CONSUMER HANDBOOK ON

Adjustable-Rate

Mortgages

Find out how

your payment can

change over time

An ofcial publication of the U.S. government

How to use the booklet

When you and your mortgage lender discuss

adjustable-rate mortgages (ARMs), you receive

a copy of this booklet. When you apply for an

ARM loan, you receive a Loan Estimate. You can

request and receive multiple Loan Estimates

from competing lenders to nd your best deal.

You may want to have your Loan Estimate handy

for any loan you are considering as you work

through this booklet. We reference a sample

Loan Estimate throughout the booklet to help

you apply the information to your situation.

You can nd more information about ARMs

at cfpb.gov/about-arms. You’ll also nd other

mortgage-related CFPB resources, facts, and

tools to help you take control of the homebuying

process.

About the CFPB

The Consumer Financial Protection Bureau

regulates the offering and provision of consumer

nancial products and services under the federal

consumer nancial laws and educates and

empowers consumers to make better informed

nancial decisions.

This booklet, titled Consumer Handbook on Adjustable

Rate Mortgages, was created to comply with federal law

pursuant to 12 U.S.C. 2604 and 12 CFR 1026.19(b)(1).

How can this booklet help you?

This booklet can help you decide whether an

adjustable-rate mortgage (ARM) is the right

choice for you and to help you take control of

the homebuying process.

Your lender may have already provided you

with a copy of Your Home Loan Toolkit. You

can also download the Toolkit from the CFPB’s

Buying a House guide at cfpb.gov/buy-a-

house/.

An ARM is a mortgage with an interest

rate that changes, or “adjusts,”

throughout the loan.

With an ARM, the interest rate and

monthly payment may start out low.

However, both the rate and the payment

can increase very quickly.

Consider an ARM only if you can afford

increases in your monthly payment—even

to the maximum amount.

After you nish this booklet:

• You’ll understand how an ARM works and

whether it’s the right choice for you. (page 2)

• You’ll know how to review important

documents when you apply for an ARM.

(page 6)

• You’ll understand the risks that come with

different types of ARMs. (page 18)

Is an ARM right for you?

ARMs come with the risk of higher payments in

the future that you might not be able to predict.

But in some situations, an ARM might make sense

for you. If you are considering an ARM, be sure to

understand the tradeoffs.

TIP

Don’t count on being able to renance before your

interest rate and monthly payments increase. You

might not qualify for renancing if the value of

your home goes down or if something unexpected

damages your nancial situation, like a job loss or

medical costs.

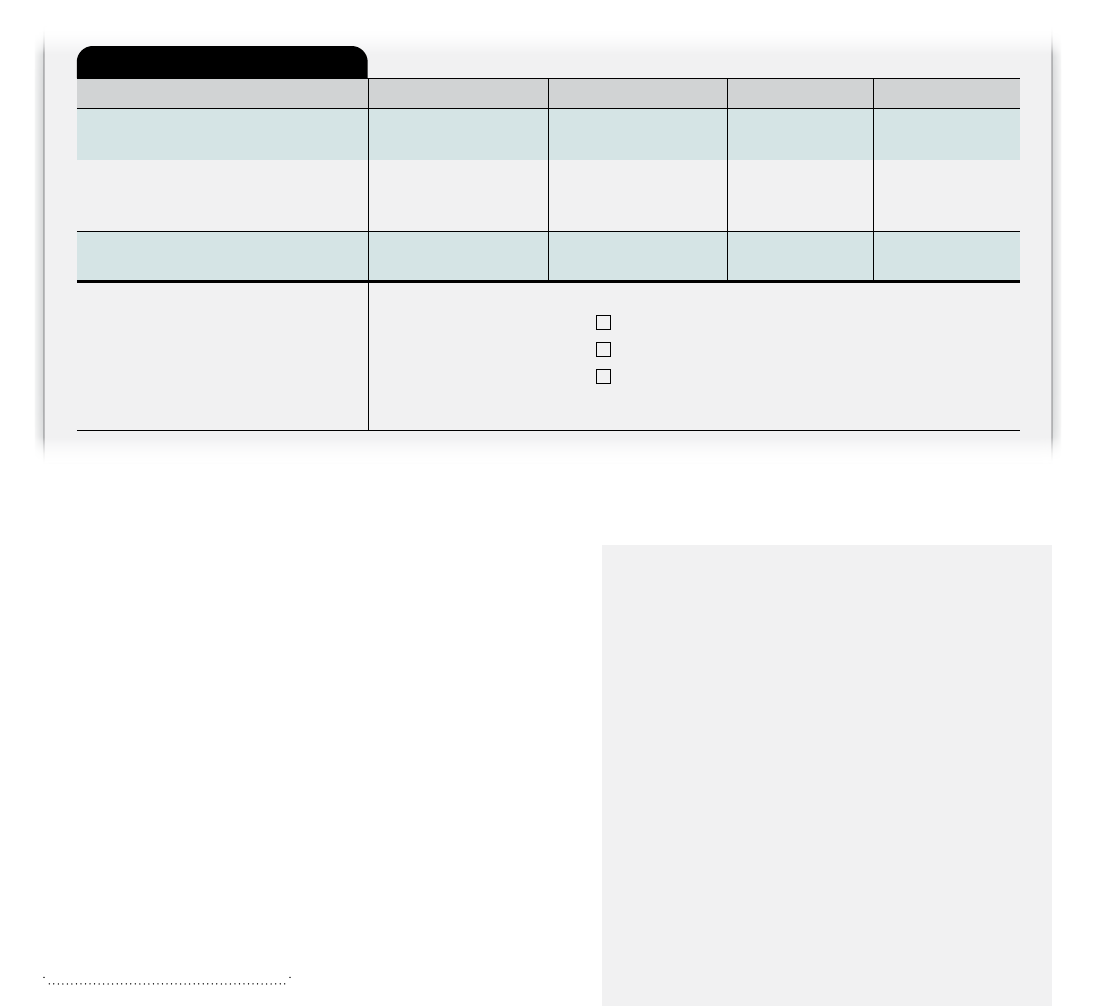

COMPARE FIXED-RATE MORTGAGE ADJUSTABLE-RATE MORTGAGE

Consider

§ You prefer predictable § You are condent you can afford increases

this option if

payments, or

§ You plan to keep your home

for a long period of time

in your monthly payment—even to the

maximum amount, or

§ You plan to sell your home within a short

period of time

Interest rate

§ Set when you take out the loan

§ Stays the same for the entire

loan term

§ Based on an index that changes

§ May start out lower than a xed rate mortgage

but you bear the risk of increases throughout

your loan

Monthly

payment

§ Principal and interest payment

stays the same over the life of

your loan

§ You know the total you will pay

in principal and interest over

the life of the loan

§ Initial principal and interest payment amount

remains in effect for a limited period

§ You can't know in advance how much

total interest you will pay because your

interest rate changes

§ If you can’t afford the increased payments,

you may lose your home to foreclosure

ADJUSTABLE-RATE MORTGAGES IS AN ADJUSTABLE-RATE MORTGAGE RIGHT FOR YOU? 1

Learn about how ARMs work

As you decide whether to move ahead with an

ARM, you should understand how they work and

how your housing costs can be affected.

