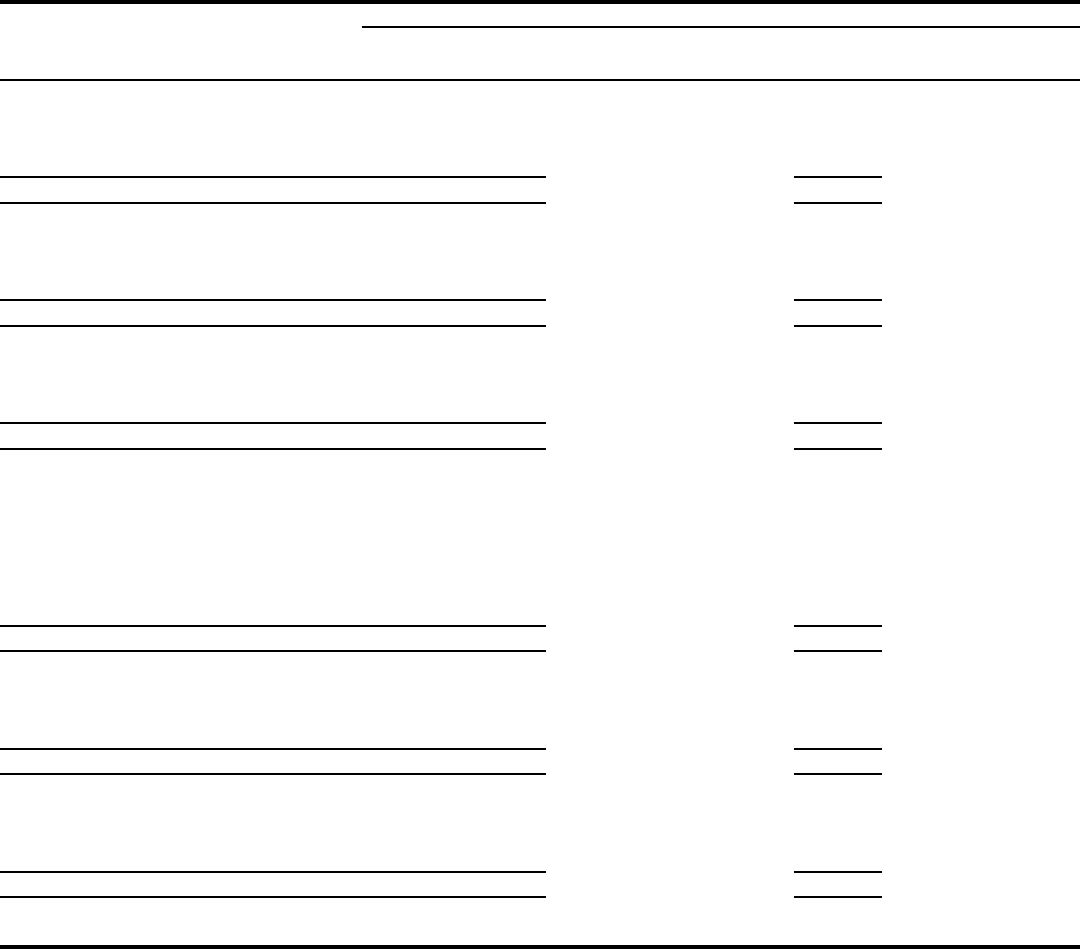

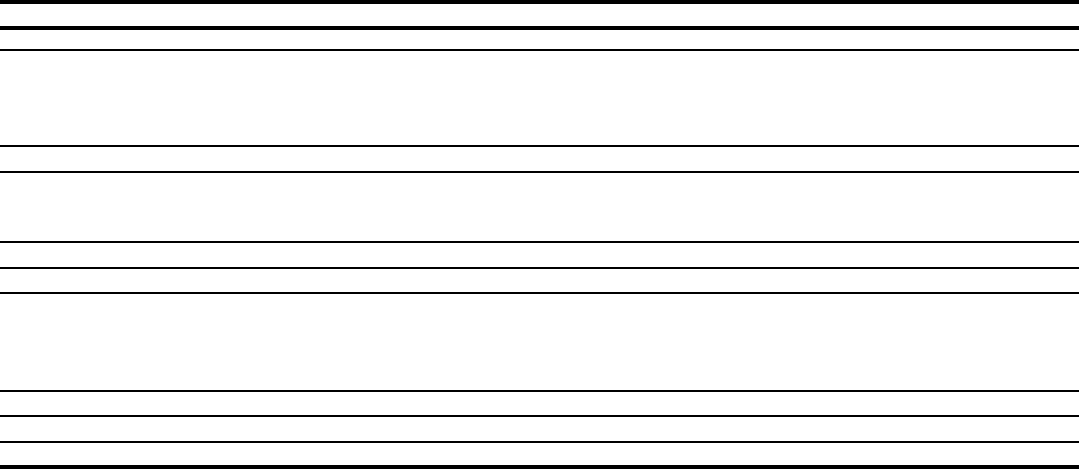

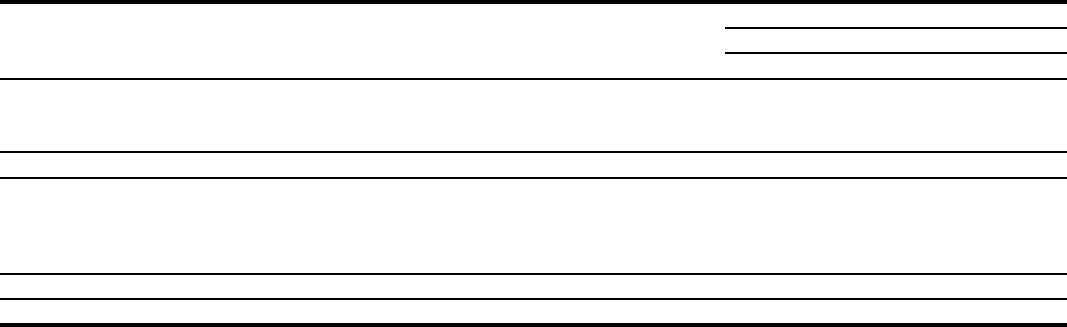

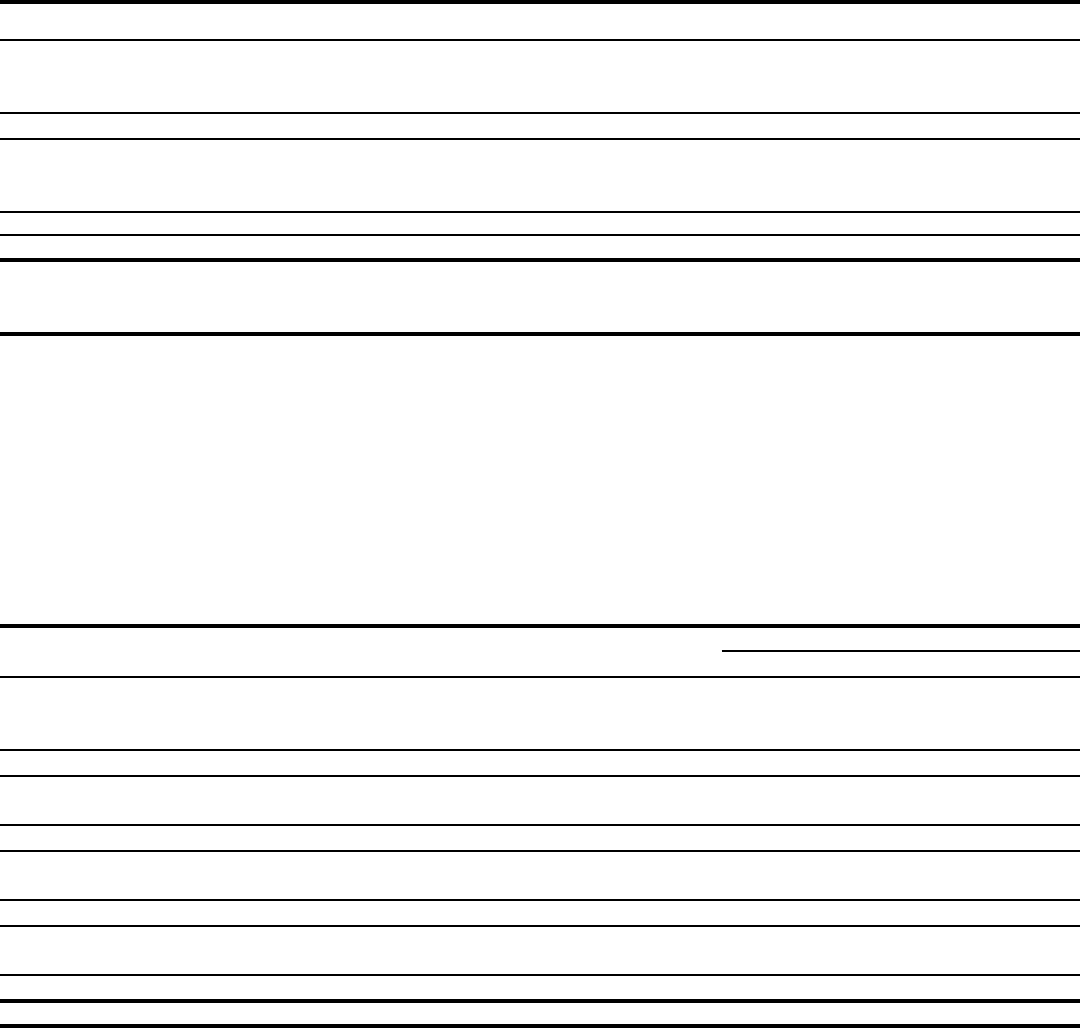

Wells Fargo & Company 2022 Financial Report

Financial Review

2

Overview

7

Earnings Performance

25

Balance Sheet Analysis

27

Off-Balance Sheet Arrangements

28

Risk Management

52

Capital Management

58

Regulatory Matters

61

Critical Accounting Policies

65

Current Accounting Developments

67

Forward-Looking Statements

69

Risk Factors

Controls and Procedures

83

Disclosure Controls and Procedures

83

Internal Control Over Financial Reporting

83

Management’s Report on Internal Control over

Financial Reporting

84

Report of Independent Registered Public

Accounting Firm (KPMG LLP, Charlotte, NC,

Auditor Firm ID: 185)

Financial Statements

85

Consolidated Statement of Income

86

Consolidated Statement of Comprehensive

Income

87

Consolidated Balance Sheet

88

Consolidated Statement of Changes in Equity

90

Consolidated Statement of Cash Flows

Notes to Financial Statements

91 1

Summary of Significant Accounting Policies

103 2

Trading Activities

104

3

Available-for-Sale and Held-to-Maturity Debt Securities

110

4

Equity Securities

112

5

Loans and Related Allowance for Credit Losses

125

6

Mortgage Banking Activities

127

7

Intangible Assets and Other Assets

128

8

Leasing Activity

130

9

Deposits

131

10

Long-Term Debt

133

11

Preferred Stock

135

12

Common Stock and Stock Plans

137

13

Legal Actions

140

14

Derivatives

148

15

Fair Values of Assets and Liabilities

158

16

Securitizations and Variable Interest Entities

163

17

Guarantees and Other Commitments

166

18

Pledged Assets and Collateral

169

19

Operating Segments

171

20

Revenue and Expenses

174

21

Employee Benefits

179

22

Income Taxes

181

23

Earnings and Dividends Per Common Share

182

24

Other Comprehensive Income

184

25

Regulatory Capital Requirements and Other Restrictions

186

26

Parent-Only Financial Statements

188 Report of Independent Registered Public

Accounting Firm

191 Quarterly Financial Data

192 Glossary of Acronyms

Wells Fargo & Company 1

This Annual Report, including the Financial Review and the Financial Statements and related Notes, contains forward-looking statements,

which may include forecasts of our financial results and condition, expectations for our operations and business, and our assumptions for those

forecasts and expectations. Do not unduly rely on forward-looking statements. Actual results may differ materially from our forward-looking

statements due to several factors. Factors that could cause our actual results to differ materially from our forward-looking statements are

described in this Report, including in the “Forward-Looking Statements” section, and in the “Risk Factors” and “Regulation and Supervision”

sections of our Annual Report on Form 10-K for the year ended December 31, 2022 (2022 Form 10-K).

When we refer to “Wells Fargo,” “the Company,” “we,” “our,” or “us” in this Report, we mean Wells Fargo & Company and Subsidiaries

(consolidated). When we refer to the “Parent,” we mean Wells Fargo & Company. See the “Glossary of Acronyms” for definitions of terms used

throughout this Report.

Financial Review

Overview

Wells Fargo & Company is a leading financial services company

that has approximately $1.9 trillion in assets, proudly serves one

in three U.S. households and more than 10% of small businesses

in the U.S., and is a leading middle market banking provider i n the

U.S. We provide a diversified set of banking, investment and

mortgage products and services, as well as consumer and

commercial finance, through our four reportable operating

segments: Consumer Banking and Lending, Commercial Banking,

Corporate and Investment Banking, and Wealth and Investment

Management. Wells Fargo ranked No. 41 on Fortune’s 2022

rankings of America’s largest corporations. We ranked fourth i n

assets and third in the market value of our common stock among

all U.S. banks at December 31, 2022 .

Wells Fargo’s top priority remains building a risk and control

infrastructure appropriate for its size and complexity. The

Company is subject to a number of consent orders and other

regulatory actions, which may require the Company, among

other things, to undertake certain changes to its business,

operations, products and services, and risk management

practices. Addressing these regulatory actions is expected to

take multiple years, and we are likely to experience issues or

delays along the way in satisfying their requirements. Issues o r

delays with one regulatory action could affect our progress on

others, and failure to satisfy the requirements of a regulator y

action on a timely basis could result in additional penalties,

business restrictions, enforcement actions, and other negative

consequences, which could be significant. While we still have

significant work to do and have not yet satisfied certain aspec ts

of these regulatory actions, the Company is committed to

devoting the resources necessary to operate with strong

business practices and controls, maintain the highest level of

integrity, and have an appropriate culture in place.

Federal Reserve Board Consent Order Regarding

Governance Oversight and Compliance and Operational

Risk Management

On February 2, 2018, the Company entered into a consent order

with the Board of Governors of the Federal Reserve System

(FRB). As required by the consent order, the Company’s Board of

Directors (Board) submitted to the FRB a plan to further enhance

the Board’s governance and oversight of the Company, and the

Company submitted to the FRB a plan to further improve the

Company’s compliance and operational risk management

program. The Company continues to engage with the FRB as the

Company works to address the consent order provisions. The

consent order also requires the Company, following the FRB’s

acceptance and approval of the plans and the Company’s

adoption and implementation of the plans, to complete an initial

third-party review of the enhancements and improvements

provided for in the plans. Until this third-party review is complete

and the plans are approved and implemented to the satisfaction

of the FRB, the Company’s total consolidated assets as defined

under the consent order will be limited to the level as of

December 31, 2017. Compliance with this asset cap is measured

on a two-quarter daily average basis to allow for management of

temporary fluctuations. After removal of the asset cap, a second

third-party review must also be conducted to assess the efficacy

and sustainability of the enhancements and improvements.