Interest rate = index + margin

The interest rate on an ARM has two parts: the

index and the margin.

INDEX

An index is a measure of interest rates generally

that reects trends in the overall economy.

Different lenders use different indexes for their

ARM programs.

Common indexes include the U.S. prime rate

and the Constant Maturity Treasury (CMT) rate.

Talk with your lender to nd out more about the

index they use, which is also shown on your Loan

Estimate.

MARGIN

The margin is an extra percentage that the

lender adds to the index.

You can shop around to different lenders to nd

the lowest combination of the index plus the

margin. Your Loan Estimate shows the index and

the margin being offered to you.

Changes to initial rate and payment

The initial interest rate and initial principal and

interest payment amount on an ARM remain in

effect for a limited period.

So, when you see ARMs advertised as 5/1 or

5/6m ARMs:

• The rst number tells you the length of time

your initial interest rate lasts.

• The second number tells you how often the

rate changes after that.

For example, during the rst ve years in a 5/6m

ARM your rate stays the same. After that, the rate

may adjust every six months (the 6m in the 5/6m

example) until the loan is paid off. This period

between rate changes is called the adjustment

period. Adjustment periods can vary. Some last

a month, a year, or like this example, six months.

For some ARMs, the initial rate and payment can

be very different from the rates and payments later

in the loan term. Even if the market for interest

rates is stable, your rates and payments could

change a lot.

ADJUSTABLE-RATE MORTGAGES

LEARN ABOUT HOW ARMS WORK 2

Loan Costs Other Costs

Total Closing Costs (J)

Closing Costs Financed (Included in Loan Amount)

Down Payment/Funds from Borrower

Deposit

Funds for Borrower

Seller Credits

Adjustments and Other Credits

Estimated Cash to Close

Calculating Cash to Close

Closing Cost Details

A. Origination Charges

% of Loan Amount (Points)

B. Services You Cannot Shop For

C. Services You Can Shop For

D. TOTAL LOAN COSTS A + B + C

E. Taxes and Other Government Fees

Recording Fees and Other Taxes

Transfer Taxes

F. Prepaids

Homeowner’s Insurance Premium ( months)

Mortgage Insurance Premium ( months)

Prepaid Interest ($ per day for days @ )

Property Taxes ( months)

G. Initial Escrow Payment at Closing

Homeowner’s Insurance $ per month for mo.

Mortgage Insurance $ per month for mo.

Property Taxes $ per month for mo.

H. Other

I. TOTAL OTHER COSTS (E + F + G + H)

J. TOTAL CLOSING COSTS

D + I

Lender Credits

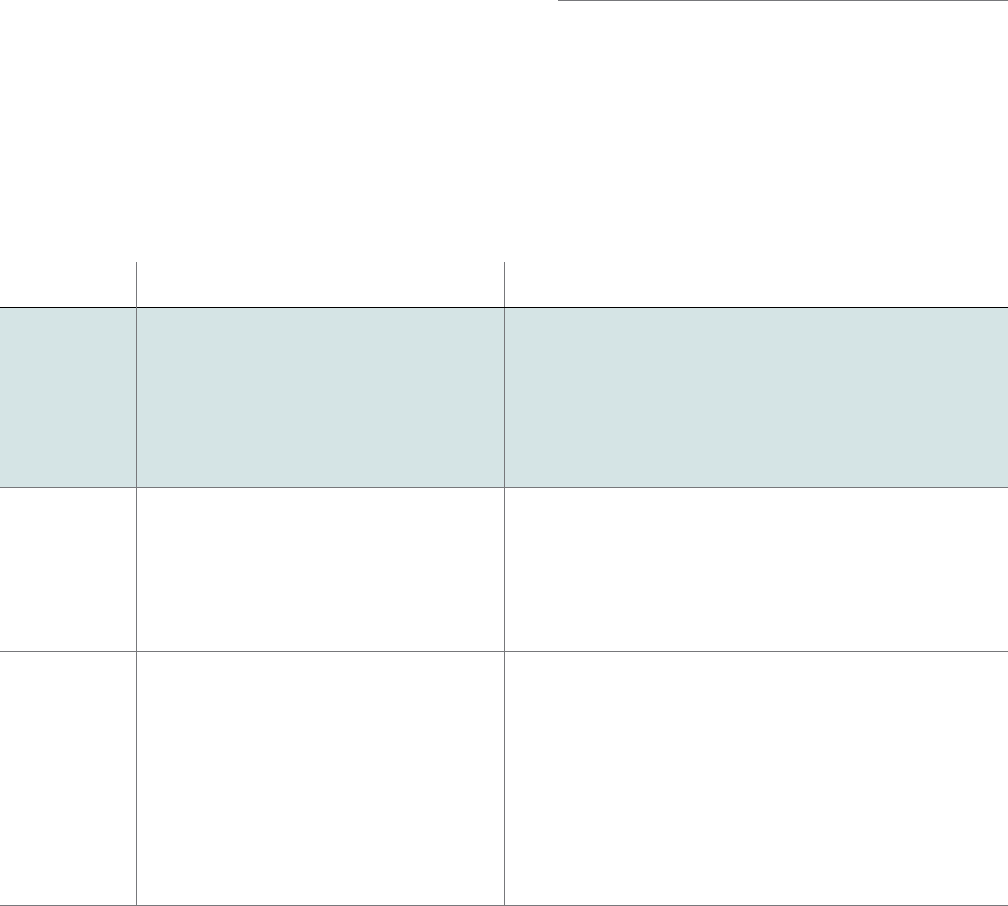

Use your Loan Estimate to

understand your ARM

When you apply for a mortgage,

the lender gives you a document

called a Loan Estimate. It

describes important features of

the loan the lender is offering

you. This section illustrates the

parts of a Loan Estimate that are

specic features of ARM loans.

An interactive, online version of a

Loan Estimate sample is available

at: cfpb.gov/arm-explainer/

Loan Terms

Projected

Payments

Product

Save this Loan Estimate to compare with your Closing Disclosure.

Loan Estimate

LOAN TERM

30 years

PURPOSE Purchase ce

DATE ISSUED

PRODUCT

5/1 Adjustable Rate

APPLICANTS

LOAN TYPE

x

Conventional FHA VA _____________

LOAN ID # 1234567891330172608

RATE LOCK

x

NO YES

PROPERTY

Before closing, your interest rate, points, and lender credits can

change unless you lock the interest rate. All other estimated

SALE PRICE

closing costs expire on

Loan Terms

Can this amount increase after closing?

Loan Amount

$216,000

NO

Interest Rate

3%

YES

· Adjusts every year starting in year 6

· Can go as high as 8% in year 8

· See AIR Table on page 2 for details

Monthly Principal & Interest

See Projected Payments Below

for Your Total Monthly Payment

$910.66

YES

· Adjusts every year starting in year 6

· Can go as high as $1,467 in year 8

Prepayment Penalty

NO

Balloon Payment

NO

Does the loan have these features?

Projected Payments

Costs at Closing

Payment Calculation Years 1-5 Years 6 Years 7 Years 8-30

Principal & Interest

$910.66 $838 min

$1,123 max

$838 min

$1,350 max

$838 min

$1,467 max

Mortgage Insurance

Estimated Escrow

Amount can increase over time

+ 99

+ 341

+ 99

+ 341

+ 99

+ 341

+ ––

+ 341

Estimated Total

Monthly Payment

$1,290 $1,217 – $1,502 $1,217 – $1,729 $1,179 – $1,808

Estimated Taxes, Insurance

& Assessments

Amount can increase over time

$341

a month

This estimate includes

x

Property Taxes

x

Homeowner’s Insurance

Other:

In escrow?

YES

YES

See Section G on page 2 for escrowed property costs.

You must pay for other property costs separately.

Estimated Closing Costs

Includes in Loan Costs + in Other Costs –

$X,XXX

in Lender Credits. See details on page 2.

Includes Closing Costs. See calculating Cash to Close on page 2

Estimated Cash to Close

$XX,XXX

for details.

Visit www.consumernance.gov/learnmore for general information and tools.

LOAN ESTIMATE PAGE 1 OF 3 • LOAN ID # 123456789

Adjustable Interest Rate (AIR) Table

Adjustable

Interest Rate

(AIR) Table

LOAN ESTIMATE

Index + Margin 1 Year Cmt + 2.25%

Initial Interest Rate 3%

Minimum/Maximum Interest Rate 2.25% / 8%

Change Frequency

First Change Beginning of 61st month

Subsequent Changes Every 12 months after first change

Limits on Interest Rate Changes

First Change 2%

Subsequent Changes 2%

PAGE 2 OF 3 • LOAN ID # 123456789

ADJUSTABLE-RATE MORTGAGES USE YOUR LOAN ESTIMATE TO UNDERSTAND YOUR ARM 3

Loan terms

INTEREST RATE

The Loan Estimate shows the initial interest rate

you pay at the beginning of your loan term. This

row also shows how often your rate can change

and how high it can go.

MONTHLY PRINCIPAL & INTEREST

The Loan Estimate shows the initial monthly

principal and interest payment you’ll make if you

accept this loan. Your principal is the money that

you originally agreed to pay back on your loan.

Interest is a cost you pay to borrow the principal.

The initial principal and interest payment

amount for an ARM is set only for the initial

period and may change after that.

THE TALK

You might hear, “An ARM makes sense

because you can renance the loan

before your interest rate and monthly

payment increase.”

Ask yourself, a spouse, or a loved one:

“What if the market value of the home

goes down?”

“What if our nancial situation or

our credit score gets damaged by

something unexpected like a job loss

or illness?”

“If we can’t renance at a better rate,

can we afford the maximum interest

rate and payment increase under

this loan?”

Loan Terms

Can this amount increase after closing?

Loan Amount

$216,000

NO

Interest Rate

3%

YES

· Adjusts every year starting in year 6

· Can go as high as 8% in year 8

· See AIR Table for details

Monthly Principal & Interest

See Projected Payments Below

for Your Total Monthly Payment

$910.66

YES

· Adjusts every year starting in year 6

· Can go as high as $1,467 in year 8

Does the loan have these features?

Prepayment Penalty

NO

Balloon Payment

NO

Example of “Loan terms” section. Find this on page 1 of

your own Loan Estimate

ADJUSTABLE-RATE MORTGAGES

USE YOUR LOAN ESTIMATE TO UNDERSTAND YOUR ARM 4

Projected Payments

Payment Calculation Years 1-5 Years 6 Years 7 Years 8-30

Principal & Interest $910.66 $838 min

$1,123 max

$838 min

$1,350 max

$838 min

$1,467 max

Mortgage Insurance

Estimated Escrow

Amount can increase over time

+ 99

+ 341

+ 99

+ 341

+ 99

+ 341

+ ––

+ 341

Estimated Total

Monthly Payment

$1,290 $1,217 – $1,502 $1,217 – $1,729 $1,179 – $1,808

Estimated Taxes, Insurance

& Assessments

Amount can increase over time

$341

a month

This estimate includes

x

Property Taxes

x

Homeowner’s Insurance

Other:

In escrow?

YES

YES

See Section G on page 2 for escrowed property costs.

You must pay for other property costs separately.

Example of “Projected payments” section. Find this on

page 1 of your own Loan Estimate

Projected payments

PRINCIPAL & INTEREST

The monthly principal and interest payment on

your ARM is likely to change after the initial period.

Review this section to see how your payment can

change based on your loan’s interest rate.

ESTIMATED TOTAL MONTHLY PAYMENT

Review this row to see the total minimum and

maximum monthly payments. The payments

include mortgage insurance, property taxes,

homeowners insurance, and any additional

property assessments or other escrow items.

Learn more about these mortgage terms at

cfpb.gov/mortgage-terms/

Keep in mind that other parts of your monthly

and annual housing costs can change, such

as your property taxes and homeowners

insurance payments.

ADJUSTABLE-RATE MORTGAGES

THE TALK

Talk over how your nancial life could

be affected if your ARM monthly

payment increases. In future years, you

might face money decisions like:

• Job changes

• School or other education expenses

• Medical needs and expenses

Because ARM adjustments are

unpredictable, you might have less or

more nancial exibility for other parts

of your life.

USE YOUR LOAN ESTIMATE TO UNDERSTAND YOUR ARM 5

Adjustable Interest Rate (AIR) table

You should read and understand the AIR table

calculations before committing to an ARM.

It's important to know how your interest rate

changes over the life of your loan.

INDEX + MARGIN

Your lender is required to show you how your

interest rate is calculated, which is determined by

the index and margin on your loan. See page 2 of

this booklet for more about index and margin.

INITIAL INTEREST RATE

This is the interest rate at the beginning of your

loan. The initial interest rate changes to the

index plus the margin at your rst adjustment

(subject to the limits on interest rate changes).