Consent Orders with the Consumer Financial Protection

Bureau and Office of the Comptroller of the Currency

Regarding Compliance Risk Management Program,

Automobile Collateral Protection Insurance Policies, and

Mortgage Interest Rate Lock Extensions

On April 20, 2018, the Company entered into consent orders

with the Consumer Financial Protection Bureau (CFPB) and the

Office of the Comptroller of the Currency (OCC) to pay an

aggregate of $1 billion in civil money penalties to resolve matters

regarding the Company’s compliance risk management program

and past practices involving certain automobile collateral

protection insurance (CPI) policies and certain mortgage interest

rate lock extensions. As required by the consent orders, the

Company submitted to the CFPB and OCC an enterprise-wide

compliance risk management plan and a plan to enhance the

Company’s internal audit program with respect to federal

consumer financial law and the terms of the consent orders. In

addition, as required by the consent orders, the Company

submitted for non-objection plans to remediate customers

affected by the automobile collateral protection insurance and

mortgage interest rate lock matters, as well as a plan for the

management of remediation activities conducted by the

Company. The Company continues to work to address the

provisions of the consent orders. On September 9, 2021, the

OCC assessed a $250 million civil money penalty against the

Company related to insufficient progress in addressing

requirements under the OCC’s April 2018 consent order and loss

mitigation activities in the Company’s Home Lending business.

On December 20, 2022, the CFPB modified its consent order to

clarify how it would terminate.

Consent Order with the OCC Regarding Loss Mitigation

Activities

On September 9, 2021, the Company entered into a consent

order with the OCC requiring the Company to improve the

execution, risk management, and oversight of loss mitigation

activities in its Home Lending business. In addition, the consent

order restricts the Company from acquiring certain third-party

Wells Fargo & Company 2

residential mortgage servicing and limits transfers of certain

mortgage loans requiring customer remediation out of the

Company’s mortgage servicing portfolio until remediation is

provided.

Consent Order with the CFPB Regarding Automobile

Lending, Consumer Deposit Accounts, and Mortgage

Lending

On December 20, 2022, the Company entered into a consent

order with the CFPB requiring the Company to provide customer

remediation for multiple matters related to automobile lending,

consumer deposit accounts, and mortgage lending; maintain

practices designed to ensure auto lending customers receive

refunds for the unused portion of certain guaranteed automobile

protection agreements; comply with certain business practice

requirements related to consumer deposit accounts; and pay a

$1.7 billion civil penalty to the CFPB. The required actions related

to many of these matters were already substantially complete at

the time we entered into the consent order, and the consent

order lays out a path to termination after the Company

completes the remainder of the required actions.

Retail Sales Practices Matters

In September 2016, we announced settlements with the CFPB,

the OCC, and the Office of the Los Angeles City Attorney, and

entered into related consent orders with the CFPB and the OCC,

in connection with allegations that some of our retail customers

received products and services they did not request. As a result, it

remains a priority to rebuild trust through a comprehensive

action plan that includes making things right for our customers,

employees, and other stakeholders, and building a better

Company for the future. On September 8, 2021, the CFPB

consent order regarding retail sales practices expired.

For additional information regarding retail sales practices

matters, including related legal and regulatory risk, see the “Risk

Factors” section and Note 13 (Legal Actions) to Financial

Statements in this Report.

Customer Remediation Activities

Our priority of rebuilding trust has included an effort to identify

areas or instances where customers may have experienced

financial harm, provide remediation as appropriate, and

implement additional operational and control procedures. We are

working with our regulatory agencies in this effort.

We have accrued for the probable and estimable costs

related to our customer remediation activities, which amounts

may change based on additional facts and information, as well as

ongoing reviews and communications with our regulators. As our

ongoing reviews continue and as we continue to strengthen our

risk and control infrastructure, we have identified and may in the

future identify additional items or areas of potential concern. To

the extent issues are identified, we will continue to assess any

customer harm and provide remediation as appropriate. We have

previously disclosed key areas of focus as part of these activities.

For additional information regarding accruals for customer

remediation, see the “Expenses” section in Note 20 (Revenue and

Expenses) to Financial Statements in this Report, and for

additional information regarding these activities, including

related legal and regulatory risk, see the “Risk Factors” section

and Note 13 (Legal Actions) to Financial Statements in this

Report.

Recent Developments

LIBOR Transition

The London Interbank Offered Rate (LIBOR) is a widely

referenced benchmark rate that seeks to estimate the cost at

which banks can borrow on an unsecured basis from other banks.

On March 5, 2021, the United Kingdom’s Financial Conduct

Authority and ICE Benchmark Administration, the administrator

of LIBOR, announced that certain settings of LIBOR would no

longer be published on a representative basis after December 31,

2021, and the most commonly used U.S. dollar (USD) LIBOR

settings would no longer be published on a representative basis

after June 30, 2023. Central banks in various jurisdictions

convened committees to identify replacement rates to facilitate

the transition away from LIBOR. The committee convened by the

Federal Reserve in the United States, the Alternative Reference

Rates Committee (ARRC), recommended the Secured Overnight

Financing Rate (SOFR) as the replacement rate for USD LIBOR.

In first quarter 2022, the Adjustable Interest Rate (LIBOR)

Act (the LIBOR Act) was enacted into U.S. federal law to provide

a statutory framework to replace LIBOR with a benchmark rate

based on SOFR in U.S. law contracts that do not have fallback

provisions or that have fallback provisions resulting in a

replacement rate based on LIBOR. The FRB adopted a final rule

implementing the LIBOR Act on December 16, 2022, which will

become effective on February 27, 2023. We expect that the

LIBOR Act will transition certain of our legacy USD LIBOR

contracts that do not have appropriate fallback provisions to the

applicable SOFR-based replacement rates specified in the FRB’s

final rule.

We no longer offer new contracts referencing LIBOR, subject

to limited exceptions based on regulatory guidance. During 2022,

we executed certain LIBOR transition activities to enhance our

operational readiness such as the development of new

alternative reference rate products, model and system updates,

and employee training.

For certain contracts, including commercial credit facilities

and related derivatives, we continue to proactively engage with

our clients and contract parties to replace LIBOR with SOFR-

based rates or other alternative reference rates in advance of the

June 30, 2023 cessation date.

Following June 30, 2023, we expect substantially all of our

consumer loans, commercial credit facilities, debt securities,

derivatives, and long-term debt indexed to USD LIBOR to

transition to SOFR-based or other alternative reference rates in

accordance with existing fallback provisions or the LIBOR Act.

For additional information regarding the risks and potential

impact of LIBOR or any other referenced financial metric being

significantly changed, replaced or discontinued, see the “Risk

Factors” section in this Report.

Wells Fargo & Company 3

Overview (continued)

Financial Performance

In 2022, we generated $13.2 billion of net income and diluted

earnings per common share (EPS) of $3.14, compared with

$21.5 billion of net income and diluted EPS of $4.95 in 2021.

Financial performance for 2022, compared with 2021, included

the following:

Credit quality reflected the following:

• total revenue decreased due to lower net gains from equity

securities, mortgage banking, and investment advisory and

other asset-based fee income, partially offset by higher net

interest income;

• provision for credit losses increased reflecting loan growth

and a less favorable economic environment;

• noninterest expense increased due to higher operating

losses, partially offset by lower personnel expense, and

professional and outside services expense;

• average loans increased driven by loan growth across both

our commercial and consumer loan portfolios; and

• average deposits decreased driven by reductions in

Corporate and Investment Banking, Commercial Banking,

Wealth and Investment Management, and Corporate,

partially offset by growth in Consumer Banking and Lending.

Capital and Liquidity

We maintained a strong capital position in 2022. Total equity of

$181.9 billion at December 31, 2022, decreased compared with

$190.1 billion at December 31, 2021, driven by a decrease in

accumulated other comprehensive income due to net unrealized

losses on available-for-sale (AFS) debt securities. Our liquidity

and regulatory capital ratios remained strong at December 31,

2022, including:

• our Common Equity Tier 1 (CET1) ratio was 10.60% under

the Standardized Approach (our binding ratio), which

continued to exceed the regulatory minimum and buffers of

9.20%;

• our total loss absorbing capacity (TLAC) as a percentage of

total risk-weighted assets was 23.27%, compared with the

regulatory minimum of 21.50%; and

• our liquidity coverage ratio (LCR) was 122%, which

continued to exceed the regulatory minimum of 100%.

See the “Capital Management” and the “Risk Management –

Asset/Liability Management – Liquidity Risk and Funding”

sections in this Report for additional information regarding our

capital and liquidity, including the calculation of our regulatory

capital and liquidity amounts.

Credit Quality

• The allowance for credit losses (ACL) for loans of

$13.6 billion at December 31, 2022, decreased $179 million

from December 31, 2021, reflecting reduced uncertainty

around the economic impact of the COVID-19 pandemic on

our loan portfolio. This decrease was partially offset by loan

growth and a less favorable economic environment.

• Our provision for credit losses for loans was $1.5 billion in

2022, compared with $(4.2) billion in 2021, reflecting loan

growth and a less favorable economic environment.

• The allowance coverage for total loans was 1.42% at

December 31, 2022, compared with 1.54% at December 31,

2021.

• Commercial portfolio net loan charge-offs were $79 million,

or 1 basis point of average commercial loans, in 2022,

compared with net loan charge-offs of $295 million, or

6 basis points, in 2021, driven by lower losses in our

commercial and industrial and commercial real estate

mortgage portfolios.

• Consumer portfolio net loan charge-offs were $1.5 billion, or

39 basis points of average consumer loans, in 2022,

compared with net loan charge-offs of $1.3 billion, or

33 basis points, in 2021, predominantly due to higher losses

in our auto portfolio.

• Nonperforming assets (NPAs) of

$5.8 billion

at

December 31, 2022

, decreased

$1.6 billion

, or

21%, from

December 31, 2021

, driven by improved credit quality across

our commercial loan portfolios, and a decrease in residential

mortgage nonaccrual loans

primarily

due to sustained

payment performance of borrowers after exiting COVID-19

-

related accommodation programs. NPAs represented

0.60%

of total loans at

December 31, 2022

.