Your loan servicer tells you your new payment

amount seven to eight months in advance, so

you can budget for it or shop for a new loan.

MINIMUM/MAXIMUM INTEREST RATE

This shows how low or high your interest rate could

be over the life of your loan. Generally, an ARM’s

interest rate is never lower than the margin.

“TEASER” RATES

Some lenders offer a “teaser,” “start,” or

“discounted” rate that is lower than their fully

indexed rate. When the teaser rate ends, your

loan takes on the fully indexed rate. Don’t

assume that a loan with a teaser rate is a

good one for you. Not everyone’s budget can

accommodate a higher payment.

CHANGE FREQUENCY

This indicates when the interest rate on your

loan will change. Your loan servicer sends you

advance notices of changes.

LIMITS ON INTEREST RATE CHANGES

This shows the highest amount your interest rate

can increase when there is a change.

Adjustable Interest Rate (AIR) Table

Index + Margin 1 Year Cmt + 2.5%

Initial Interest Rate 3%

Minimum/Maximum Interest Rate 2.5% / 8%

Change Frequency

First Change Beginning of 61st month

Subsequent Changes Every 12 months after rst change

Limits on Interest Rate Changes

First Change 2%

Subsequent Changes 2%

Example of “AIR table” section. Find this on page 2 of your

own Loan Estimate

Consider this example:

• A lender’s fully indexed rate is 4.5%

(the index is 2% and the margin is 2.5%).

• The loan also features a “teaser” rate of 3%.

• Even if the index doesn’t change,

your interest rate still increases from 3%

to 4.5% when your teaser rate expires.