Wells Fargo & Company 4

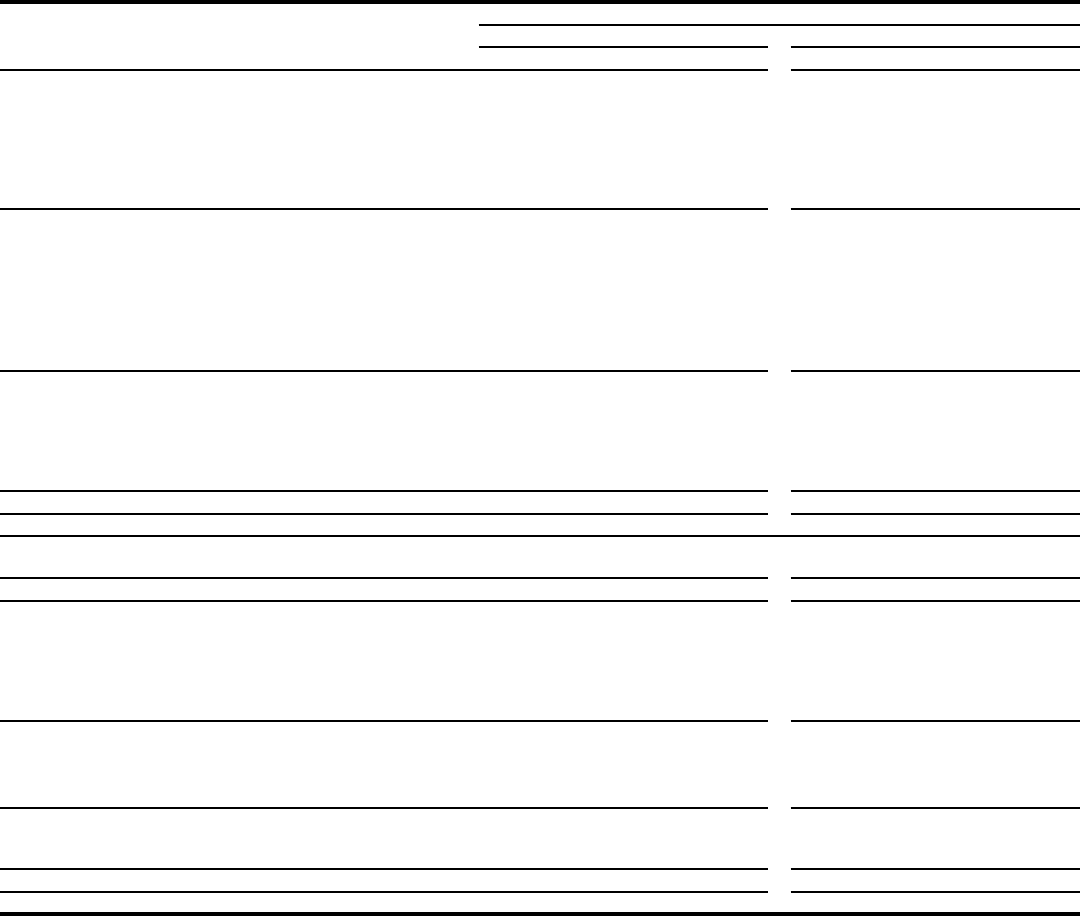

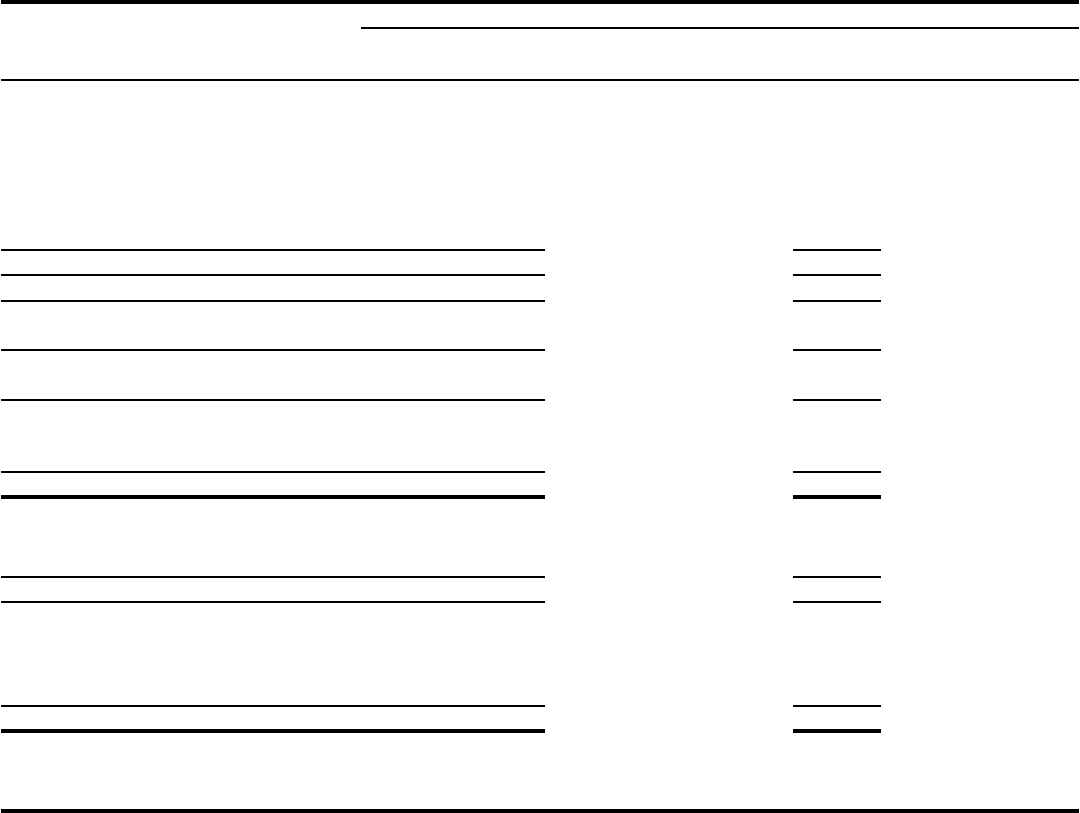

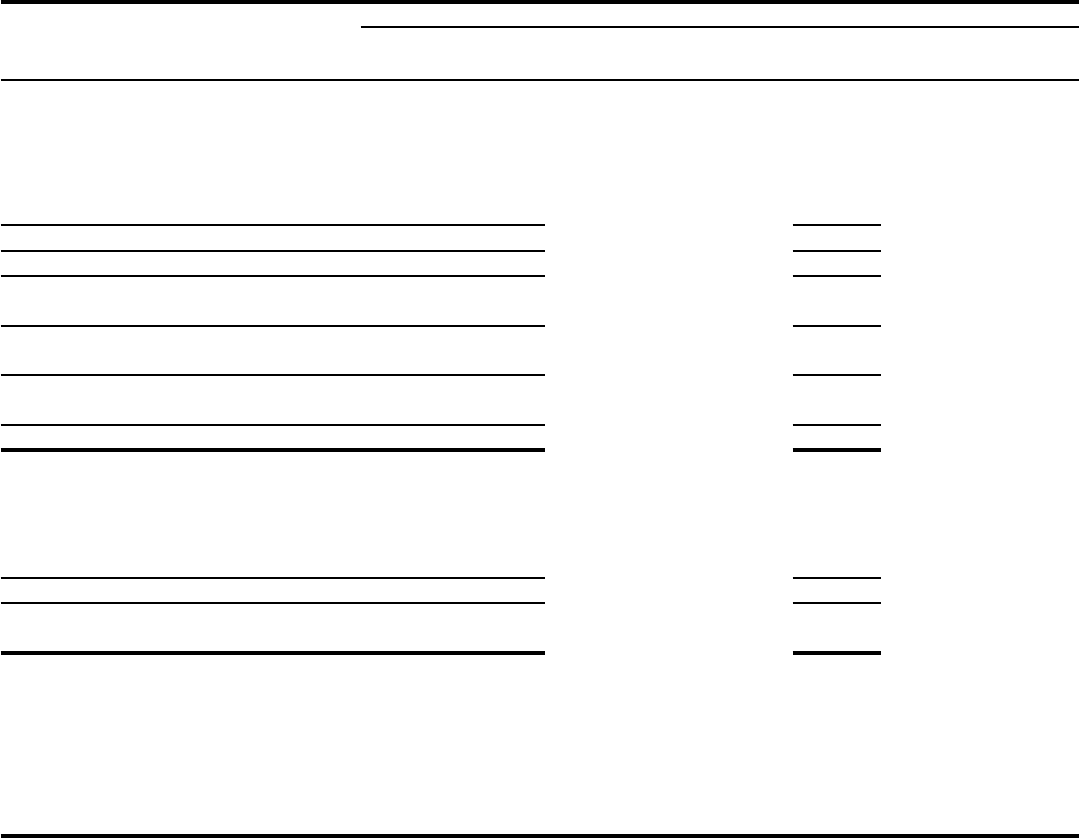

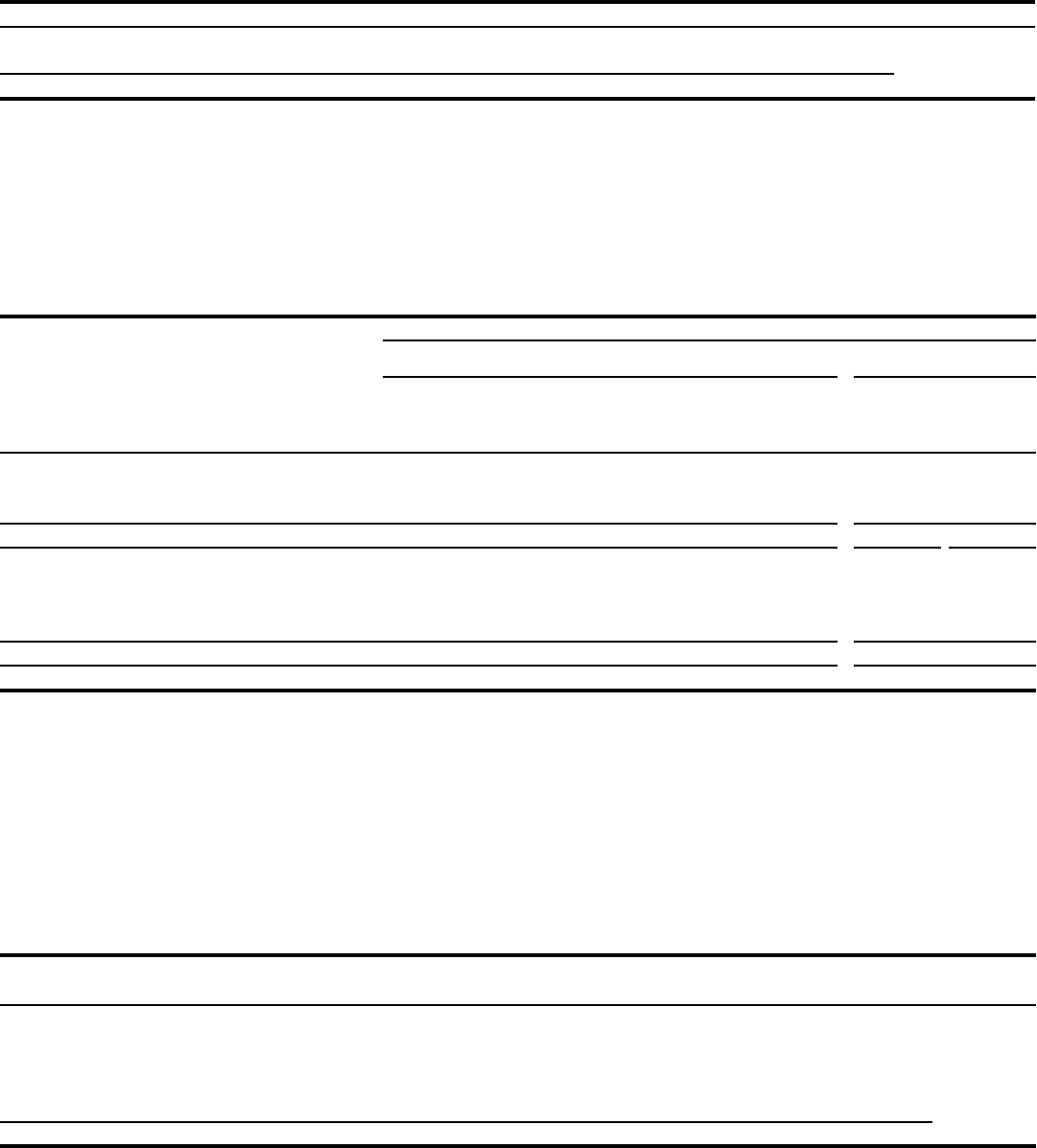

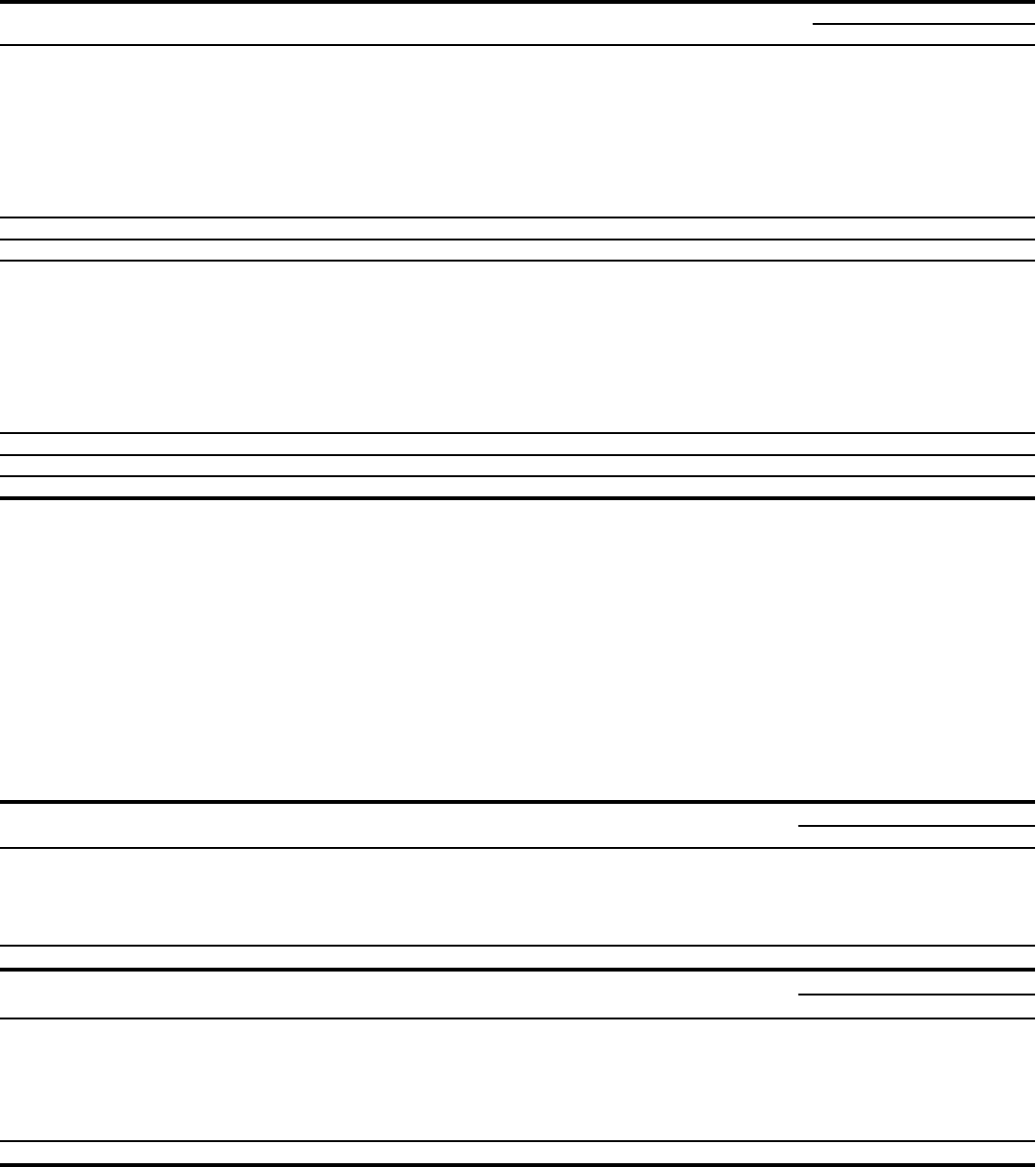

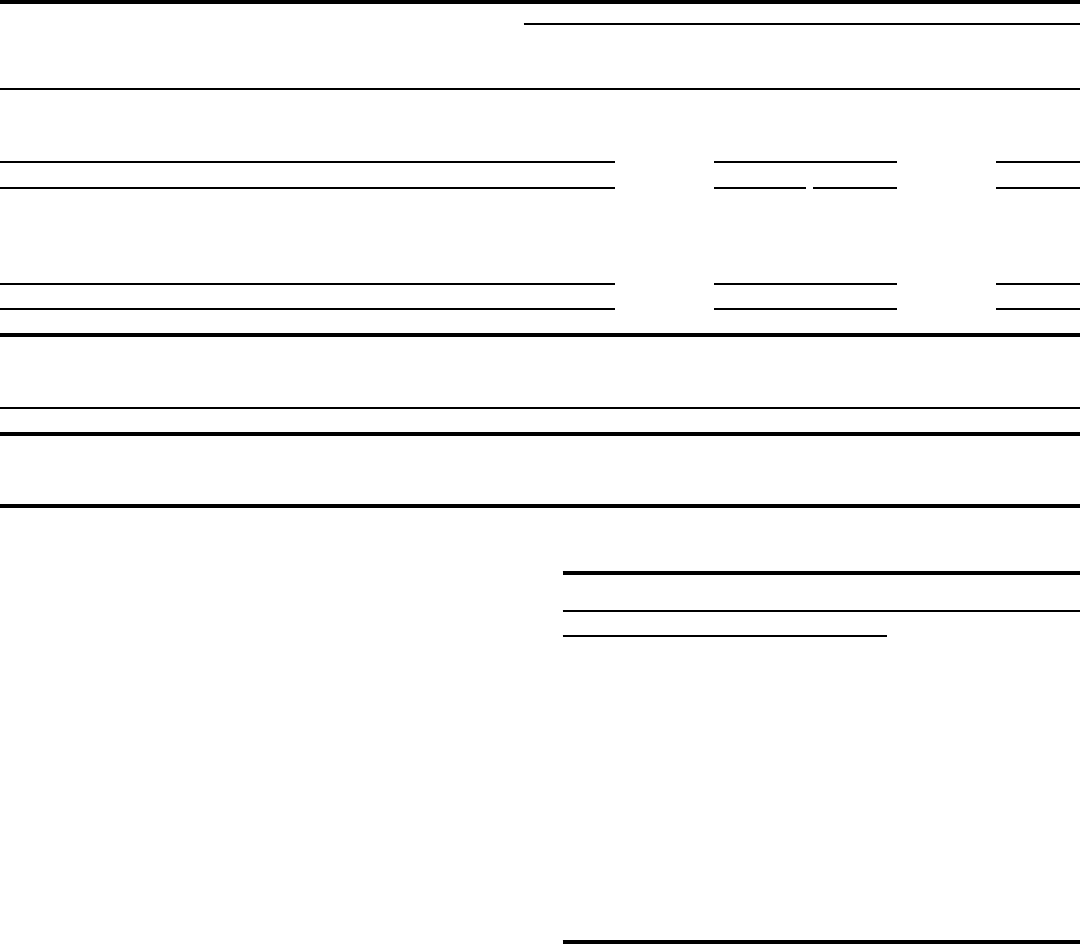

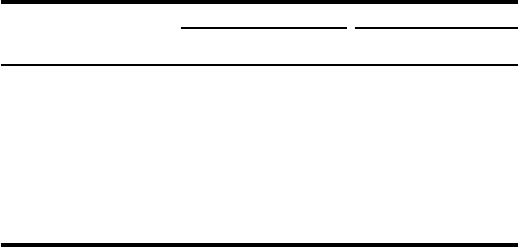

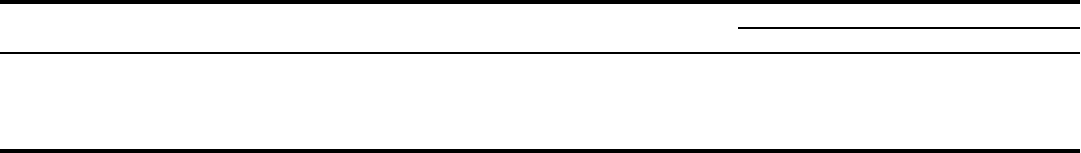

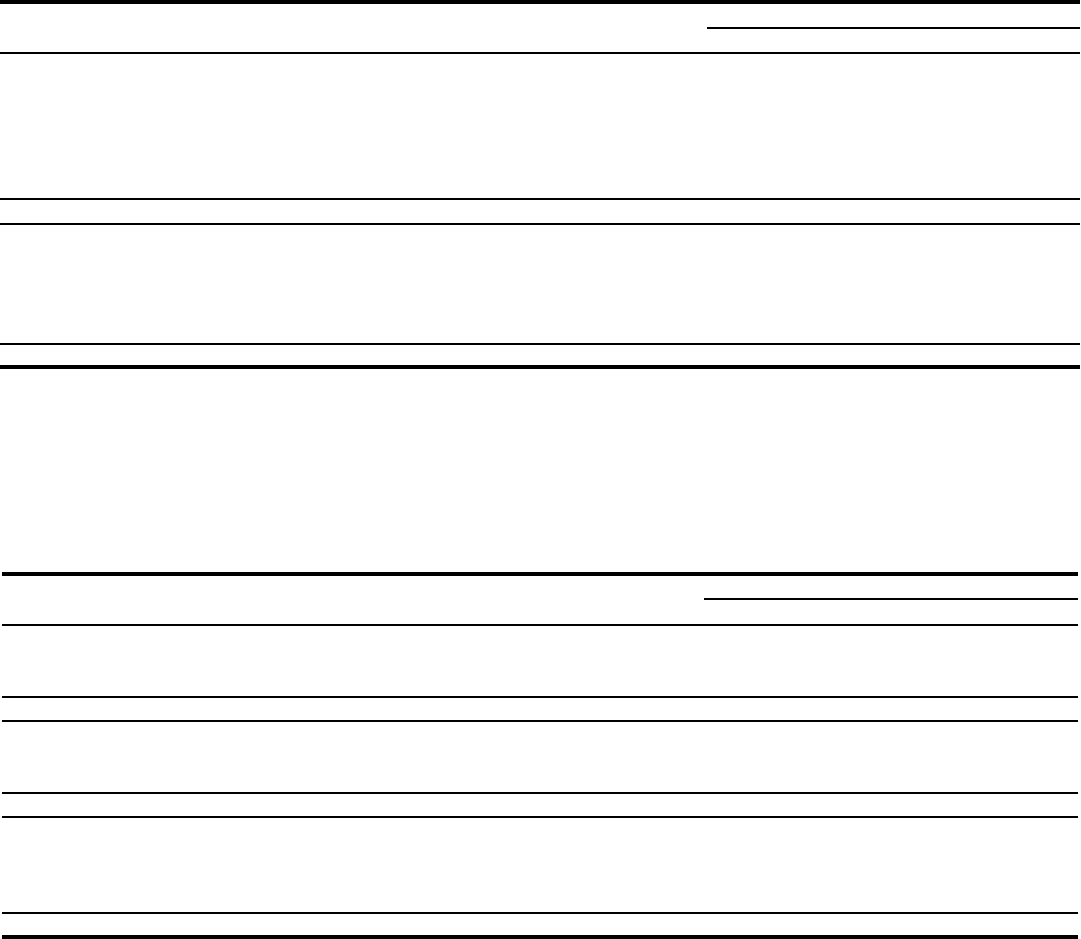

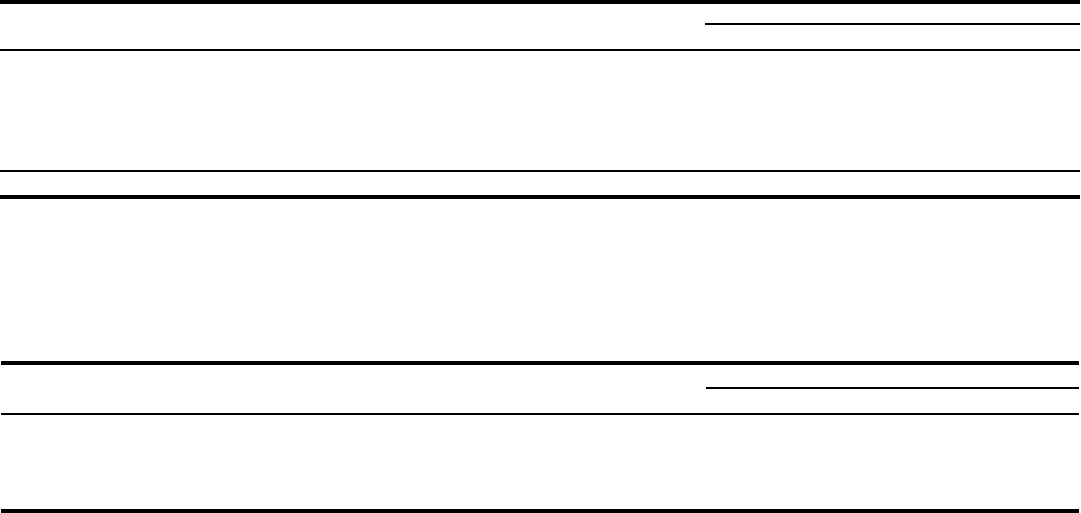

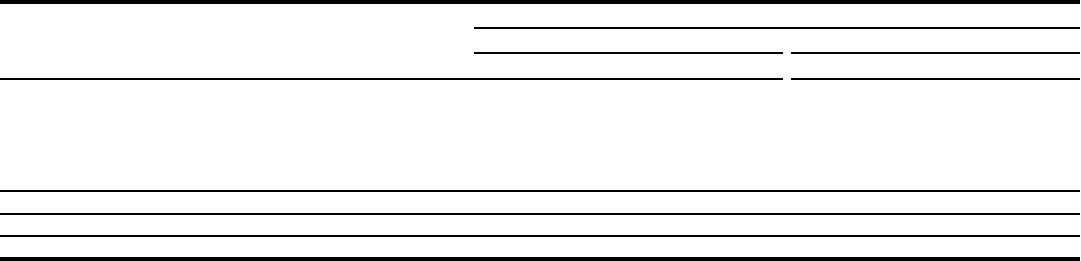

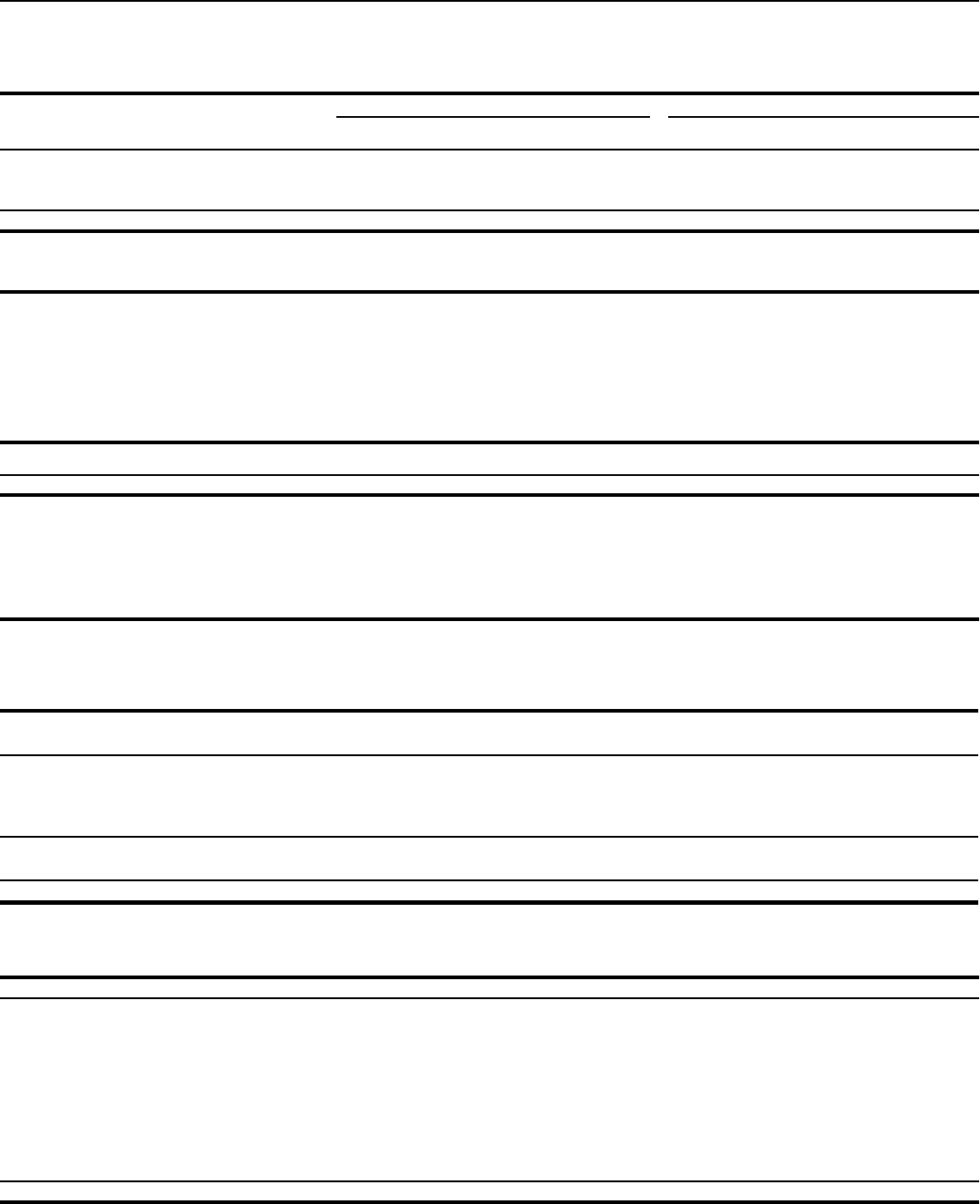

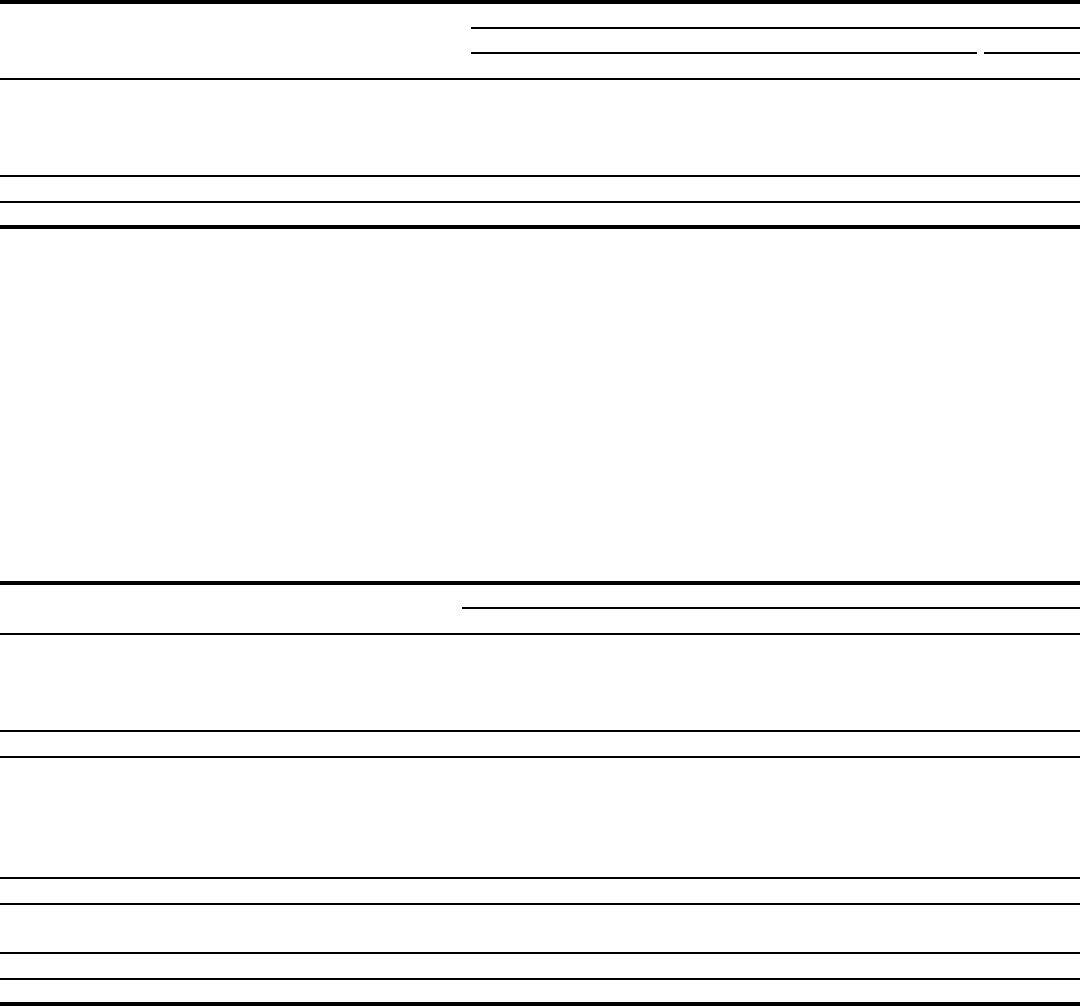

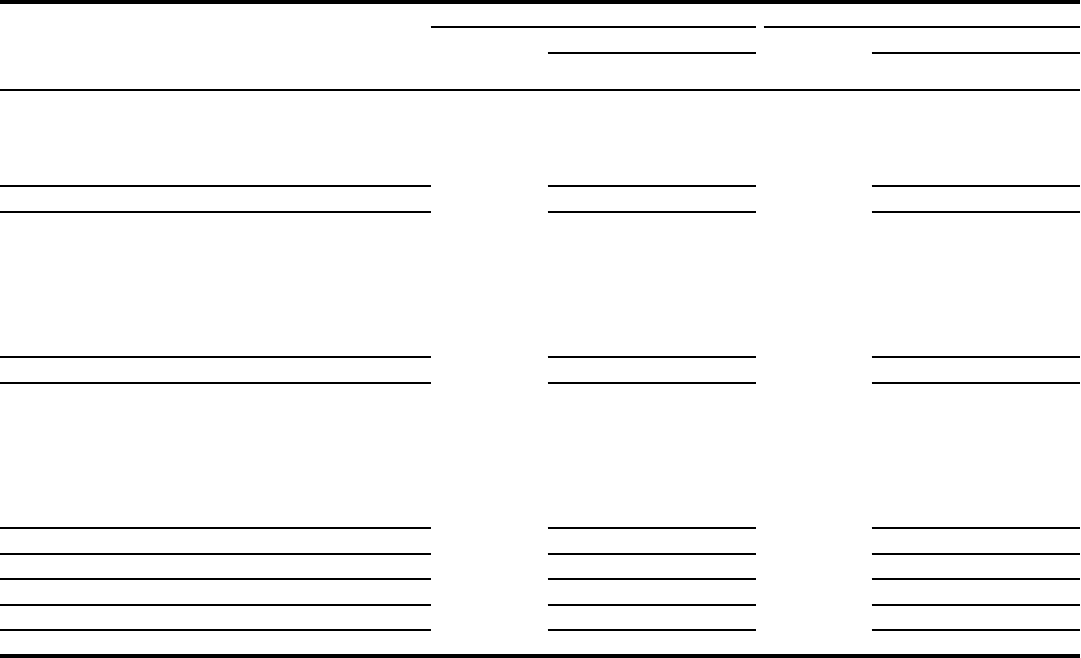

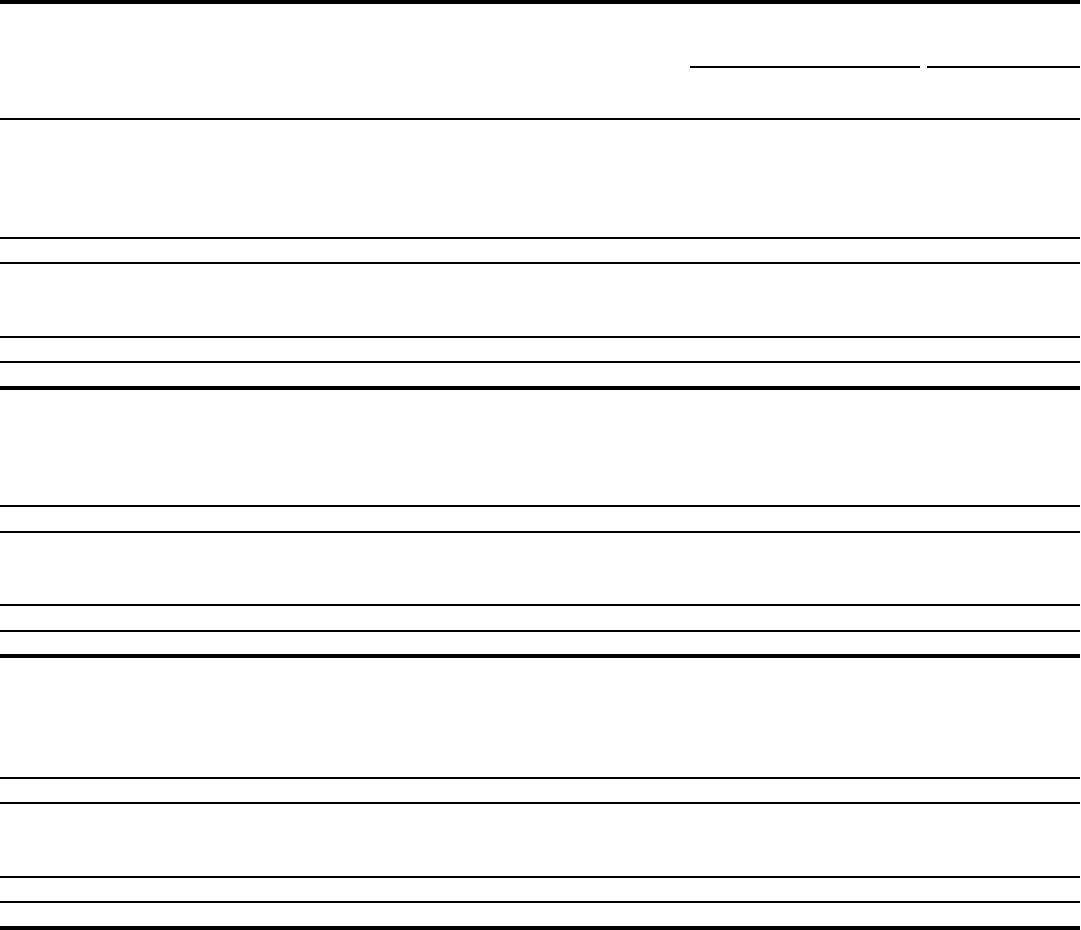

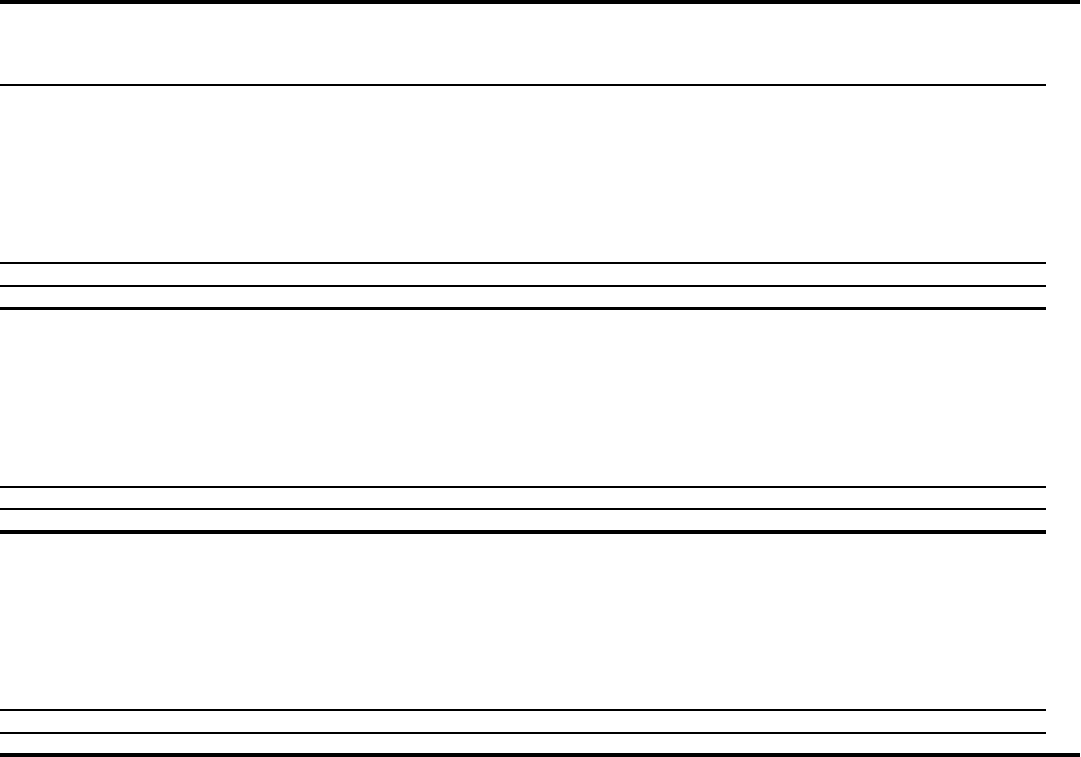