ADJUSTABLE-RATE MORTGAGES USE YOUR LOAN ESTIMATE TO UNDERSTAND YOUR ARM 6

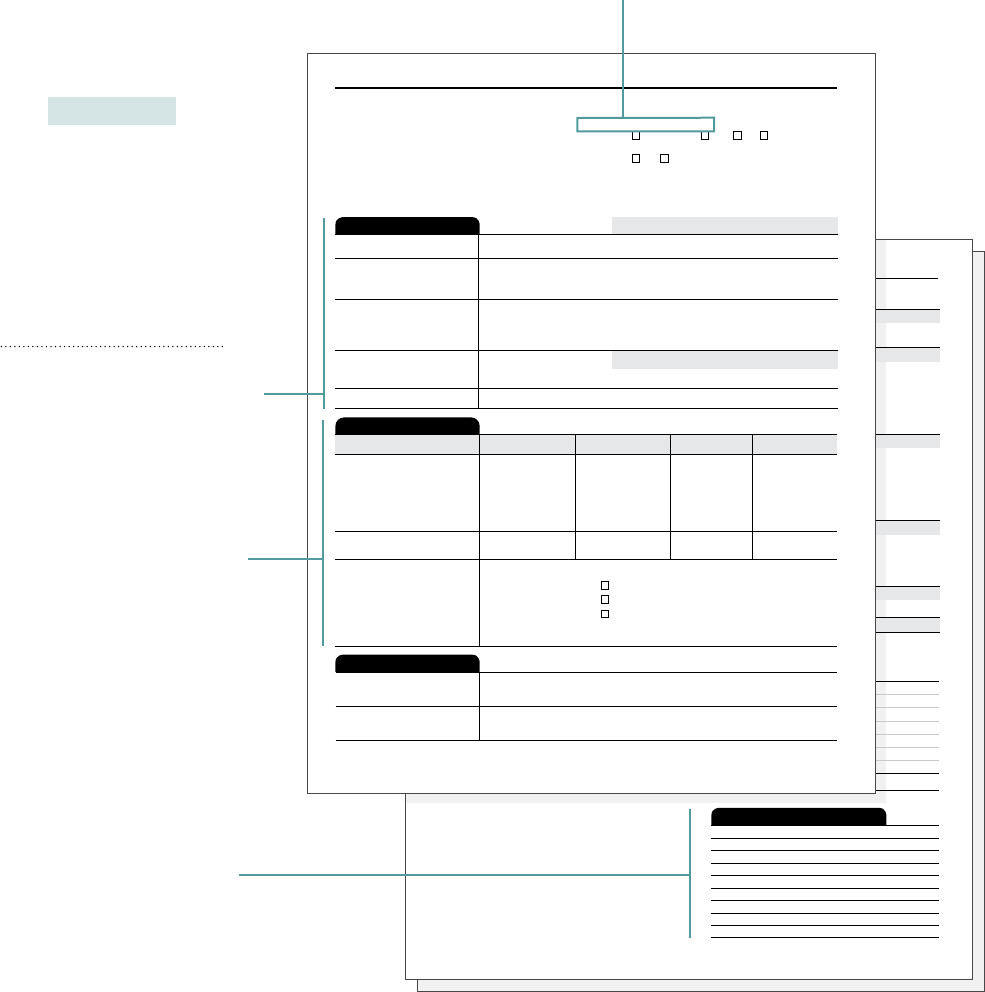

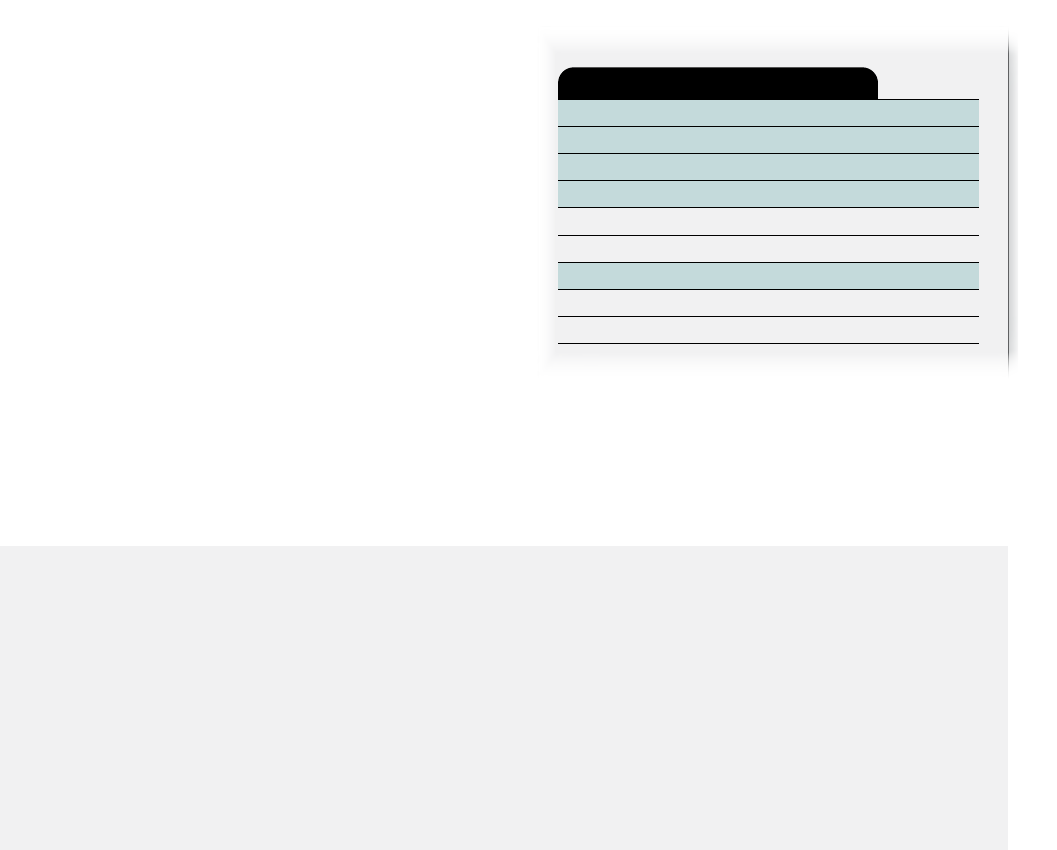

COMPARE YOUR ARM OFFERS

Shop for at least three loan offers, and ll in the blanks

below using the information on your Loan Estimates:

ARM OFFER 1 ARM OFFER 2

FIXED-RATE

OFFER

Lender name

Loan amount

Initial interest rate

Initial principal and interest payment

Index

Margin

How long will the initial interest rate and initial

payment apply?

How high can my interest rate go?

How high can my principal and interest payment go?

THE TALK

You are in control of whether or not to proceed

with an ARM. If you prefer to proceed with a

xed-rate mortgage, here is one way to start

the conversation with a lender:

My best loan offer is:

“Axed-ratemortgageseemstobeabetter

tforme.Let’stalkaboutwhatyoucanoffer

andhowitcomparestootherloansImaybe

abletoget.”

ADJUSTABLE-RATE MORTGAGES COMPARE YOUR ARM OFFERS 7

c s

Review your lender’s ARM

program disclosure

Your lender gives you an ARM program disclosure

when they give you an application. This is the

lender’s opportunity to tell you about their

different ARM loans and how the loans work. The

index and margin can differ from one lender to

another, so it is helpful to compare offers from

different lenders.

Generally, the index your lender uses won’t

change after you get your loan, but your loan

contract may allow the lender to switch to a

different index in some situations.

GATHER FACTS

Review your program disclosure and ask your

lender questions to understand their ARM

loan offerings:

How are the interest rate and payment

determined?

Does this loan have interest-rate ap (that

caps

is, limits on interest rate changes)?

How often do the interest rate and

payment adjust?

What index is used and where is it published?

Is the initial interest rate lower than the fully

indexed rate? (see “Teaser rates,” on page 12)

What type of information is provided in notices

of adjustment and when do I receive them?

Ask about other options

offered by your lender

Conversion option

Your loan agreement may include a clause

that lets you convert the ARM to a xed-rate

mortgage in the future.

When you convert, the new rate is generally set

using a formula given in your loan documents.

That xed rate may be higher or lower than

interest rates available to you in the market at

that time. Also your lender may charge you a

conversion fee. Ask your lender whether the loan

you are being offered has a conversion feature

and how it works.

Special features

You can shop around to understand what special

ARM features may be available from different

lenders.

Not all programs are the same. Talk with your

lender to nd out if there’s anything special about

their ARM programs that you may nd valuable.

ADJUSTABLE-RATE MORTGAGES REVIEW YOUR LENDER’S ARM PROGRAM DISCLOSURE 8

Check your ARM for features

that could pose risks

Some types of ARMs have features that can

reduce your payments in the short term but

may include fees or the risk of higher payments

later. Review your loan terms and make sure

that you understand the fees and how your rate

and payment may change. Lower payments at

the beginning could mean higher fees or much

higher payments later.

Paying points to reduce your initial

interest rate

Lenders can offer you a lower rate in exchange

for paying loan fees at closing, or points.

With an ARM, paying points often reduces

your interest rate only until the end of the initial

period—the reduction most likely does not apply

over the life of your loan.

If you are using an ARM to renance a loan,

points are often rolled into your new loan

amount. You might not realize you are paying

points unless you look carefully. Points are

disclosed on the top of Page 2 of your Loan

Estimate.

Lenders may give you the option to pay points,

but you never have to take that option. To gure

out if you have a good deal, compare your cost

in points with the amount that you will save with

a lower interest rate.

Loan Costs

A. Origination Charges $3,160

1% of Loan Amount (Points) $2,160

Application Fee $500

Processing Fee $500

Example of “Loan costs” section. Find this on page 2 of

your own Loan Estimate

THE TALK

If your Loan Estimate shows points, ask

your lender:

• “What is my interest rate if I choose

not to pay points?”

• “How much money do I pay in

points? And, compared to the

total reduction in my payments

during the initial period, am I

coming out ahead?”

• “Can I see a revised Loan Estimate

with the points removed and the

interest rate adjusted?”

ADJUSTABLE-RATE MORTGAGES

CHECK YOUR ARM FOR ADDITIONAL FEATURES 9

Interest-only ARMs

With an interest-only ARM payment plan, you pay

only the interest for a specied number of years.

During this interest-only period, you have smaller

monthly payments, but you are not paying

anything toward your mortgage loan balance.

When the interest-only period ends, your

monthly payment increases—even if interest

rates stay the same—because you must start

paying back the principal plus the interest each

month. Your monthly payments can increase

a lot. The longer the interest-only period, the

more your monthly payments increase after the

interest-only period ends.

Payment option ARMs

Payment option ARMs were common before

2008 when the housing crisis began, and some

lenders might still offer them.

A payment option ARM means the borrower can

choose from different payment options, such as:

• A traditional principal and interest payment

• An interest-only payment (see above)

• A minimum payment, which could result in

negative amortization

Negative amortization happens when you are

Negative amortization

not paying enough to cover all of the interest

due. Your loan balance goes up instead of down.

GATHER FACTS

Learn more information about payment option

ARMs and negative amortization at:

• cfpb.gov/payment-option-arm/

• cfpb.gov/negative-amortization/

WELL DONE!

Choosing the right home loan is just

as important as choosing the right

home. By equipping yourself with

knowledge about ARMs, you can

decide whether or not this type of

loan is the right choice for you.

ADJUSTABLE-RATE MORTGAGES CHECK YOUR ARM FOR ADDITIONAL FEATURES 10

Consumer Handbook on

Adjustable-Rate Mortgages

ASK YOUR LENDER

• How high can my payment go?