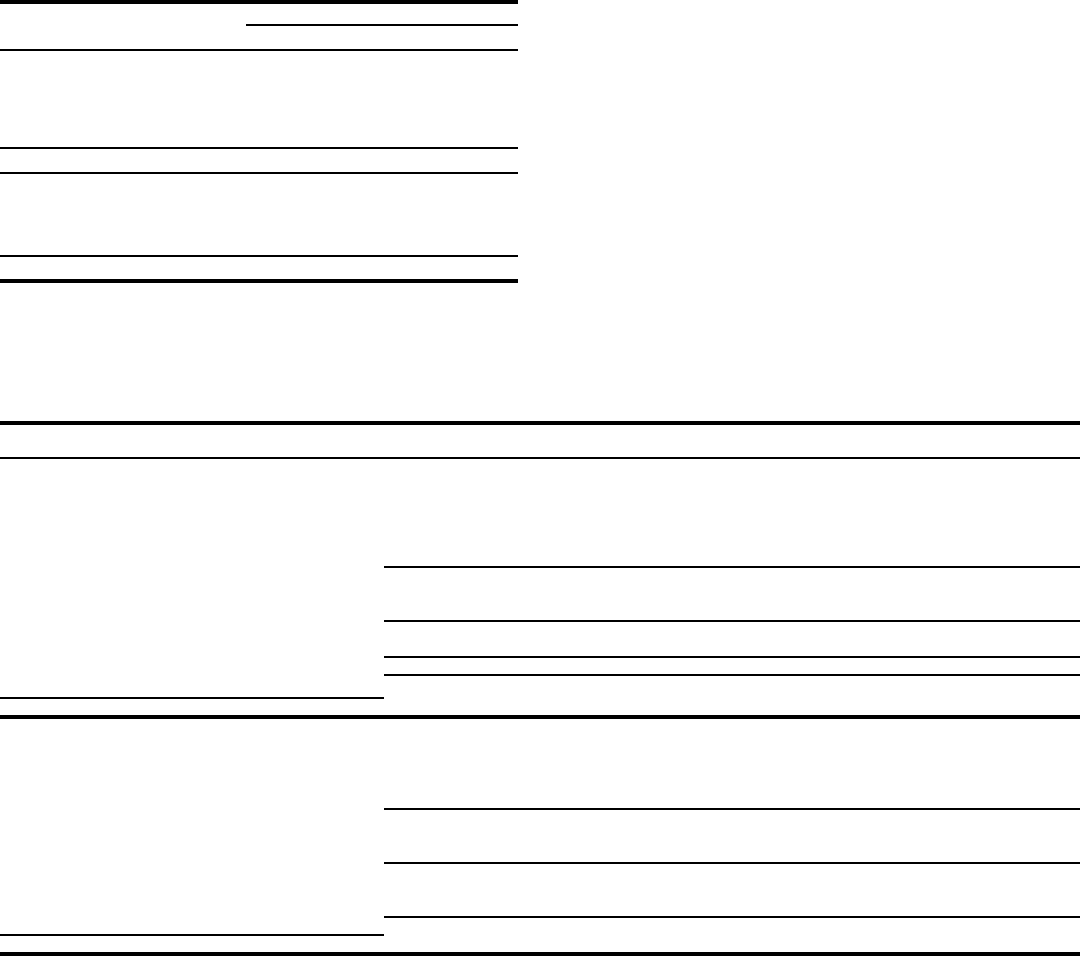

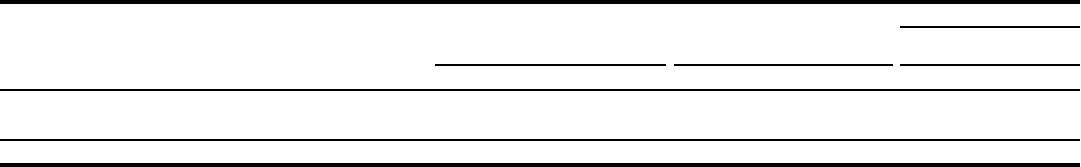

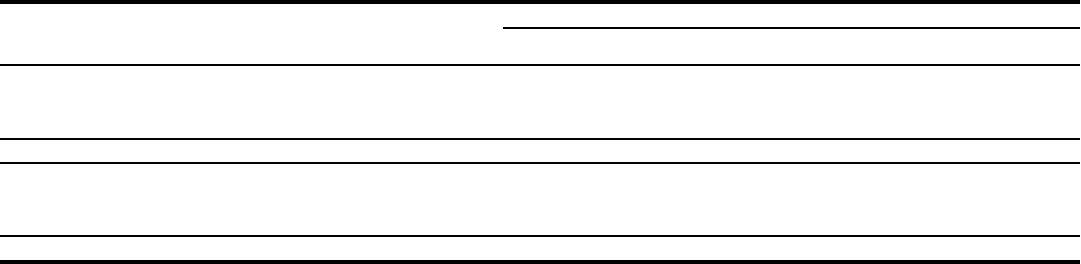

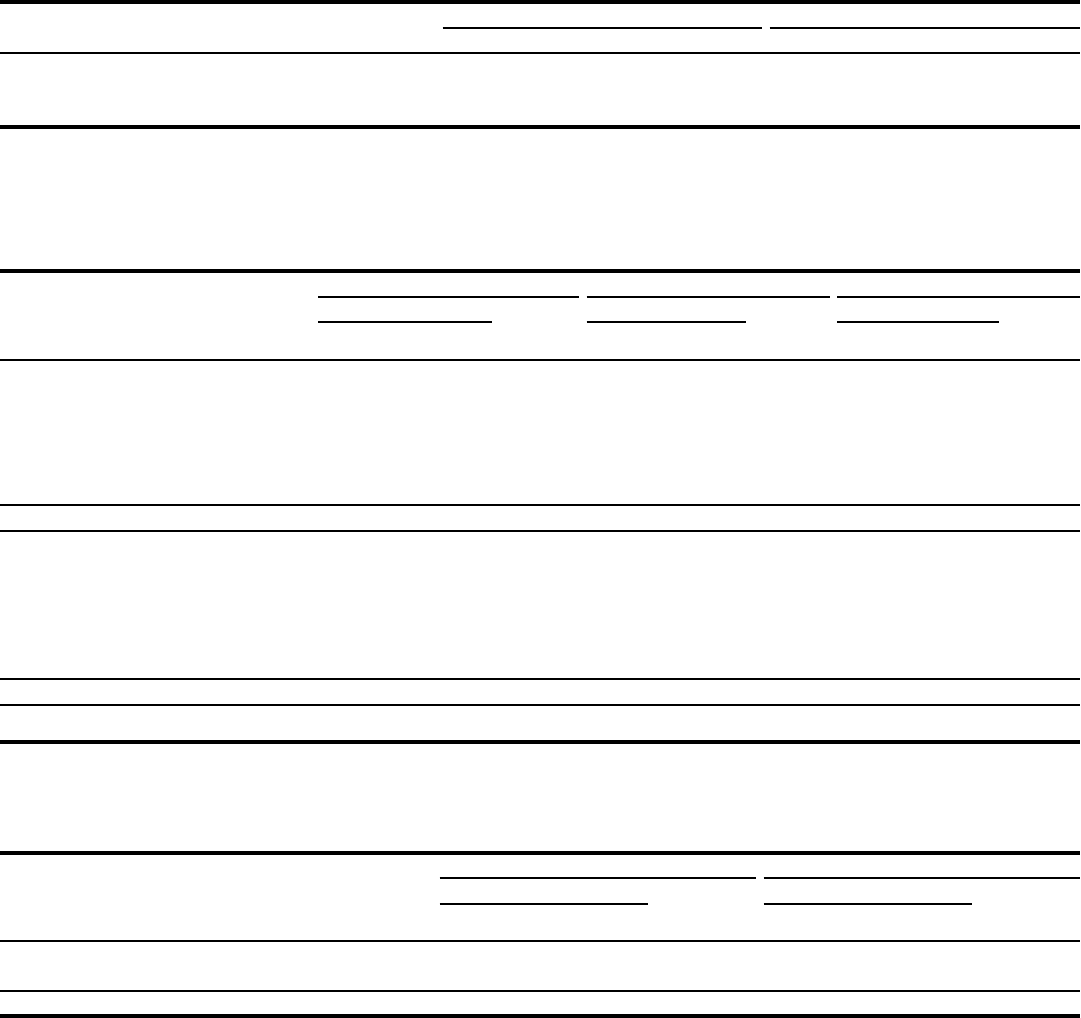

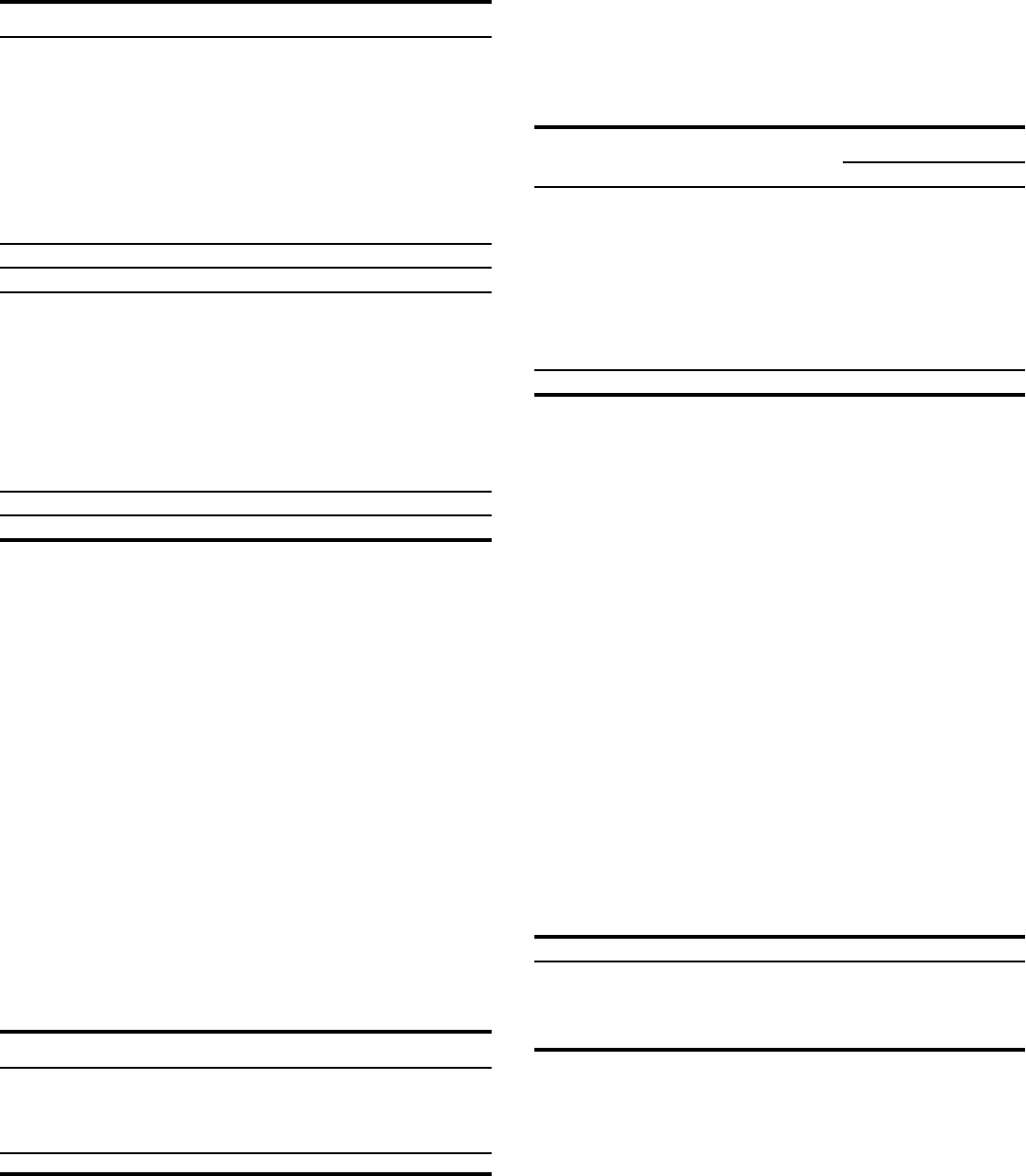

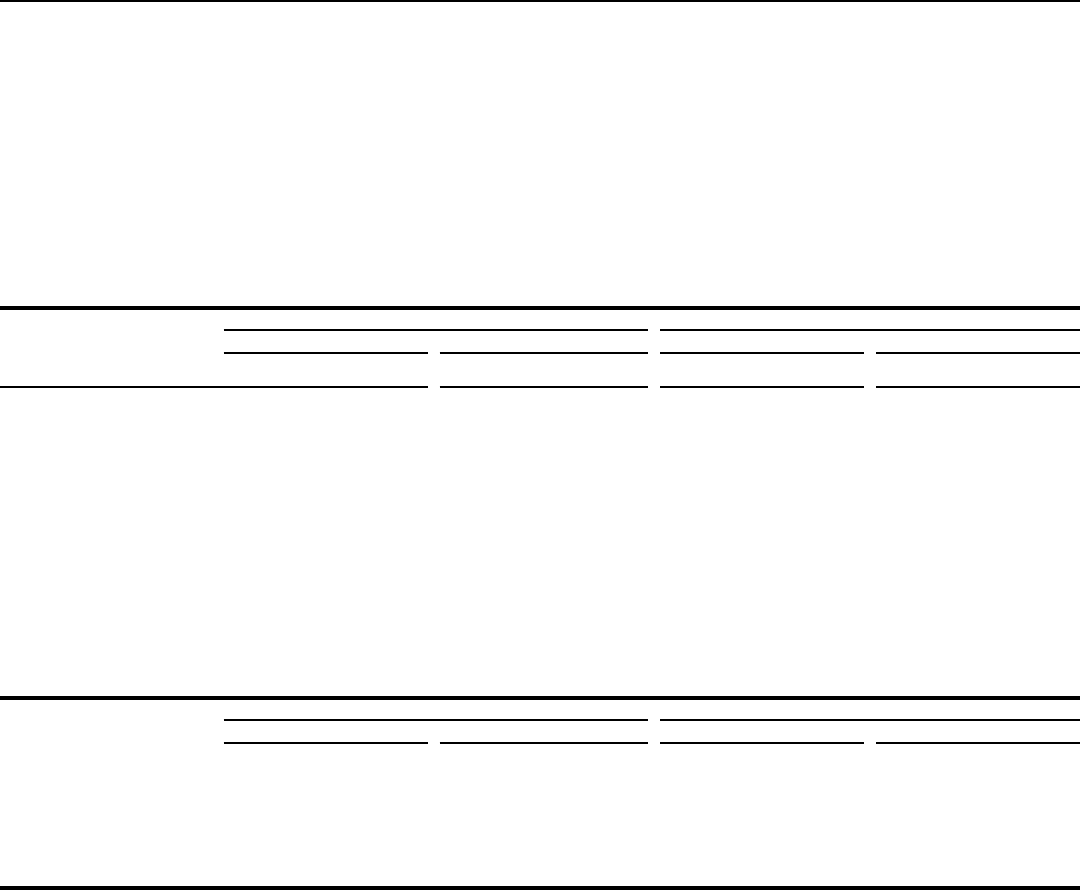

Table 1 presents a three-year summary of selected financial

data and Table 2 presents selected ratios and per common share

data.

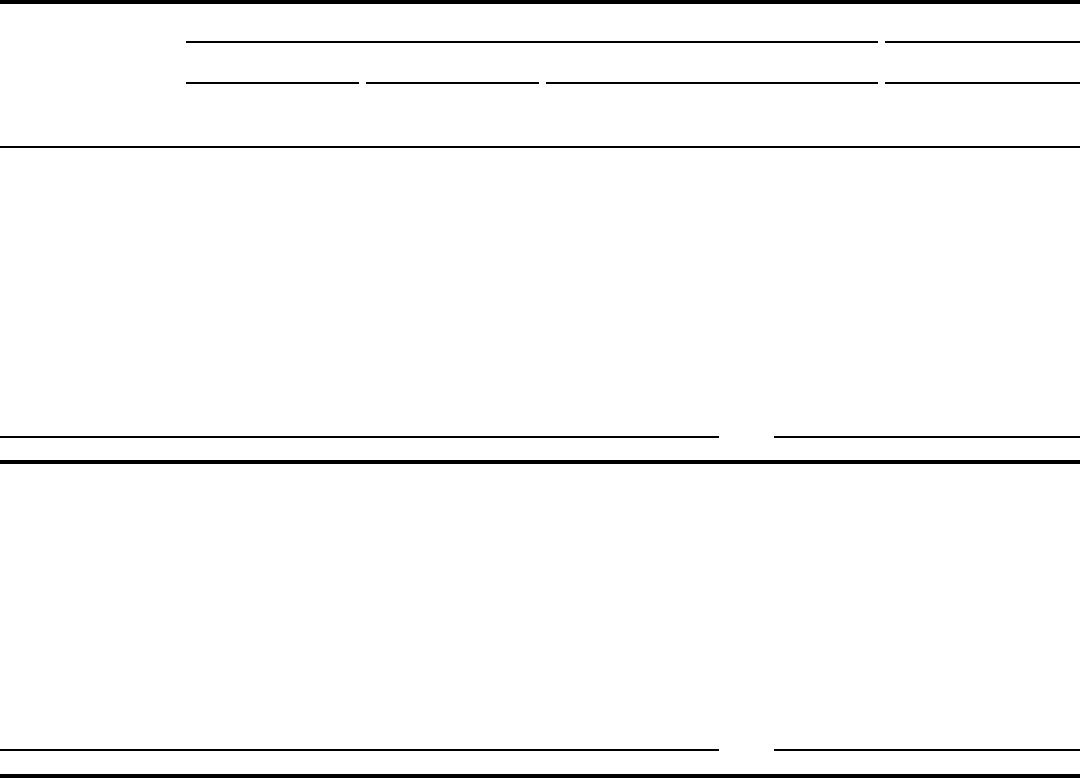

Table 1: Summary of Selected Financial Data

Year ended December 31,

(in millions, except per share amounts) 2022 2021

$ Change

2022/

2021

% Change

2022/

2021 2020

$ Change

2021/

2020

% Change

2021/

2020

Income statement