• How high can my interest rate go?

• How long is my initial principal and

interest payment guaranteed?

ASK YOURSELF

• Have I shopped around to compare ARMs

and xed-rate loans?

• If an ARM has a lower initial interest rate

than a xed-rate mortgage, is paying less

money now worth the risk of an increase

later?

• Can I afford the highest payment possible

with the ARM if I can’t sell the home, or

renance into a lower rate, before the

increase?

ONLINE TOOLS

CFPB website

cfpb.gov

Answers to common questions

cfpb.gov/askcfpb

Tools and resources for home buyers

cfpb.gov/owning-a-home

Talk to a housing counselor

cfpb.gov/nd-a-housing-counselor

Submit a complaint

cfpb.gov/complaint

Last updated 06/20

11

Your Lender’s ARM Disclosure & Description of

Programs

This disclosure describes the features of the adjustable-rate mortgage (ARM) programs your lender offers. Depending on

the existing market conditions, your lender may not offer all of the programs described in this booklet at any given time.

This disclosure is not a commitment by the lender to make you a loan on any of the terms described in this disclosure. It is

intended solely to provide you with a general description of your lender’s loan programs. If you eventually obtain a loan

from the lender, the loan note, security instrument and related documents (“Loan Documents”) will establish your legal

rights and obligations. Information on any other ARM programs we may have is available on request.

I. ARM Program

How Your Interest Rate and Payments are Determined

Your interest rate will be based on an index plus a margin. Your payment will be based on the interest rate, loan balance,

and loan term.

The initial interest rate may be a discount rate or premium rate and may not be based on the index used to make later

adjustments. A premium interest rate is one that is greater than the interest rate calculated by adding the index and the

margin. A discount interest rate is one that is less than the interest rate calculated by adding the index and the margin. Ask

us for the amount of any current interest rate discounts or premiums. After the initial period, your interest rate will equal

the current index rate plus the margin rounded to the nearest 1/8 of one percentage point (0.125%), unless an Adjustment

Cap or the Lifetime Cap limits the amount of change in the interest rate. Ask us for our current interest rate and margin.

The index will depend on which ARM program you select. We offer ARM programs with the following indexes:

United States Treasury Securities

The index is, depending on the product, the weekly average yield on United States Treasury Securities adjusted to a

constant maturity of one year. Information about this index is published by the Federal Reserve Board in publication

H.15. Current and historical H.15 data are available on the Federal Reserve Board's web site (www.federalreserve.gov/).

For information about individual copies or subscriptions, contact Publications Services at the Federal Reserve Board

(phone 202-452-3244, fax 202-728-5886). For paid electronic access to current and historical data, call STAT-USA at 1-

800-782-8872 or 202-482-1986.

Secured Overnight Financing Rate (SOFR)

The index is the overnight rate for U.S. dollar-denominated loans, as published by the Federal Reserve Bank of New York.

The daily SOFR is based on transactions in the Treasury repurchase market, where investors offer banks overnight loans

backed by their bond assets. If for any reason the index is not available, the lender will use a new index based on

comparable information.

ADJUSTABLE-RATE MORTGAGES

WELLS FARGO BANK, N.A.

12

I. ARM Program (continued)

How Your Interest Rate Can Change

Your interest rate can change every six or twelve months after the first interest rate change date (“First Change Date”).

The First Change Date and Subsequent Change Dates will depend on which ARM program you select based on

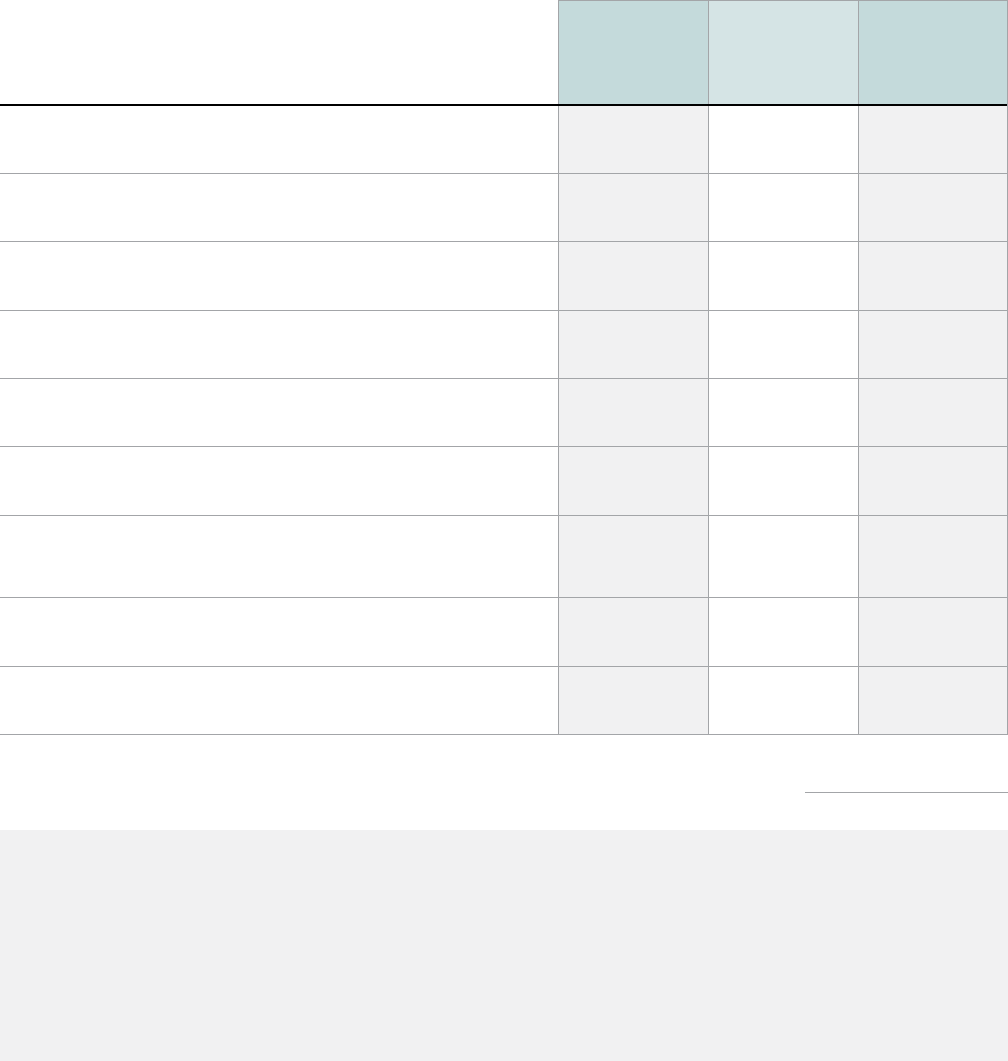

availability as set forth in the following chart:

Program

First Change Date

from the 1

st

payment date

Subsequent Change Date

after the 1

st

change date

Conventional 10/6m

119 months

Every 6 months

Conventional 7/6m

83 months

Every 6 months

Conventional 5/6m

59 months

Every 6 months

Non-Conforming 10/6m

119 months

Every 6 months

Non-Conforming 7/6m

83 months

Every 6 months

Non-Conforming 5/6m

59 months

Every 6 months

FHA / VA 5/1

61-63 monthsmo

Every 12 months

At the First Change Date, your interest rate cannot increase or decrease more than the First Adjustment Cap. No interest

rate change after the First Change Date will be more than the Subsequent Adjustment Cap. Your First Adjustment Cap will

be set at an amount between 1 and 6 percentage points or another specific numeric cap identified in your loan documents,

depending on the ARM program. Your Subsequent Adjustment Cap will be set at an amount between 1 and 2 percentage

points for each adjustment, depending on the ARM program. There is no limitation on the total amount by which your

interest rate can decrease over the life of your loan; depending on the loan program, your interest rate can never be lower

than the margin regardless of how low the index may drop over the term of the loan. (For FHA and VA ARM loans, the

First Adjustment Cap, Subsequent Adjustment Cap, and Lifetime Cap apply to both increases and decreases.)

Regardless of the current value of the index plus margin, your interest rate can never exceed the Lifetime Cap which will

be established when you “lock-in” or price protect with your lender the initial interest rate and discount points applicable

to your loan. Your Lifetime Cap will be set at 5 or 6 percentage points above your initial rate, depending on the ARM

program. Ask for our current First and Subsequent Adjustment Caps and Lifetime Cap information.

How Your Monthly Payment Can Change

Your monthly payment can increase or decrease substantially based on the annual changes in the interest rate. The

amount of your new payments will be due starting on the first monthly payment date after the Change Date until the

amount of your monthly payment changes again.

The following examples demonstrate how your monthly payment can change.

ADJUSTABLE-RATE MORTGAGES

WELLS FARGO BANK, N.A.

13

I. ARM Program (continued)

A. ARM Programs with Indexes Based on U.S. Treasury Securities

On a $10,000 loan with the terms and the initial interest rates shown below (minus a discount or plus a premium recently

used for the program, which discount or premium is set forth below), the maximum amount that the interest rate can rise

under the program is shown below. The monthly payment can increase from the initial payment shown below to the

maximum payment shown in the year indicated.

Program

Amortiz-

ation

(years)

Index

Value

(%)

(1)

Margin

(%)

(2)

Discount

(d)

Premium

(p)

%

(3)

Initial

Rate

(%)

(4)

Initial P&I

Payment

Adjustment

Caps (%)

(5)

Max

Rate

(%)

(6)

Max P&I

Payment

(7)

Year of

Max

Payment

___________________________________________________________________________________________________________________________

FHA /

VA 5/1 30 0.08 1.750 2.7950

(p)

4.625 $51.41 1/1/5 9.625 $78.86

(1) One year Treasury constant maturity for the week ending 09/30/2021.

(2) This is a margin we have used recently for this program; your margin may be different.

(3) This is the amount of a discount (d) or a premium (p) used recently for this program; your initial rate may be discounted or priced at a

premium by a different amount.

(4) Index Value plus Margin less Discount or plus Premium, rounded to the nearest one eighth of one percent.

(5) First Adjustment Cap/Subsequent Adjustment Cap/Lifetime Cap.

(6) Initial Rate plus Lifetime Cap.

(7) See the table below for the payment schedule for Government ARM Products.

Payment Schedule for Government ARMs, assuming maximum rate increases on a $10,000 loan. (Initial and maximum

interest rates are shown in the preceding table.)

Program Initial Payment 1st Increase 2nd Increase 3rd Increase 4th Increase 5th Increase

For FHA & $51.41 for $56.77 in $62.22 in $67.73 in

$73.28 in

$78.86 in

VA 5/1 ARM 5 years year 6 year 7 year 8

year 9

year 10

You will be notified in writing at least 60 days, but not more than 120 days, before the due date of a payment at a new

level. This notice will contain information about your index, interest rates, payment amount, and loan balance.

To see what your payment would have been for any program during any period, divide your mortgage amount by

$10,000; then multiply the monthly payment by that amount. (For example, the initial monthly payment on an FHA 5/1

ARM loan for a mortgage amount of $60,000 with a 30-year term would be: $60,000/$10,000 = 6; 6 X $48.46 =

$290.76.)

ADJUSTABLE-RATE MORTGAGES

WELLS FARGO BANK, N.A.

10

14

I. ARM Program (continued)

B. ARM Programs with Indexes Based on Secured Overnight Financing Rate (SOFR)

On a $10,000 loan with the terms and the initial interest rates shown below (minus a discount or plus a premium recently

used for the program, which discount or premium is set forth below), the maximum amount that the interest rate can rise

under the program is shown below. The monthly payment can increase from the initial payment shown below to the

maximum payment shown in the year indicated.

Conforming Loans

Program

Amortiz-

ation

(years)

Index

Value (%)

(1)

Margin

(%)

(2)

Discount

(d)

Premium

(p)

%

(3)

Initial

Rate

(%)

(4)

Initial P&I

Payment

Adjustment

Caps (%)

(5)

Max

Rate (%)

(6)

Max P&I

Payment

Year of

Max

Payment

10/6m 30

0.0500 2.750

0.0750

(p)

2.875 $41.49 5/1/5 7.875 $62.70 11

7/6m 30 0.0500 2.750

0.3000

(d)

2.500 $39.51 5/1/5 7.500 $63.10 8

5/6m 30 0.0500 2.750 0.5500

(d)

2.250 $38.22 2/1/5 7.250 $62.84 7

Non-Conforming Loans

Max

Program

Amortiz-

(years) Value (%)

(1)

(%)

(2)

%

(3)

ation

Index Margin

Discount

(d)

Premium

(p)

Initial

Rate

(%)

(4)

Initial P&I

Payment

Adjustment

Caps (%)

(5) (6)

Max P&I

Payment

Year of

Max

Payment

Rate (%)

10/6m 30

0.0500 2.750

0.0750

(p)

2.875 $41.49 2/1/5 7.875 $62.15 12

7/6m 30 0.0500 2.750

0.0500

(p)

2.750 $40.82 2/1/5 7.750 $64.33

9

5/6m 30 0.0500 2.750

0.0500

(p)

2.750 $40.82 2/1/5 7.750 $66.34 7

(1) Secured Overnight Financing Rate - 30-Day Average, 09/30/2021, Federal Reserve Bank of New York.