Net interest income $ 44,950 35,779 9,171 26 % $ 39,956 (4,177) (10)%

Noninterest income 28,835 42,713 (13,878) (32) 34,308 8,405 24

Total revenue 73,785 78,492 (4,707) (6) 74,264 4,228 6

Net charge-offs 1,609 1,582 27 2 3,370 (1,788) (53)

Change in the allowance for credit losses (75) (5,737) 5,662 99 10,759 (16,496) NM

Provision for credit losses 1,534 (4,155) 5,689 137 14,129 (18,284) NM

Noninterest expense 57,282 53,831 3,451 6 57,630 (3,799) (7)

Net income before noncontrolling interests 12,882 23,238 (10,356) (45) 3,662 19,576 535

Less: Net income from noncontrolling interests (300) 1,690 (1,990) NM 285 1,405 493

Wells Fargo net income 13,182 21,548 (8,366) (39) 3,377 18,171 538

Earnings per common share 3.17 4.99 (1.82) (36) 0.43 4.56 NM

Diluted earnings per common share 3.14 4.95 (1.81) (37) 0.43 4.52 NM

Dividends declared per common share 1.10 0.60 0.50 83 1.22 (0.62) (51)

Balance sheet (at year end)

Debt securities 496,808 537,531 (40,723) (8) 501,207 36,324 7

Loans 955,871 895,394 60,477 7 887,637 7,757 1

Allowance for loan losses

12,985 12,490 495 4 18,516 (6,026) (33)

Equity securities 64,414 72,886 (8,472) (12) 60,008 12,878 21

Assets 1,881,016 1,948,068 (67,052) (3) 1,952,911 (4,843) —

Deposits 1,383,985 1,482,479 (98,494) (7) 1,404,381 78,098 6

Long-term debt 174,870 160,689 14,181 9 212,950 (52,261) (25)

Common stockholders’ equity 160,614 168,331 (7,717) (5) 164,570 3,761 2

Wells Fargo stockholders’ equity 179,889 187,606 (7,717) (4) 184,680 2,926 2

Total equity 181,875 190,110 (8,235) (4) 185,712 4,398 2

NM – Not meaningful

Wells Fargo & Company 5

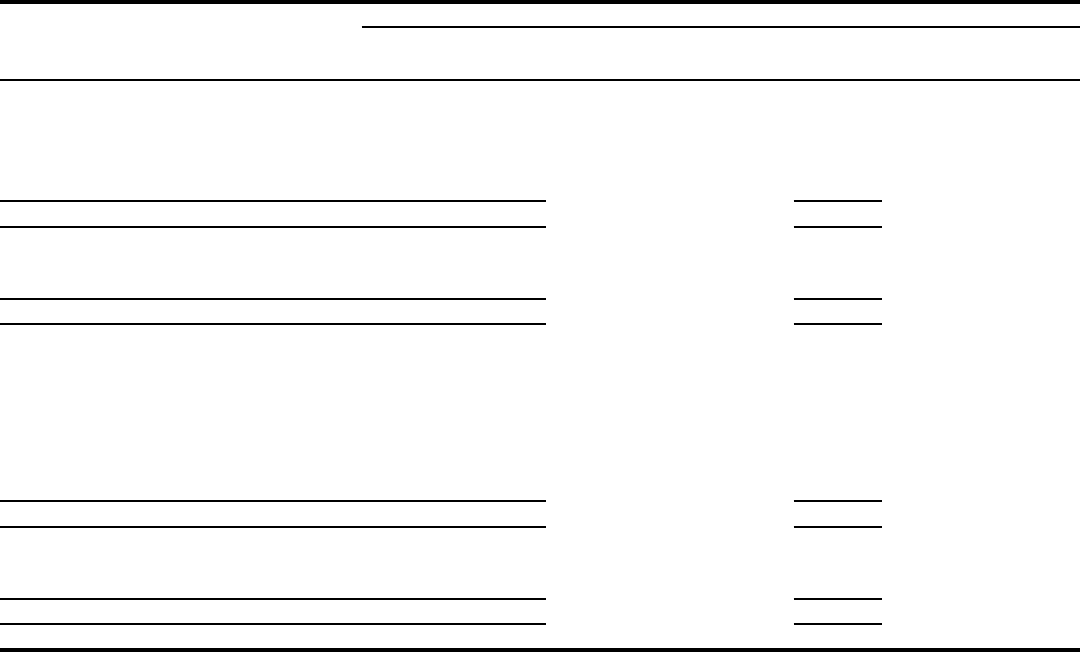

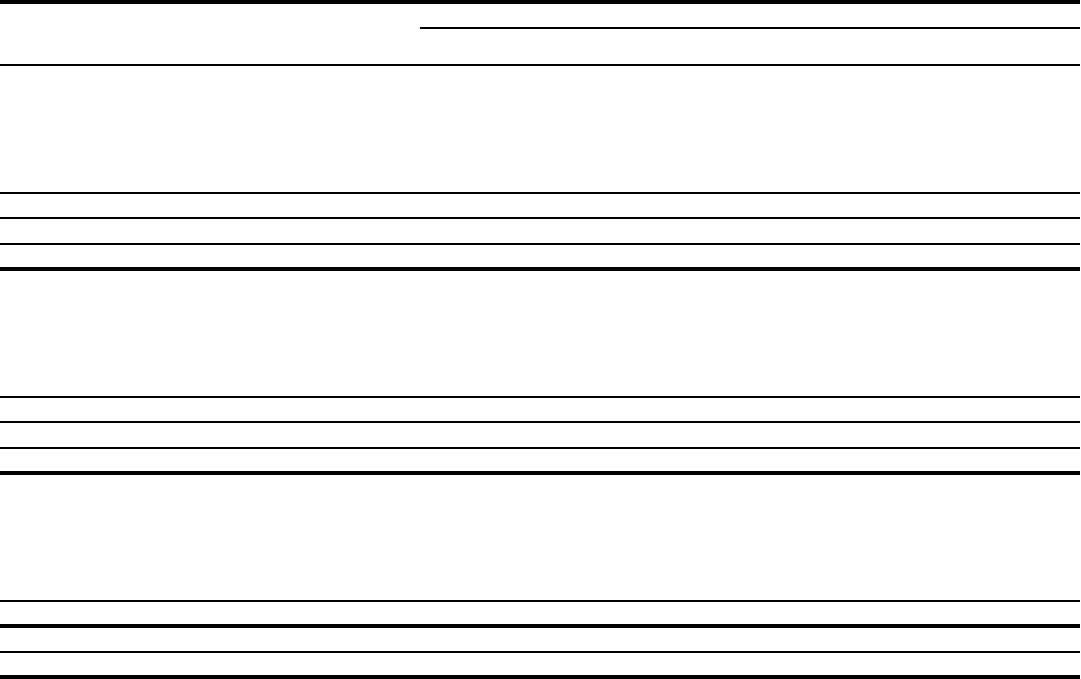

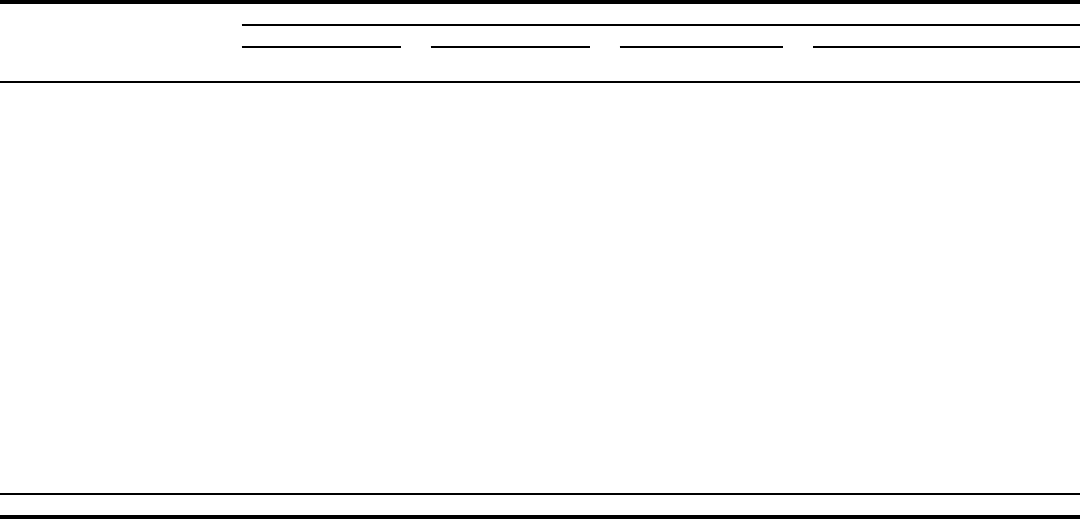

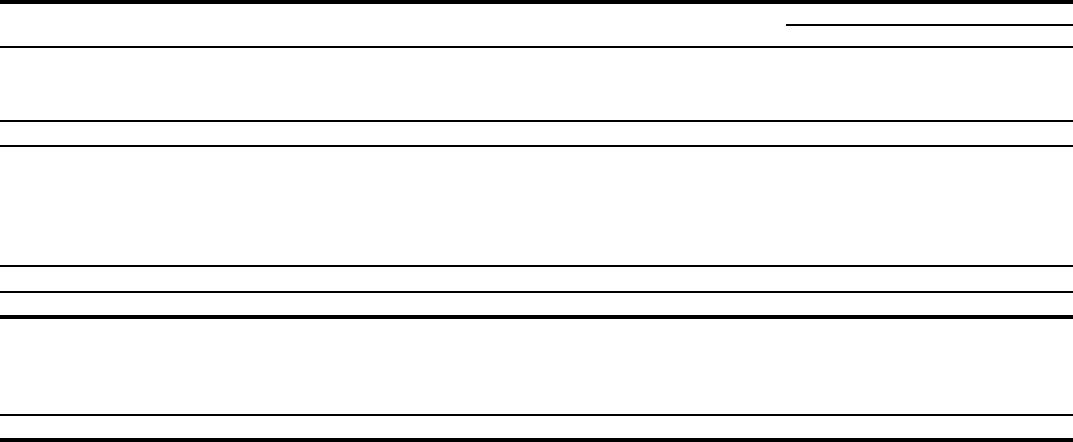

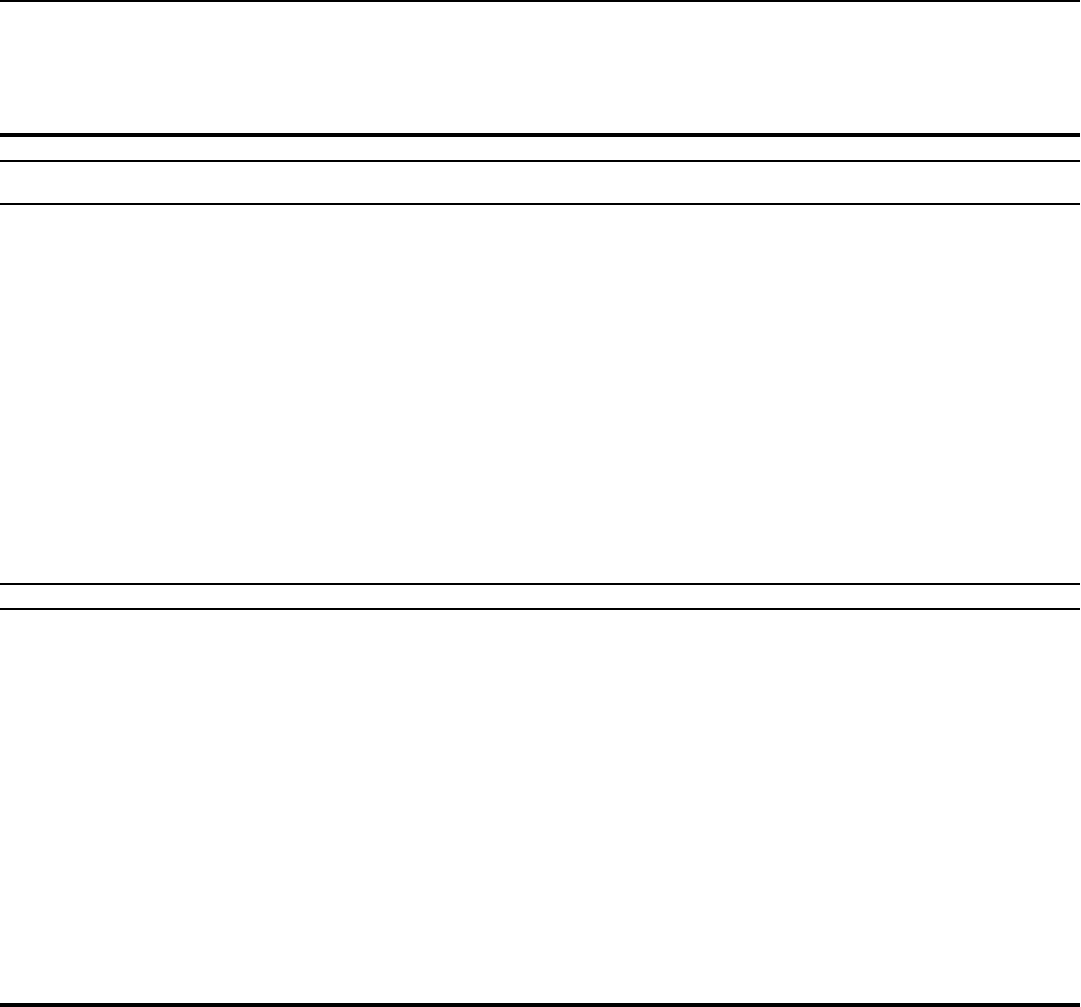

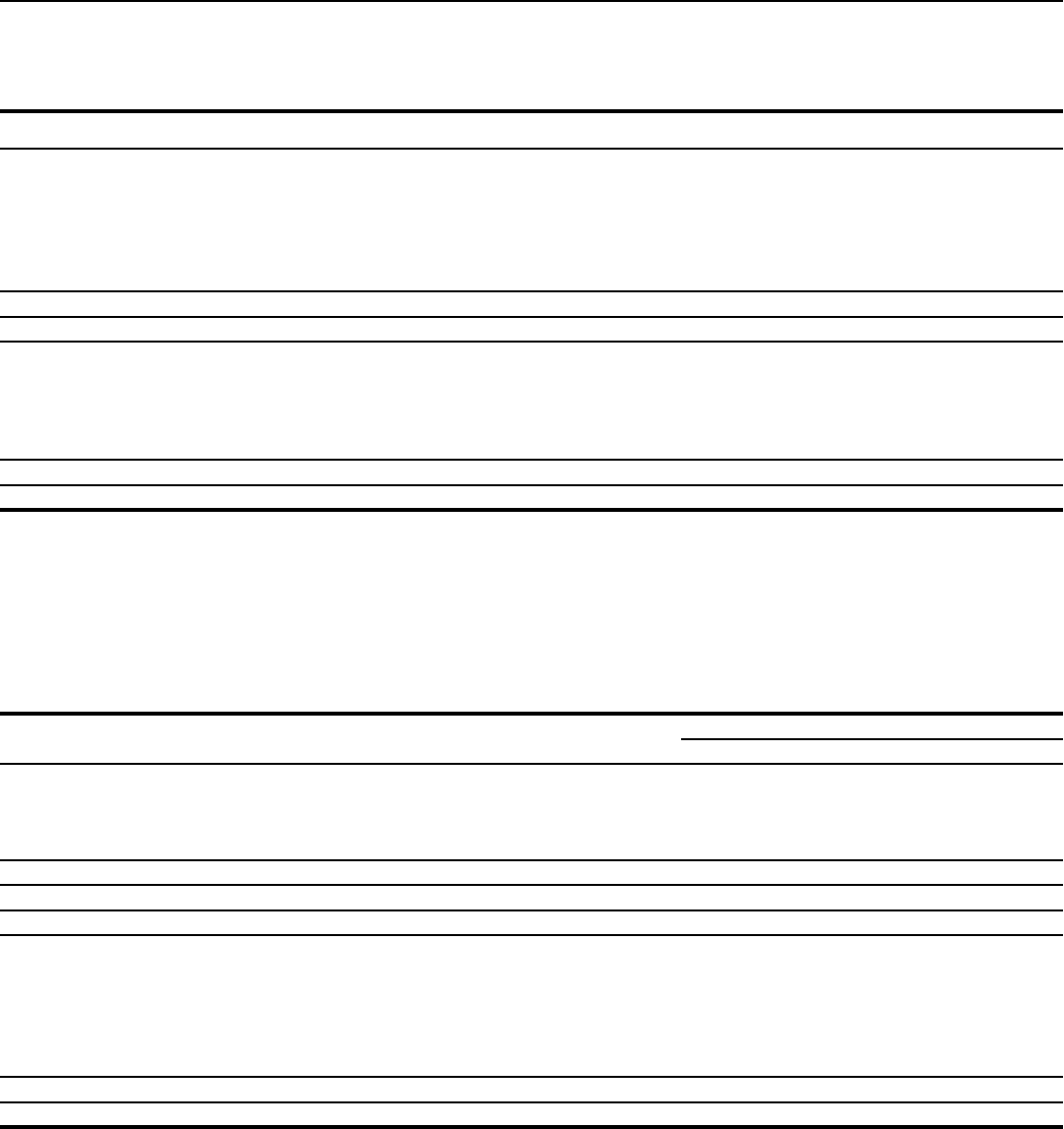

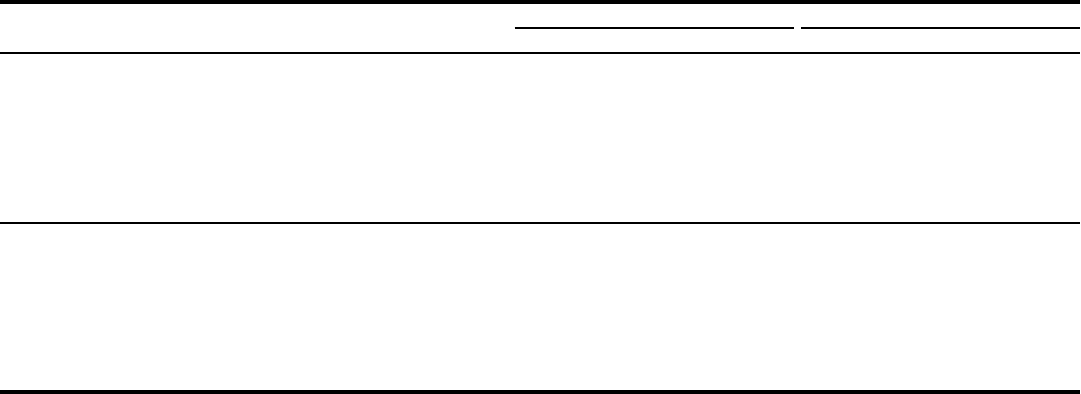

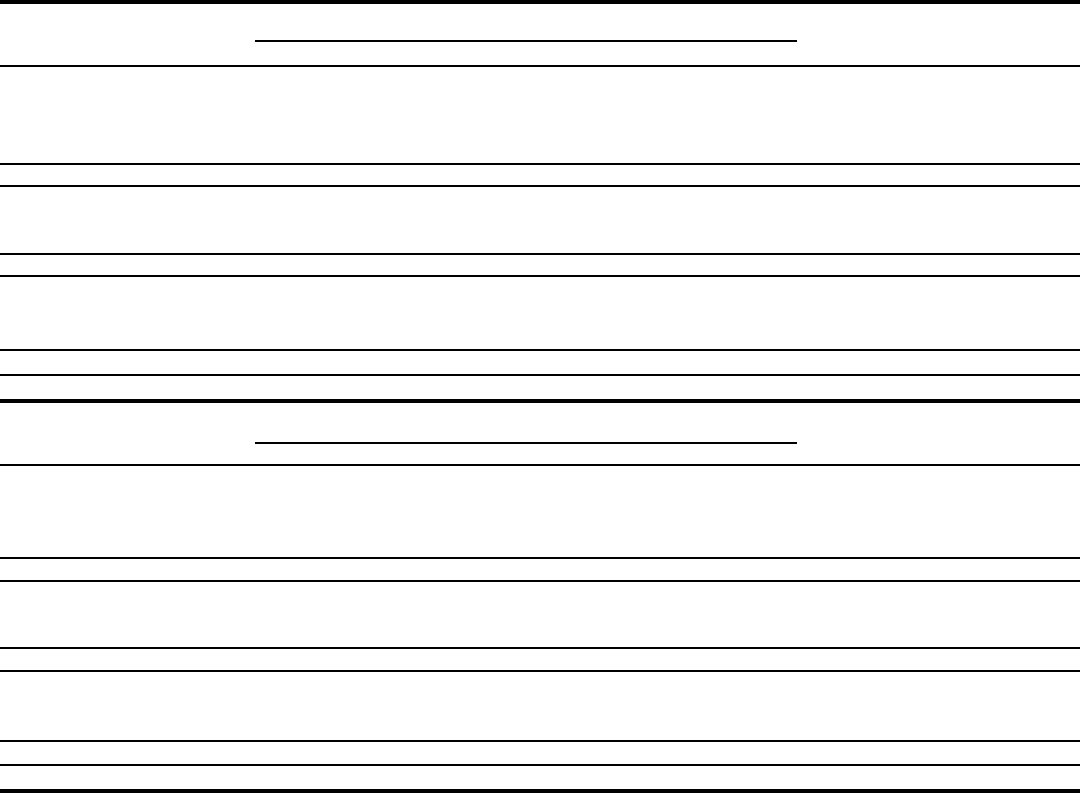

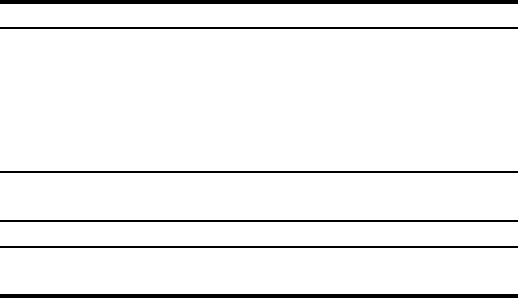

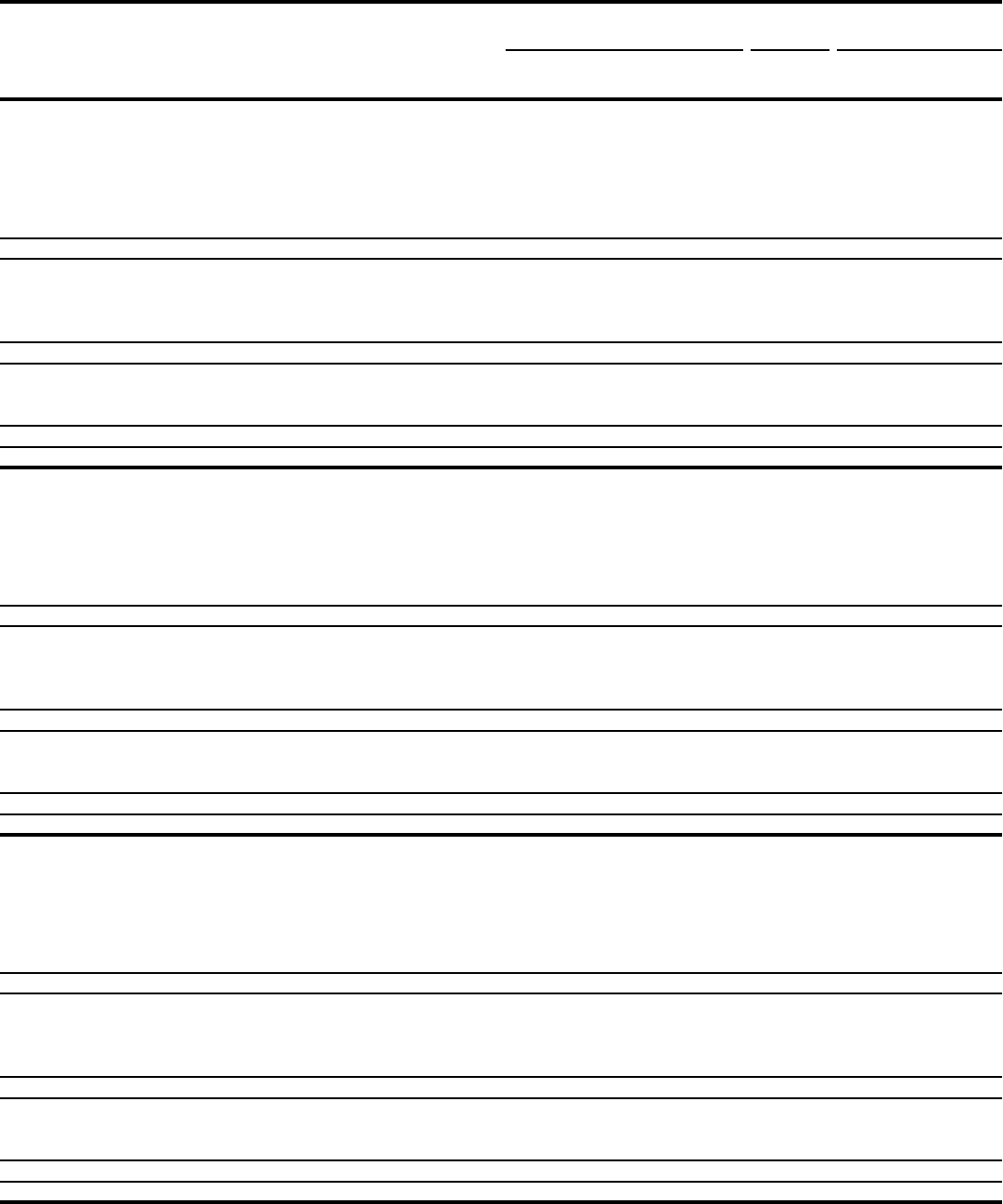

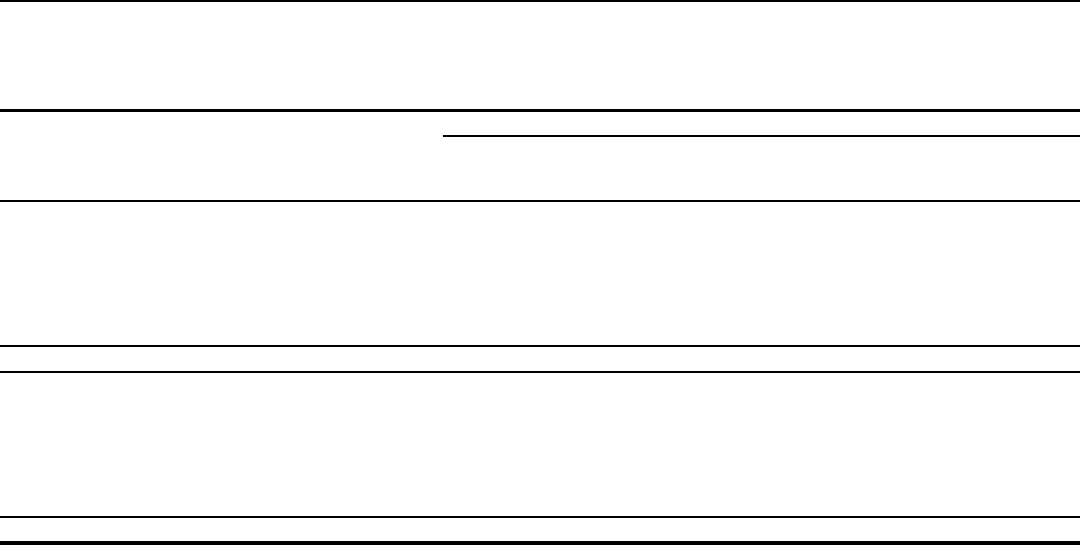

Table 2: Ratios and Per Common Share Data

Year ended December 31,

2022 2021 2020

Performance ratios

Return on average assets (ROA) (1)

0.70%

1.11

0.17

Return on average equity (ROE) (2)

7.5

12.0

1.1

(3) Return on average tangible common equity (ROTCE)

9.0

14.3

1.3

(4) Efficiency ratio

78

69

78

(5) Capital and other metrics

At year end:

Wells Fargo common stockholders’ equity to assets

8.54

8.64

8.43

Total equity to assets

9.67

9.76

9.51

Risk-based capital ratios and components:

Standardized Approach:

Common Equity Tier 1 (CET1)

10.60

11.35

11.59

Tier 1 capital

12.11

12.89

13.25

Total capital

14.82

15.84

16.47

Risk-weighted assets (RWAs) (in billions)

$

1,259.9

1,239.0

1,193.7

Advanced Approach:

Common Equity Tier 1 (CET1)

12.00%

12.60

11.94

Tier 1 capital

13.72

14.31

13.66

Total capital

15.94

16.72

16.14

Risk-weighted assets (RWAs) (in billions)

$

1,112.3

1,116.1

1,158.4

Tier 1 leverage ratio

8.26%

8.34

8.32

Supplementary Leverage Ratio (SLR)

6.86

6.89

8.05

Total Loss Absorbing Capacity (TLAC) Ratio (6)

23.27

23.03

25.74

Liquidity Coverage Ratio (LCR) (7)

122

118

133

Average balances:

Average Wells Fargo common stockholders’ equity to average assets

8.51

8.73

8.43

Average total equity to average assets

9.67

9.85

9.51

Per common share data

Dividend payout ratio (8)

35.0

12.1

283.7

Book value (9)

$

41.89

43.32

39.71

Overview (continued)

(1) Represents Wells Fargo net income divided by average assets.

(2) Represents Wells Fargo net income applicable to common stock divided by average common stockholders’ equity.