(2) This is the margin we have used recently for this program; your margin may be different.

(3) This is the amount of a discount (d) or a premium (p) used recently for this program; your initial rate may be discounted or priced at a

premium by a different amount.

(4) Index Value plus Margin less Discount or plus Premium, rounded to the nearest one eighth of one percent.

(5) First Adjustment Cap/Subsequent Adjustment Cap/Lifetime Cap.

(6) Initial Rate plus Lifetime Cap.

You will be notified in writing at least 60 days, but not more than 120 days, before the due date of a payment at a new

level. This notice will contain information about your index, interest rates, payment amount, and loan balance.

To see what your payment would have been for any program during any period, divide your mortgage amount by

$10,000; then multiply the monthly payment by that amount. (For example, the initial monthly payment on a

Conforming 7/6m SOFR ARM loan for a mortgage amount of $60,000 with a 30-year term would be: $60,000/$10,000

= 6; 6 X $39.51 = $237.06)

ADJUSTABLE-RATE MORTGAGES

WELLS FARGO BANK, N.A.

15

II. Additional Information Concerning Program Features (continued)

A. Buydown Option

As a separate feature of our loan programs, we may offer you, in connection with your ARM loan, a buydown option. If

you choose to take advantage of the buydown option, you or a third party, such as a seller or builder, may agree to

“buydown” your loan payments for a period of years. This means that someone pays a lump sum at closing which we agree

to apply as a “subsidy” towards the full monthly payment due under your note for a specified period of time. This lowers

your actual out-of-pocket monthly payment during that period of time. A buydown is simply an alternative repayment

method for the first few years of your loan.

The following example shows how your monthly payment can change if you have a buydown. For example, a 2-1 buydown

over two years, on a $10,000, 30-year conforming 7/6m ARM, using the rate shown for the conforming 7/6m SOFR ARM

Program Example, using the SOFR based index, would work this way:

Payment Number Interest Rate

Effective Rate with

Monthly Subsidy

Amount

Borrower

Payment (P&I

Payment less

Subsidy)

Monthly

Subsidy

Amount

P&I Payment

1 2.500% 0.500% $29.92 $9.59 $39.51

13 2.500% 1.500% $34.51 $5.00 $39.51

25 2.500% 2.500% $39.51 $0.00 $39.51

Your monthly payments in year one would have $9.59 subtracted as the “bought down payment subsidy” and your

monthly payments in year two would have $5.00 subtracted. At the end of the buydown period, you

are obligated to make payments based on the interest rate contained in the Loan Documents.

Remember that the terms of the ARM programs described in this disclosure have been described without reference to the

buydown option.

ADJUSTABLE-RATE MORTGAGES

WELLS FARGO BANK, N.A.

16

II. Additional Information Concerning Program Features (continued)

B. Interest-Only

How Your Monthly Payment Can Change

Your monthly payment can increase or decrease substantially based on the annual changes in the interest rate. No

payments of principal are due during the “Interest-Only Period.” For example, on a $10,000 loan with the terms and the

initial interest rates shown below (minus a discount or plus a premium recently used for the program, which discount or

premium is set forth below), the maximum amount that the interest rate can rise under the program is shown below. The

monthly payments can increase from the initial payment shown below to the maximum payment shown in the year

indicated.

Non-Conforming Loans

Interest- Adjust-

Amortiz- Index Discount

(d)

Initial Max Year of

Only Margin Initial ment Max P&I

Program

ation Value

Premium

(p)

Rate Rate Max

Period

(%)

(3)

%

(4)

Payment

(6)

Caps

Payment

(9)

(years) (%)

(%)

(5)

(%)

(8)

Payment

(years)

(%)

(7)

SOFR

10/6m 10 30

0.0500

(2)

2.750 0.3250

(p)

3.125 $26.04 2/2/5 8.125 $83.71 12

7/6m 10 30

0.0500

(2)

2.750 0.2000

(p)

3.000 $25.00 2/2/5 8.000 $83.65 11

5/6m 10 30

0.0500

(2)

2.750 0.2000

(p)

3.000 $25.00 2/2/5 8.000 $83.65 11

(1) Secured Overnight Financing Rate - 30-Day Average, 09/30/2021, Federal Reserve Bank of New York.

(2) This is a margin we have used recently for this program; your margin may be different.

(3) This is the amount of discount (d) or a premium (p) used recently for this program; your initial rate may be

discounted or priced at a premium by a different amount.

(4) Index Value plus Margin less Discount or plus Premium, rounded to the nearest one eighth of one percent.

(5) During Interest-Only period: monthly payments of Interest-Only.

(6) First Adjustment Cap/Subsequent Adjustment Cap/Lifetime Cap.

(7) Initial Rate plus Lifetime Cap, or simply Lifetime Cap, if applicable.

(8) Includes Principal & Interest.

You will be notified in writing at least 60 days, but not more than 120 days, before the due date of a payment at a new

level. This notice will contain information about your index, interest rates, payment amount and loan balance.

To see what your payment would have been for any program during the Interest-Only period, divide your mortgage amount

by $10,000, then multiply the monthly payment by that amount. For example:

• The initial monthly payment on a non-conforming SOFR 10/6m Interest-Only ARM loan with an Interest-Only Period

of 10 years for a mortgage amount of $60,000 with a 30-year term would be: $60,000/$10,000 = 6; 6 X $26.04 =

$156.24.)

ADJUSTABLE-RATE MORTGAGES

WELLS FARGO BANK, N.A.

17

II. Additional Information Concerning Program Features (continued)

Additional Information Concerning Interest-Only Feature

If your ARM has an Interest-Only feature, prior to the expiration of the “Interest-Only Period,” your monthly payment will

be comprised of interest only, calculated on the basis of your current interest rate applied to the outstanding principal

balance of your loan (the “Interest-Only Payments”). No payments of principal will be due during the Interest-Only Period.

Your Interest-Only Payments will not reduce the principal balance of your loan, and you will not be contributing to

increasing equity in your home. You may, however, make extra payments to reduce the loan principal at any time.

If you make an extra payment during the Interest-Only Period, your loan will be re-amortized based on the reduced

principal balance, when your next regularly scheduled payment is processed. At the expiration of your Interest-Only

Period, your monthly payments will be both principal and interest. The lender will determine the amount of the monthly

payment that would be sufficient to repay the unpaid principal that you owe at the expiration of the Interest-Only Period,

and all subsequent Change Dates, in substantially equal payments until your loan’s maturity date.

June 2022

ADJUSTABLE-RATE MORTGAGES

WELLS FARGO BANK, N.A.

18