(3) Tangible common equity is a non-GAAP financial measure and represents total equity less preferred equity, noncontrolling interests, goodwill, certain identifiable intangible assets (other than

mortgage servicing rights) and goodwill and other intangibles on investments in consolidated portfolio companies, net of applicable deferred taxes. The methodology of determining tangible

common equity may differ among companies. Management believes that return on average tangible common equity, which utilizes tangible common equity, is a useful financial measure because it

enables management, investors, and others to assess the Company’s use of equity. For additional information, including a corresponding reconciliation to generally accepted accounting principles

(GAAP) financial measures, see the “Capital Management – Tangible Common Equity” section in this Report.

(4) The efficiency ratio is noninterest expense divided by total revenue (net interest income and noninterest income).

(5) See the “Capital Management” section and Note 25 (Regulatory Capital Requirements and Other Restrictions) to Financial Statements in this Report for additional information.

(6) Represents TLAC divided by risk-weighted assets (RWAs), which is our binding TLAC ratio, determined by using the greater of RWAs under the Standardized and Advanced Approaches.

(7) Represents average high-quality liquid assets divided by average projected net cash outflows, as each is defined under the LCR rule.

(8) Dividend payout ratio is dividends declared per common share as a percentage of diluted earnings per common share.

(9) Book value per common share is common stockholders’ equity divided by common shares outstanding.

Wells Fargo & Company 6

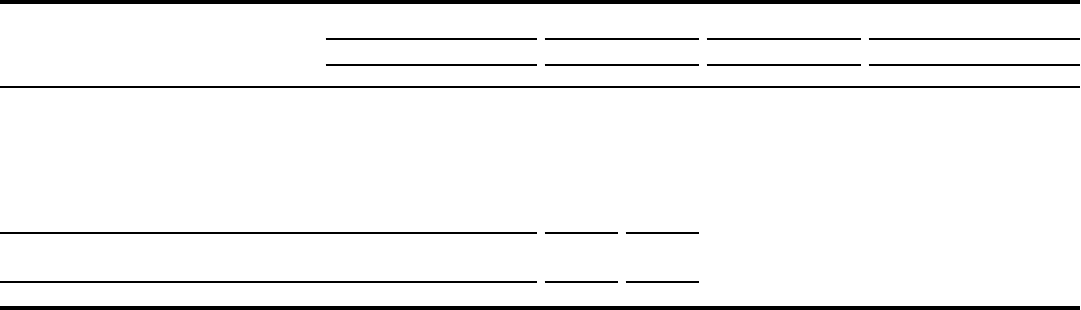

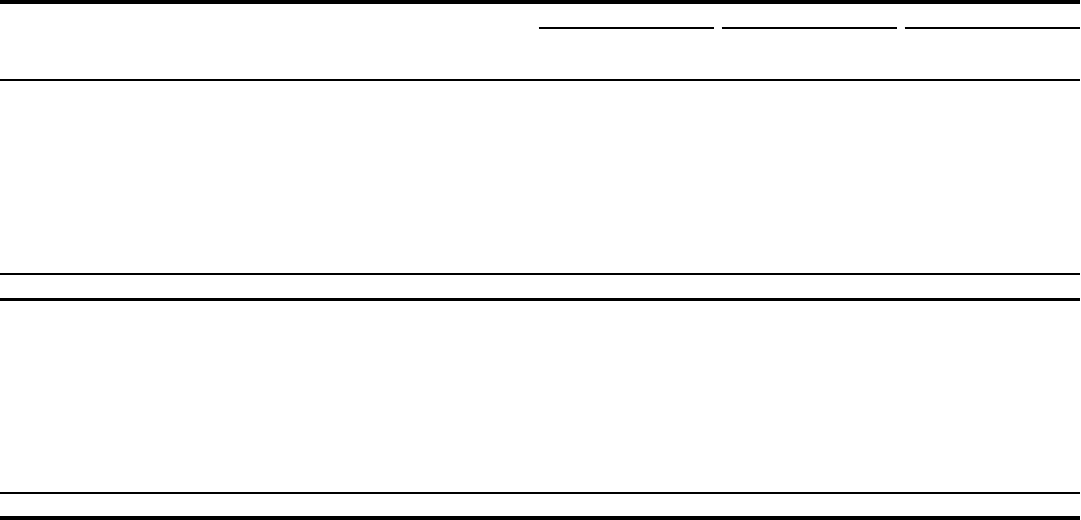

Earnings Performance

Wells Fargo net income for 2022 was $13.2 billion ($3.14 diluted

EPS), compared with $21.5 billion ($4.95 diluted EPS) in 2021.

Net income decreased in 2022, compared with 2021, due to a

$13.9 billion decrease in noninterest income, a $5.7 billion

increase in provision for credit losses, and a $3.5 billion increase

in noninterest expense, partially offset by a $9.2 billion increase

in net interest income, a $3.5 billion decrease in income tax